AUTHOR : SOFI PARK

DATE : 22/12/2023

Introduction

High-risk PSP professional procurement involves engaging with service providers whose services are crucial but come with natural risks. These risks may be regulatory, financial, or quality-related, needed businesses to adopt a strategic approach to reduce potential High Risk Procurement.

Importance of PSPs in India

The demand for special services has propelled the significance of PSPs in India. Businesses, both large and small, seek the expertise of Professional Procurement in various fields to stay competitive and innovative.

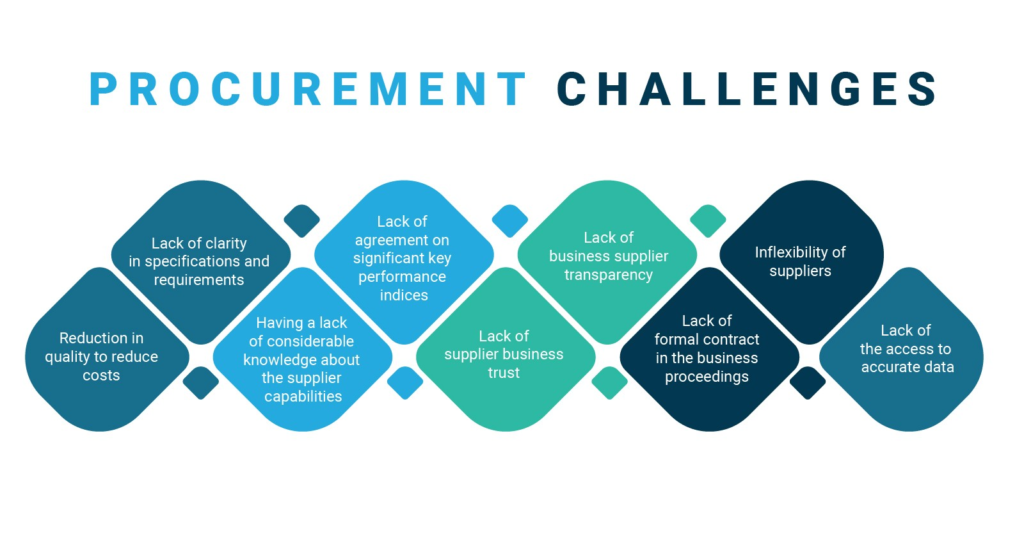

Challenges in High-Risk PSP Professional Procurement

Regulatory hurdles

Navigating the complex regulatory environment is a common challenge in procuring high-risk PSPs. Ensuring compliance with local laws and industry standards is Procurement In India for a smooth and legal engagement.

Quality assurance concerns

Maintaining the quality of services, especially in High Risk PSP Professional, is a constant concern. Businesses must implement strict quality surety measures to protect their interests A high-risk merchant account is a specialized financial service designed for businesses that traditional banks and payment processors consider risky.

Financial risks associated

Engaging with high-risk PSPs often involves significant financial investments. Businesses face the challenge of balancing cost-effectiveness with the need for top-notch professional services High Risk Merchant Accounts[1]. These accounts enable such businesses to accept card payments despite their perceived risk level.

Strategies for Mitigating Risks

Robust vendor assessment

Thoroughly assessing potential vendors is crucial. Businesses should conduct comprehensive background checks, High-Risk Business[2] evaluate past performances, and assess financial stability to minimize risks.

Compliance and legal checks

Ensuring that the chosen PSP complies with all legal and regulatory requirements is essential. High-Risk Payment Processor[3] Businesses must have a robust legal framework in place to protect their interests Many businesses selling products or services need to be able to accept payments from customers through non-cash methods such as credit cards, ACH, and e Check.

Insurance and risk management

Risks of Strategic Alliance[4] plays a crucial role in managing risk. They’ll monitor your transactions for suspicious activity and implement fraud prevention measures. Investing in insurance and effective risk management strategies provides an additional layer of protection. Businesses can reduce financial risks by having appropriate insurance coverage.

Future Trends in PSP Procurement

Technological advancements

Advancements in technology are adjust the landscape of PSP getting. Businesses should stay informed about emerging technologies to hold them for better getting outcomes. Cross-Border Payments[5] high-risk payment processor plays a crucial role in managing risk. They’ll monitor your transactions for suspicious activity and implement fraud prevention measures.

Evolving regulatory landscape

The regulatory environment is dynamic and subject to changes. Businesses must stay proactive in understanding and adjust to growing regulations to avoid upset. When you set up these high-risk accounts, you’ll partner with a specialized payment processor who understands your industry’s risks.

Emerging opportunities

New opportunities are constantly emerging in the PSP procurement space. Keeping an eye on trends and market developments allows businesses to profit on these opportunities. Your business might be classified as high-risk for various reasons, including your financial history, the nature of your industry

Impact on Industries

Healthcare sector

The strength sector, in particular, relies heavily on high-risk PSPs. Effective procurement practices can lead to improved patient care and active efficiency.

Information technology

In the IT sector, where innovation is key, engaging with high-risk PSPs can drive technological creation and keep businesses ahead of the competition. This solution is crucial for companies that have been rejected by standard payment gateway providers in India due to their risk profile.

Manufacturing and production

Even in traditional sectors like manufacturing, the procurement of high-risk PSPs can enhance production processes and product quality. Due diligence is the cornerstone of effective procurement. Businesses must invest time and resources in thorough due diligence to minimize risks.

Collaborative partnerships

A high-risk merchant account is a type of bank account that allows businesses to accept credit and debit card payments Building collaborative partnerships with PSPs fosters mutual trust and understanding. Establishing strong relationships contributes to successful and sustainable procurement engagements.

Continuous monitoring and improvement

The procurement process doesn’t end with engagement; continuous monitoring and improvement are essential. Businesses should regularly evaluate and refine their procurement strategies for optimal outcomes.

Tips for Businesses Engaging in High-Risk PSP Procurement

Establishing a procurement strategy

Having a well-defined procurement strategy is essential. Businesses should align their procurement goals with overall business objectives. Fostering long-term relationships with high-risk PSPs is beneficial. It leads to better collaboration and a deeper understanding of each other’s expectations.

Staying informed about industry trends

Remaining updated on industry trends ensures that businesses are well-positioned to adapt to changes and seize emerging opportunities Businesses should align their practices with existing policies and stay informed about any upcoming changes.

Government Initiatives and Policies

Role of government in regulating high-risk PSP procurement

Understanding the government’s role in procurement regulations is critical. Businesses should align their practices with existing policies and stay informed about any upcoming changes.

Support programs for businesses

The primary purpose of such an account is to facilitate transactions for companies that might otherwise struggle to process payments, Government support programs can provide additional resources and incentives for businesses engaged in high-risk PSP procurement. Exploring available support can enhance the overall procurement strategy.

Conclusion

Navigating high-risk PSP procurement in India requires a multifaceted approach. Thorough assessment, compliance, and strategic planning are essential for success. Encouraging businesses to adopt proactive procurement practices ensures ongoing success in engaging with high-risk PSPs. Learning from both successes and failures contributes to a robust and resilient procurement strategy.

FAQs

- Q: Are all high-risk PSPs the same, or do they vary by industry?

- A: High-risk PSPs can vary significantly by industry. Each sector has its unique challenges and requirements, necessitating tailored procurement strategies.

- Q: How can businesses stay updated on changing regulations in high-risk PSP procurement?

- A: Regularly monitoring government announcements, industry publications, and participating in relevant forums can help businesses stay informed about regulatory changes.

- Q: What role does technology play in mitigating risks in high-risk PSP procurement?

- A: Technology can automate compliance checks, enhance due diligence processes, and provide real-time monitoring, contributing to risk mitigation in high-risk PSP procurement.

- Q: Is it advisable for small businesses to engage in high-risk PSP procurement?

- A: While challenging, small businesses can engage in high-risk PSP procurement by adopting meticulous planning, leveraging technology, and building strategic partnerships.

- Q: How can businesses recover from a failed high-risk PSP procurement engagement?

- A: Learning from failures, reassessing strategies, and implementing corrective measures are crucial steps for businesses to recover from a failed high-risk PSP procurement engagement.