AUTHOR NAME : JASMINE

DATE : 22/12/2023

Introduction

In the dynamic landscape of Indian wholesale trade, the integration of high-risk payment service providers (PSPs) has become a pivotal factor in ensuring seamless transactions. This article delves into the complication of high-risk PSPs and their significance in the wholesale trade sector in India.

High risk PSP Wholesale trade in India refer to payment service providers that operate in industries prone to raised financial risks. In the context of Indian wholesale trade, these risks are multifaceted and require a nuanced understanding.

Overview of Wholesale Trade in India

The wholesale trade sector in India serves as the spine of the economy, Merchant Services for Wholesalers[1] acting as the bridge between manufacturers and retailers. Understanding the nuances of this sector is crucial for comprehending the role of high-risk PSPs trade in India.

Significance of High-Risk PSP in Wholesale Trade

The integration of high-risk PSPs in wholesale trade holds immense significance, addressing specific challenges and fostering growth opportunities. Exploring this mutual relationship unveils the potential for a more robust and efficient trading ecosystem trade in India.

Understanding High-Risk PSP in India

Regulatory Landscape

Navigating the complex regulatory landscape is a chief concern for high-risk PSPs operating in India. This section explores the Wholesale Payments[2] regulatory framework and its implications on wholesale trade.

Key Challenges Faced by High-Risk PSPs

Payment Risks

Understanding and reduce payment risks are essential for the bookable of high-risk PSPs in the wholesale trade sector. This sub-section delves into the difficulties of payment-related challenges New regulations and customer demand will continue to require banks to expose APIs and connect to 3rd party distribution channels E-commerce payment systems[3].

Regulatory Compliance

Staying abreast of regulatory changes and secure compliance is a constant struggle for high-risk PSPs. Wholesale traders need to understand the regulatory expectations and work in tandem with their payment partners wholesale distribution payments[4]

Fraud Prevention

With the increasing style of cyber threats, fraud prevention becomes a critical aspect of high-risk PSP operations. The wholesale payments and cash management (PCM) business provides corporate and institutional clients with solutions that facilitate Streamline Supplier Payments[5], This sub-section explores the develop landscape of fraud and the strategies to combat it.

Navigating the Regulatory Environment

RBI Guidelines for High-Risk PSPs

The Reserve Bank of India (RBI) plays a pivotal role in shaping the regulatory environment for high-risk PSPs. Understanding and bond to RBI guidelines is non-negotiable for players in the wholesale trade sector. Technology firms have disrupted traditional businesses at a terrifying pace. Underpinning their success is a simple principle: start with the customer.

Compliance Measures for Wholesale Traders

Wholesale traders must also take driven measures to ensure compliance with existing regulations. This involves adopting firm Know Your Customer (KYC) processes and anti-money laundering (AML) practices High risk PSP Wholesale trade in India.

Mitigating Payment Risks

Importance of Secure Payment Gateways

Implementing secure payment gateways is a foundational step in reduce payment risks. This section emphasizes the significance of robust payment infrastructure in wholesale trade.

Implementing Risk Management Strategies

Two-Factor Authentication

Integrating two-factor authentication adds an additional layer of security, reducing the weakness of transactions to fraudulent activities High risk PSP Wholesale trade in India. Wholesale merchant services offer unique solutions due to the industry’s place in the supply chain.

Real-time Transaction Monitoring

Real-time transaction monitoring allows high-risk PSPs and wholesale traders to detect and respond to potential threats swiftly See what wholesalers should consider beyond payment processingWholesalers are those who connect manufacturers and retailers. They are a vital link in the chain of events from raw materials to consumers..

Importance of KYC (Know Your Customer)

In the realm of high-risk PSPs, KYC practices are crucial . Understanding the customer profile and transaction history is crucial for compliance and risk management.

Combatting Fraud in High-Risk PSP

Advanced Fraud Detection Technologies

High-risk PSPs need to invest in advanced fraud detection technologies to stay one step ahead of cyber threats. This section explores the innovative solutions available. Wholesale traders should adopt AML practices to prevent their platforms from being misused for money laundering activities. This involves thorough due diligence on transactions and partner.

Educating Wholesale Traders on Cybersecurity

Wholesalers are those who connect manufacturers and retailers. They are a vital link in the chain of events from raw materials to consumers Building a resilient wholesale trade ecosystem requires educating wholesale traders about cybersecurity best practices. Awareness programs can empower traders to safeguard their transactions.

Opportunities for Growth

Emerging Trends in Wholesale Trade

Understanding the evolving trends in wholesale trade is essential for high-risk PSPs seeking growth opportunities. This section explores emerging trends and their implications.

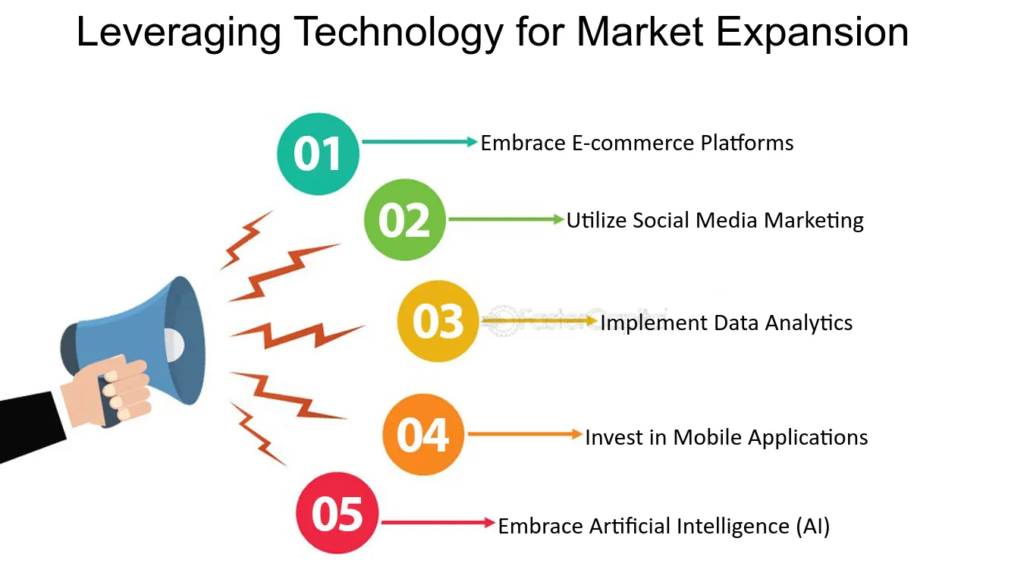

Leveraging Technology for Market Expansion

High-risk PSPs can leverage technology to expand their market reach. Exploring innovative solutions and partnerships can open new avenues for growth.

Building Trust in High-Risk PSP Relationships

Building and maintaining trust is a cornerstone of success for high-risk PSPs. And that unique place in the supply chain means they have some unique needs in merchant services. Establishing transparent communication and delivering on promises fosters long-term relationships with wholesale traders.

Successful Implementation of High-Risk PSP in Indian Wholesale Trade

Examining successful case studies provides insights into best practices for implementing high-risk PSPs in the Indian wholesale trade sector. Merchant services refer to the range of services associated with collecting payments. However, merchant service providers can do more than just facilitate wholesale credit card processing services alone.

Learning from Challenges Faced by Others

As we will see, other services like loans and software suites can complement merchant processing systems for collecting payments. Learning from challenges is equally crucial. Analyzing case studies where high-risk PSPs faced obstacles provides valuable lessons for the industry.

Conclusion

In conclusion, the integration of high-risk PSPs in Indian total trade brings both challenges and opportunities. Recapitulating key points emphasize the importance of a strategic approach High risk PSP Wholesale trade in India. As technology evolves and regulations adapt, the future outlook for high-risk PSPs in the wholesale trade sector looks promising. Staying agile and proactive is key to steer this ever-changing landscape.

FAQs

- Q: What makes a PSP high-risk in the context of wholesale trade?

A: High-risk PSPs in wholesale trade often operate in industries prone to raised financial risks, requiring them to address specific challenges such as payment risks, regulatory compliance, and fraud prevention. - Q: How can wholesale traders ensure compliance with RBI guidelines?

A: Wholesale traders can ensure compliance by adopting stringent KYC processes, implementing AML practices, and staying informed about the latest RBI guidelines. - Q: What role does technology play in mitigating payment risks for high-risk PSPs?

A: Technology, including secure payment gateways, two-factor authentication, and real-time transaction monitoring, plays a crucial role in mitigating payment risks for high-risk PSPs. - Q: How can high-risk PSPs build trust in their relationships with wholesale traders?

A: High-risk PSPs can build trust by establishing transparent communication, delivering on promises, and consistently demonstrating the reliability of their services. - Q: What are the key trends shaping the future of wholesale trade in India?

A: Emerging trends in wholesale trade include the adoption of technology for market expansion, a focus on building resilient cybersecurity practices, and a continuous effort to stay informed about evolving industry dynamics.