AUTHOR : JENNY

DATE : 20-12-2023

Introduction

In today’s digital landscape, the integration of payment gateways has become an integral part of businesses across India. As the country witnesses a significant surge in online transactions, understanding and implementing robust payment gateway integration have become imperative for enterprises aiming to thrive in the digital realm Integration in India.

Definition and Importance

Payment gateway integration refers to the process of enabling businesses to accept and process online payments securely. Business Integration It acts as a bridge between a merchant’s website and the financial institution that facilitates the transaction, ensuring a smooth and secure transfer of funds.

Growth in India’s Digital Payments Sector

India has witnessed a remarkable evolution in its digital payments ecosystem, with a notable increase in online transactions across various industries. Payment Gateway Business This shift has propelled businesses to adopt sophisticated payment gateway integration strategies to cater to the growing consumer demand for seamless online payment experiences.

Understanding Payment Gateway Business Integration

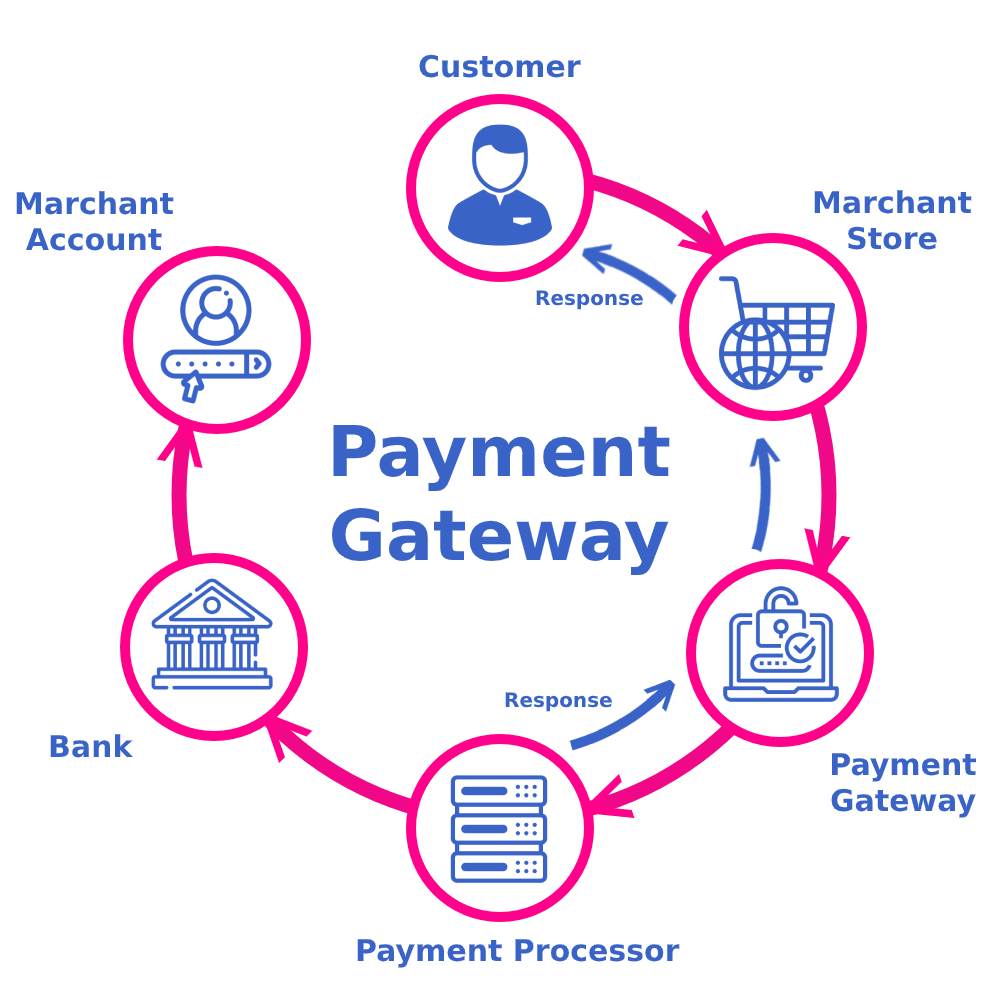

What is a Payment Gateway?

A payment for Business Integration is a technology that facilitates online transactions by authorizing payments between merchants and customers. It encrypts sensitive information, such as credit card details, ensuring secure and efficient transactions.

Role of Integration in Business Operations

integrated payments[1] of a payment gateway into business operations streamlines the payment process, offering customers a hassle-free checkout experience. It enhances the overall efficiency of transactions, boosting customer satisfaction and trust.

Key Factors for Successful Integration

Security Measures and Compliance

Ensuring robust security measures and compliance with industry standards such as PCI DSS (Payment Card Industry Data Security Standard) is crucial for safeguarding sensitive customer information Prior to the emergence of integrated payment systems[2], businesses had to rely on multiple payment systems and standalone platforms depending on the customers’.

Seamless User Experience

A seamless and user-friendly payment experience is vital for customer retention. Integration should focus on creating an intuitive interface and reducing checkout friction When shopping in person, customers were commonly limited to cash and card payments, as the store’s payment infrastructure couldn’t support a wider range of Digital Integrated payment[3]

Integration with Multiple Payment Options

Providing diverse payment options—credit/debit cards, net banking, mobile wallets—is essential to cater to varied customer preferences and increase conversion rates. Not only did this fragmented framework make for a more tedious and sub-par customer journey, but it also made it very difficult for businesses to track Successful Payments Analysis[4] sales data.

Popular Payment Gateway Services in India

Overview of Leading Payment Gateways

India boasts several prominent payment gateway services like Paytm, Razor pay, Interzoo, and others, each offering unique features and functionalities With Domestic and International Credit & Debit cards, EMIs ( Credit/Debit Cards & Cardless).

Features and Offerings

These gateways provide a range of features such as easy integration APIs, multi-currency support, recurring billing, and robust security protocols. Integrated payments are a streamlined way of paying for goods and services where payment

Integration Process for Different Platforms

The integration process varies for different platforms like websites, mobile apps, and e-commerce platforms, requiring tailored approaches for seamless integration. An easy to integrate Checkout with cards saved across businesses so that your customers can pay seamlessly

Challenges and Solutions in Integration

Technical Challenges Faced

Businesses encounter technical hurdles like API compatibility issues, downtime risks, and data security concerns during the integration process[5] Get reports and detailed statistics on payments, settlements, refunds and much more for you to take better business decisions.

Solutions and Best Practices

Implementing robust testing procedures, employing skilled developers, and ensuring regular updates and patches can mitigate integration challenges effectively The market value of global e-commerce sales is projected to grow to US$6.35 trillion by 2027. As customers increasingly prefer digital transactions, b.

Benefits of Payment Gateway Integration

Enhanced Transaction Security

Integration enhances security measures, reducing the risk of fraudulent activities and ensuring secure payment transactions.

Streamlined Payment Processes

Businesses experience streamlined payment processes, leading to faster and efficient transactions, ultimately improving operational efficiency Payment gateways play a key role in achieving this complex and important goal. Below, we discuss what businesses need to know about what payment gateways are, how they work.

Increased Customer Trust and Satisfaction

A seamless and secure payment experience fosters customer trust and satisfaction, leading to increased loyalty and repeat transactions. A payment gateway is a technology platform that acts as an intermediary in electronic financial transactions.

Selecting a payment gateway aligning with business needs, considering factors like fees, security, features, and customer support.

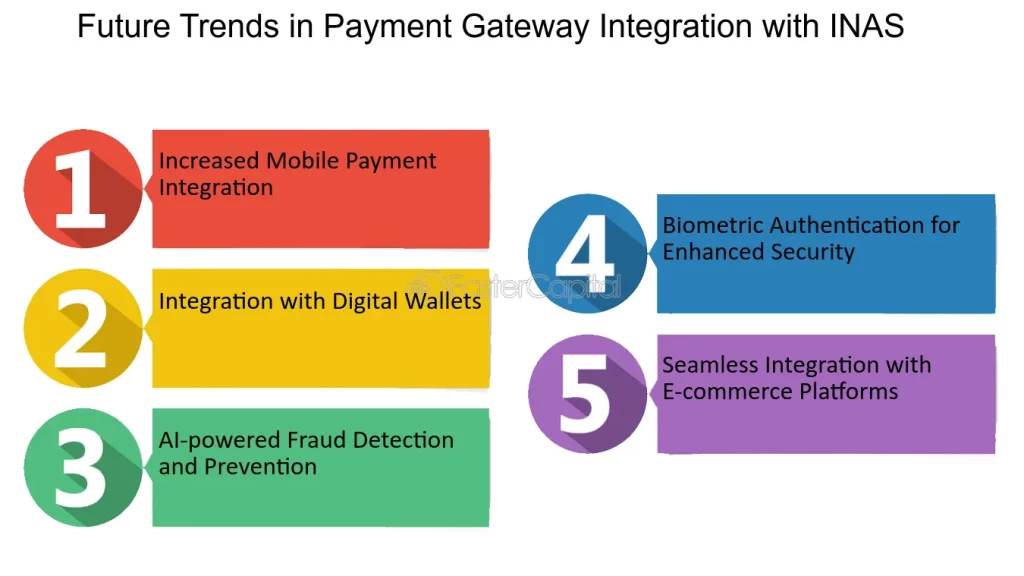

Future Trends in Payment Gateway Integration

Innovations and Advancements

he payment gateway bridges the gap between the customer, the business, and their respective financial institutions in one platform, typically charging a fee every time a transaction is processed. The future holds innovations like biometric authentication, AI-driven fraud detection, and blockchain-based transactions, transforming the payment landscape.

The Impact of Evolving Technology

Evolving technology will drive the evolution of payment gateways, catering to changing consumer behaviors and enhancing transaction security. the payment gateway bridges the gap between the customer, the business, and their respective financial institutions in one platform, typically charging a fee every time a transaction is processed.

Conclusion

In conclusion, payment gateway integration stands as a pivotal element for businesses in India’s dynamic digital ecosystem. Embracing seamless integration not only ensures secure transactions but also fosters customer trust and satisfaction, driving growth and success in the ever-expanding online marketplace.

FAQs

1. How long does it take to integrate a payment gateway into a website?

Integration timelines vary based on the chosen gateway and the complexity of the website. Typically, it can take a few days to a few weeks for seamless integration.

2. Are there any risks associated with payment gateway integration?

Yes, risks like data breaches, technical glitches, and compatibility issues may arise. However, implementing robust security measures and following best practices can mitigate these risks.

3. Can businesses integrate multiple payment gateways?

Yes, businesses can integrate multiple gateways to offer customers a variety of payment options and improve conversion rates.

4. What role does compliance play in payment gateway integration?

Compliance with industry standards like PCI DSS is crucial to ensure the security and confidentiality of customer payment data.

5. How can businesses stay updated with the latest trends in payment gateway integration?

Staying connected with industry forums, attending webinars, and collaborating with payment service providers can help businesses stay informed about the latest trends and advancements in payment gateway integration.