AUTHOR :HAANA TINE

DATE :20/12/2023

Introduction

Definition of Payment Gateway

A payment gateway[1] serves as a virtual bridge, facilitating secure and efficient financial transactions between parties involved in B2B dealings. It acts as a secure intermediary that ensures the seamless transfer of funds between buyers and sellers Transactions in India.

Significance in B2B Transactions

The significance of payment gateways in B2B transactions[2] cannot be overstated. These gateways provide a reliable and efficient means for businesses to transact, allowing for smoother financial interactions and enhanced operational efficiency.

Evolution of Payment Gateways in India

Historical Overview

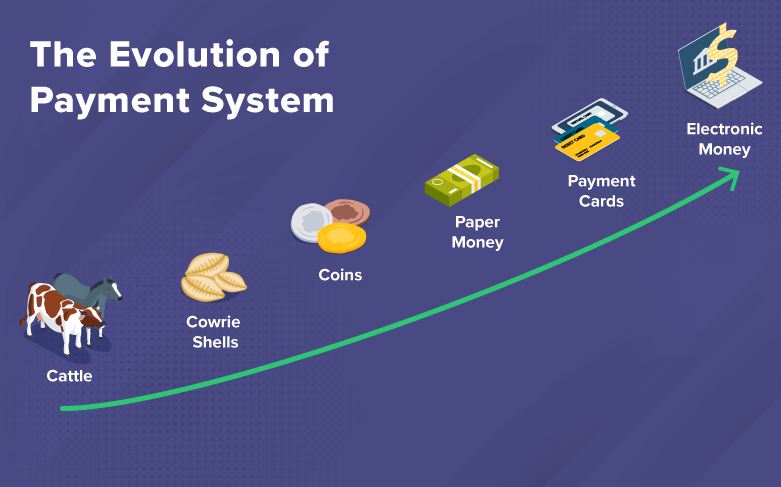

The evolution of payment gateways in India has been a journey marked by technological milestones. From the early days of traditional banking to the advent of online transactions, the landscape has witnessed a significant transformation.

Technological Advancements

The integration of cutting-edge technologies, such as blockchain and artificial intelligence, has further propelled the evolution of Payment service provider[3]. These advancements have not only enhanced the speed of transactions but also fortified the security measures in place.

Importance of Payment Gateways in B2B Transactions

Streamlining Transactions

One of the primary advantages of payment gateways in B2B transactions is the streamlined nature of financial interactions. These gateways enable businesses to conduct transactions with minimal friction, reducing delays and improving overall efficiency.

Enhancing Security Measures

Security is paramount in B2B transactions, given the substantial sums involved. incorporate robust security measures, including encryption and multi-factor authentication, to safeguard sensitive financial information Secure Web Gateway[4].

Popular Payment Gateways in India

Analysis of Key Players

In the Indian market, several payment gateways have emerged as key players. A comprehensive analysis of these Residential gateway[5]

businesses with insights into the features and offerings that set them apart.

Unique Features and Offerings

Different payment gateways come with unique features tailored to specific business needs. Whether it’s real-time analytics, customizable interfaces, or integrated fraud detection, businesses can choose a payment gateway that aligns with their requirements.

Challenges and Solutions

Addressing Security Concerns

While payment gateways offer enhanced security, concerns may still arise. Addressing these concerns involves constant monitoring, regular updates to security protocols, and collaboration between businesses and service providers.

Overcoming Integration Challenges

The seamless integration of payment gateways into existing B2B systems can be a challenge. However, service providers offer comprehensive support to ensure a smooth transition, minimizing disruptions to business operations.

Regulatory Framework

Government Regulations

The regulatory framework surrounding B2B transactions and payment gateways is a critical aspect.Payment Gateway Business-to-Business Transactions in India Businesses must stay abreast of government regulations to ensure compliance and mitigate legal risks.

Compliance Standards in B2B Transactions

Adhering to industry compliance standards is imperative for businesses utilizing payment gateways. This ensures that transactions are conducted in a transparent and legally sound manner This entails providing a payment portal or checkout page for customers to submit their payment.

Advantages of Payment Gateways in B2B Transactions

Efficiency and Speed

One of the significant advantages of payment gateways is the speed at which transactions can be executed. This efficiency contributes to improved cash flow and overall business agility.

Improved Cash Flow

Payment gateways play a crucial role in optimizing cash flow for businesses engaged in B2B transactions. Timely payments and reduced processing times positively impact liquidity A payment gateway is the system that allows your website to collect credit and debit card payments. .

Case Studies

Successful Implementations

Examining case studies of successful implementations provides valuable insights into how businesses have benefited from integrating payment gateways. Real-world examples demonstrate the tangible impact on operational efficiency and financial outcomes.

Lessons Learned

Learning from the experiences of other businesses helps navigate potential pitfalls. Understanding the challenges faced and the strategies employed can inform decision-making for businesses considering payment gateway integration.

Future Trends

Emerging Technologies

The future of payment gateways in B2B transactions is closely tied to emerging technologies. Payment Gateway Business-to-Business Transactions in India Blockchain, artificial intelligence, and machine learning are expected to play pivotal roles in shaping the landscape.

Anticipated Developments

As technology continues to evolve, anticipating developments in payment gateways becomes crucial for businesses. Staying ahead of the curve ensures that businesses can leverage new features and functionalities to maintain a competitive edge.

Tips for Choosing the Right Payment Gateway

Understanding Business Needs

Selecting the right payment gateway begins with a understanding of business requirements. Different industries may specific features, and the choice to these needs is essential.

Evaluating Service Providers

Beyond features, businesses must evaluate the reliability and reputation of payment gateway service It serves as the go-between for the customer, business, and payment processor providers. Customer reviews, industry reputation, and customer support are critical factors to consider.

Conclusion

In conclusion, payment gateways have become in the realm of B2B transactions in India. The evolution of technology, coupled with the increasing demand for efficiency, has paved the way for financial interactions. As businesses continue to the dynamic landscape, the strategic integration of payment gateways remains a key driver for success.

FAQs

1. How do payment gateways benefit B2B transactions?

Payment Openings benefit B2B transactions by streamlining the payment process, reducing friction, and enhancing overall efficiency. They offer secure and efficient means for businesses to conduct financial transactions.

2. Are there any security risks associated with using payment Openings?

While payment gateways prioritize security, risks may still exist.Payment Gateway Business-to-Business Transactions in India Regular monitoring, updates to security protocols, and collaboration between businesses and service providers are essential to mitigate potential risks.

3. What criteria should businesses take into account when selecting a payment gateway for their transactions?

Businesses should consider their specific needs, industry requirements, and the reputation of service providers when choosing a payment gateway. Evaluating features, customer reviews, and support services is crucial.

4. Can payment Openings be customized to suit specific business needs?

Yes, many payment Openings offer customization options to align with the specific needs of businesses. This may include features like real-time analytics, customizable interfaces, and integrated fraud detection.

5. How has the landscape of B2B transactions in India changed with the advent of payment Openings?

The advent of payment Openings has significantly transformed the landscape of B2B transactions in India. It has led to increased efficiency, improved cash flow, and enhanced security in financial dealings.