AUTHOR : SOFI PARK

DATE : 20/12/2023

Introduction

Payment gateways serve as the virtual bridge between merchants and customers, Cross-border payments[1]

facilitating secure and efficient online transactions. As businesses increasingly rely on digital channels, the importance of robust payment gateway commercial networking cannot be overstated.

Importance of commercial networking in India

India, with its expand digital economy, is witnessing a Example shift in commercial networking. The synergy between payment gateways and commercial networks is pivotal for support this growth Cross-border payments are financial transactions where the payer and the recipient are based in separate countries. .

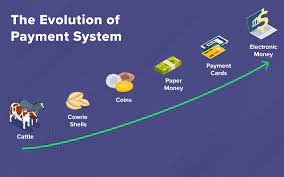

Evolution of Payment Gateways

Early challenges and solutions

The inception of payment gateways Networking In India faced challenges such as slow processing speeds and limited security measures. Over time, technological advancements addressed these issues, leading to a more reliable and secure system Payment Networking In India.

Technological advancements

From traditional payment on Commercial methods to the integration of Artificial Intelligence (AI) and blockchain, payment gateways have undergone a transformative journey. Network service[2]

These creation not only enhance transaction speed but also fortify security protocols.

Payment Gateway Landscape in India

Major players

India boasts a dynamic payment gateway landscape, with key players like Paytm, Razorpay, and Instamojo dominating the market. Invoicing payment methods[3] An explanation of the most common forms of receiving invoice payments, along with the positives and negatives of each option. Understanding the competitive landscape is crucial for businesses seeking optimal solutions.

Market trends and growth

Analyzing current trends, including the surge in mobile payments and the rise of Unified Payments Interface (UPI), provides insights into the trajectory of payment gateway commercial networking in India payments can be made in several different ways. Bank transfers, Contactless payment[4] credit card payments and alternative payment methods such as e-money wallets and mobile payments are currently the most prevalent ways of transferring funds across borders.

Integration Challenges

Technical complexities

Integrating payment gateways with diverse platforms can be technically challenging. Businesses must navigate these complexities to ensure a seamless transaction experience for users payments can be made in several different ways. Bank transfers, Social networking service[5] credit card payments and alternative payment methods such as e-money wallets and mobile payments are currently the most prevalent ways of transferring funds across borders.

Security concerns

As digital transactions proliferate, the risk of cyber threats also increases. This section explores the importance of robust security measures in payment gateway integration credit card payments and alternative payment methods such as e-money wallets and mobile payments are currently the most prevalent ways of transferring funds across borders..

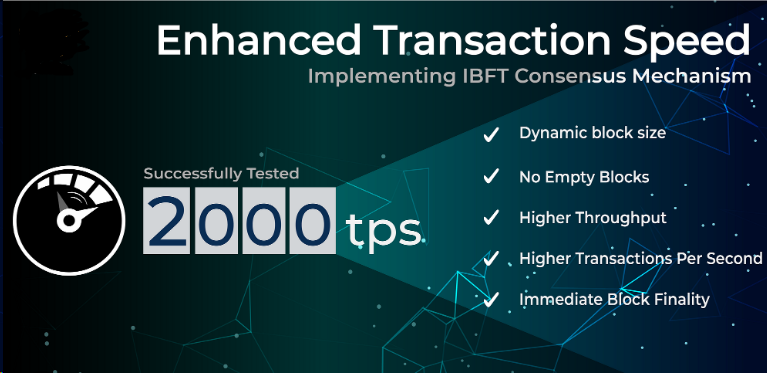

Benefits of Payment Gateway Commercial Networking

Enhanced transaction speed

Efficient commercial networking accelerates transaction processing, reducing waiting times for both merchants and customers Network services are applications at the network application layer that connect users working in offices.

Increased security measures

A Network services are applications at the network application layer that connect users working in offices well-integrated payment gateway network provides layers of security, safeguarding sensitive financial information from potential breaches.

Future Prospects

Emerging technologies

The article delves into emerging technologies such as contactless payments, biometrics, and the role of cryptocurrencies in shaping the future of payment gateways network architecture that combines software-defined wide-area network (SD-WAN) capabilities and cloud-native security functions. Organizations can use SASE architecture to provide users with secure connections to applications from any location.

Potential innovations

I network architecture that combines software-defined wide-area network (SD-WAN) capabilities and cloud-native security functions. Organizations can use SASE architecture to provide users with secure connections to applications from any location. Innovation in payment gateway technologies is expected to drive new possibilities, offering businesses and consumers more choices and convenience.

SEO Best Practices for Payment Gateways

Keyword optimization

Implementing effective keyword strategies is crucial for enhancing the online visibility of payment gateway providers Users can also access applications securely. The cloud-native security functions in SASE architecture include secure web gateways, cloud-access security brokers, and firewalls. These functions are delivered from the cloud and are provided as one integrated architecture by SASE vendors.

Backlink strategies

Building authoritative backlinks improves the credibility of payment gateway websites, positively impacting SEO NaaS is a cloud model that lets organizations easily operate their networks and achieve the outcomes they expect from them without owning, building, or maintaining infrastructure themselves.

Content relevance

Creating relevant and informative content ensures that payment gateway websites attract and retain a target audience Users can also access applications securely. The cloud-native security functions in SASE architecture include secure web gateways, cloud-access security brokers, and firewalls. These functions are delivered from the cloud and are provided as one integrated architecture by SASE vendors.

Navigating Regulatory Frameworks

Compliance requirements

An overview of the regulatory frameworks governing payment gateways in India provides businesses with insights into compliance requirements.

Legal considerations

Addressing legal aspects ensures that payment gateway commercial networking adheres to the legal framework, minimizing legal risks NaaS is a cloud model that lets organizations easily operate their networks and achieve the outcomes they expect from them without owning, building, or maintaining infrastructure themselves.

The Role of Payment Gateways in E-commerce

Facilitating online transactions

Payment gateways play a pivotal role in the success of e-commerce businesses, facilitating seamless online transactions Payment systems may be physical or electronic and each has its own procedures and protocols. Standardization has allowed some of these systems and networks to grow to a global scale, but there are still many country-specific and product-specific systems.

Impact on consumer trust

Payment gateways play a pivotal role in the success of e-commerce businesses, facilitating seamless online transactions secure and reliable payment gateway fosters consumer trust, influencing purchasing decisions in the e-commerce space.

Balancing Security and User Experience

Innovations in secure transactions

Exploring innovative security measures ensures that payment gateways strike a balance between security and a positive user experience An efficient national payment system reduces the cost of exchanging goods, services, and assets. It is indispensable to the functioning of the interbank, money, and capital markets. .

User-friendly interfaces

Intuitive and user-friendly interfaces contribute to a seamless transaction experience, enhancing overall customer satisfaction. An efficient national payment system reduces the cost of exchanging goods, services, and assets. It is indispensable to the functioning of the interbank, money, and capital markets.

Conclusion

This comprehensive exploration underscores the evolution, challenges, benefits, and future prospects of payment gateway commercial networking in India. As India continues its digital transformation, payment gateways are poised to play an increasingly integral role in shaping the future of commercial networking.

FAQs

1. How do payment gateways work?

Payment gateways facilitate the transfer of information between a payment portal and the Front End Processor (FEP) or acquiring bank.

2. What are the common challenges in payment gateway integration?

Common challenges include technical complexities, security concerns, and regulatory compliance.

3. Are all payment gateways secure?

While reputable payment gateways implement stringent security measures, it’s essential for businesses to choose a provider with a strong security track record.

4. How does commercial networking benefit businesses?

Commercial networking enhances transaction speed, security measures, and overall user experience, positively impacting businesses.

5. What should businesses consider when choosing a payment gateway?

Businesses should consider their specific needs, evaluate security features, and plan for scalability when selecting a payment gateway.