AUTHOR : KIM FERNANDEZ

DATE : 28/02/2024

Introduction

Definition of Payment Gateway

A Payment Gateway[1] is a digital interface that facilitates the secure transfer[2] of financial information between a merchant[3] and a customer. It ensures seamless transactions[4] and also plays a crucial role in the rapidly advancing digital economy[5].

Significance in the Digital Era

In an era dominated[1] by digital interactions, payment gateways serve as the anchor of online transactions, offering a secure and efficient way to transfer funds[2].

Evolution of Payment Gateways in India

Early Adoption

India witnessed an early adoption of payment gateways with the rise of e-commerce[3] platforms in the late 20th century. The need for secure transactions fueled the development of these digital solutions[4].

Growth Factors

Several factors This relates to the rapid growth of payment[5] gateways in India, including the surge in internet users, smartphone penetration, and government initiatives promoting a digital economy.

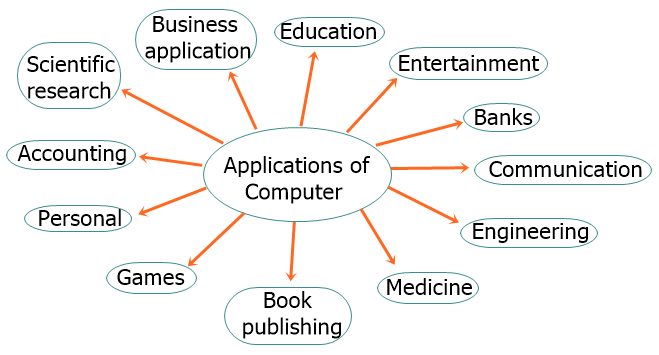

Types of Payment Gateways

Traditional Payment Gateways

Traditional entrances paved the way for digital transactions, with a focus on web-based platforms. They laid the foundation for the sophisticated systems we see today.

Modern Innovations

Continual innovation has led to the development of modern payment gateways, incorporating features such as biometric authentication, one-click payments, and also tokenization for enhanced security.

Integration and Security

Seamless Integration Processes

Businesses today benefit from user-friendly integration processes, ensuring a smooth transition to digital transactions without disrupting operations.

Importance of Secure Transactions

The emphasis on secure transactions is paramount, with Payment Gateway Computer Applications in India employing robust security measures, including multi-factor authentication, to protect sensitive financial information.

Role in E-commerce

Facilitating Online Transactions

Payment gateways play a pivotal role in facilitating online transactions, ensuring that customers can make purchases securely and conveniently.

Enhancing Customer Trust

The integration of reliable payment gateways enhances customer trust, contributing to increased conversion rates and customer satisfaction in the competitive e-commerce landscape.

Regulatory Landscape

Regulatory Framework in India

The Reserve Bank of India (RBI) and other regulatory bodies have established a comprehensive framework to govern payment gateways, ensuring compliance with standards and guidelines.

Compliance Requirements

Businesses utilizing Payment Gateway computer applications in India must adhere to compliance requirements, including data protection standards, to mitigate legal risks and build trust among users.

Challenges and Solutions

Security Concerns

Security remains a constant challenge in the digital realm. Payment Gateway Computer Applications India address these concerns by implementing state-of-the-art security measures and also educating users on best practices.

Transaction Failures

To tackle transaction failures, continuous monitoring and upgrading of systems are essential, ensuring a smooth and reliable payment experience for both merchants and consumers.

Future Trends

Advancements in Technology

As technology undergoes Nonstop evolution, payment gateways are Expected to seamlessly integrate advanced features, including artificial intelligence and machine learning, thereby enhancing security measures and Uplifting the overall user experience.

Integration with Emerging Tech

The integration of payment gateways with emerging technologies, including Distributed ledger and IoT, is on the horizon, promising further efficiency, Clearness, and also security.

Case Studies

Successful Implementations

Examining successful implementations not only provides in-depth insights into the effective utilization of payment gateways but also furnishes valuable lessons for businesses aspiring to continuously optimize and enhance their digital transactions.

Lessons Learned

By meticulously analyzing both past challenges and successes in payment gateway implementations, businesses can derive a comprehensive roadmap, guiding them effectively to navigate the complexities of digital transactions.

Importance for Small Businesses

Leveling the Playing Field

Payment gateways empower small businesses by providing them with access to a secure and also efficient means of handling transactions, Equalizing the playing field in the competitive market.

Cost-Effective Solutions

For small businesses, the cost-effective payment solutions offered by payment gateways not only contribute to financial durability but also pave the way for significant growth opportunities in the dynamic marketplace.

Consumer Education

Understanding the Payment Process

Educating consumers about the intricacies of the payment process enhances their confidence in using digital transactions, Contributory to the overall growth of the digital economy.

Promoting Digital Literacy

Promoting digital literacy is not only essential for fostering a society comfortable with online transactions but also plays a crucial role in reducing barriers to entry for individuals and businesses alike.

Impact on Traditional Banking

Changing Dynamics

The adoption of payment gateways has changed the dynamics of traditional banking, pushing financial institutions to adapt to the digital era and also offer innovative services.

Collaborations and Partnerships

Collaborations between payment gateways and traditional banks not only create synergies but also lead to mutually beneficial partnerships, thereby enhancing the overall financial ecosystem.

Social and Economic Implications

Financial Inclusion

Payment gateways contribute significantly to financial inclusion by providing individuals in remote areas with convenient access to digital transactions, thereby reducing their reliance on physical currency.

Boosting Digital Economy

The widespread use of payment gateways contributes to the growth of the digital economy, fostering innovation, entrepreneurship, and also economic development.

Global Perspective

Comparative Analysis with Other Countries

Comparing India’s approach to payment gateways with other countries offers valuable insights into global best practices and also areas for improvement.

Lessons for Continuous Improvement

Learning from the experiences of other countries not only allows India to continuously improve its payment gateway ecosystem but also ensures it remains at the forefront of innovation in the dynamic realm of digital transactions.

Conclusion

In conclusion, payment gateways in India have evolved into indispensable tools, Assisting secure and efficient digital transactions and also playing a pivotal role in fostering the nation’s economic growth.

FAQs

- Are payment gateways safe for online transactions?

- Yes, payment gateways use advanced encryption and security measures to ensure the safety of online transactions.

- How do payment gateways impact small businesses?

- Payment gateways empower small businesses by providing cost-effective solutions, expanding their customer base, and leveling the playing field.

- What role do regulatory bodies play in governing payment gateways?

- Regulatory bodies, such as the RBI, establish frameworks and compliance requirements to ensure the secure and legal operation of payment gateways.

- What is the future outlook for payment gateways in India?

- The future outlook involves advancements in technology, integration with emerging tech, and a focus on increasing mobile transactions.

- How do payment gateways contribute to financial inclusion?

- Payment gateways contribute to financial inclusion by providing individuals in remote areas with access to digital transactions, reducing reliance on physical currency.