AUTHOR : RIVA BLACKLEY

DATE : 06/12/2023

Introduction

In the fast-paced world of online transactions, payment gateways[1] play a pivotal role in facilitating smooth and secure financial transactions. However, businesses often find themselves grappling with the challenges posed by payment gateway debt. In this article, we delve into the concept of payment gateway debt consolidation in India, exploring its nuances, benefits, and the impact on businesses’ financial well-being.

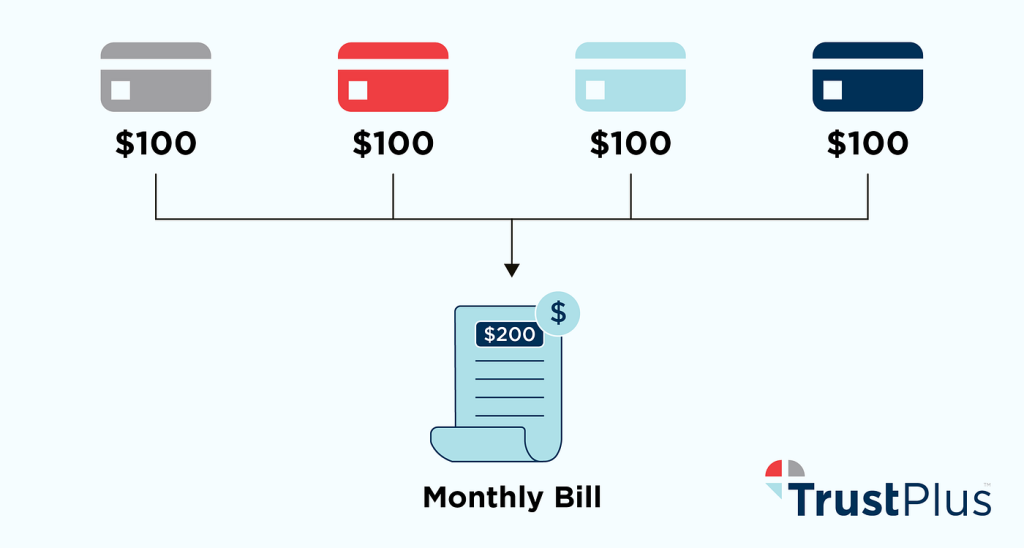

Understanding Debt Consolidation

Debt consolidation[2] is a financial strategy that involves combining multiple debts into a single, manageable payment. This approach aims to streamline the repayment process, offering businesses a more organized and structured approach to clearing their financial obligations. The benefits of debt consolidation are multifaceted, ranging from reduced interest rates to simplified financial management[3]

Payment Gateway Challenges

While payment gateways streamline transactions, businesses encounter various challenges, leading to accumulated debt. Common issues include high transaction fees, delayed settlements, and unexpected technical glitches. Such challenges can have a detrimental impact on the financial health of businesses, necessitating the need for strategic debt management[4].

Payment Gateway Debt Consolidation in India

In recent times, a notable trend has emerged in the Indian market — the adoption of payment gateway debt consolidation. As businesses grapple with economic uncertainties and market fluctuations, the need for a comprehensive solution to manage payment gateway debt has become increasingly apparent. Factors such as economic downturns, unexpected expenses, and changing market dynamics contribute to the surge in demand for debt consolidation services.

Advantages of Consolidating Payment Gateway Debt

Businesses opting for payment gateway debt consolidation stand to gain several advantages. Cost savings, improved financial stability[5], and an enhanced business reputation are among the notable benefits. By consolidating their debts, businesses can negotiate better terms with creditors, resulting in a more favorable financial landscape.

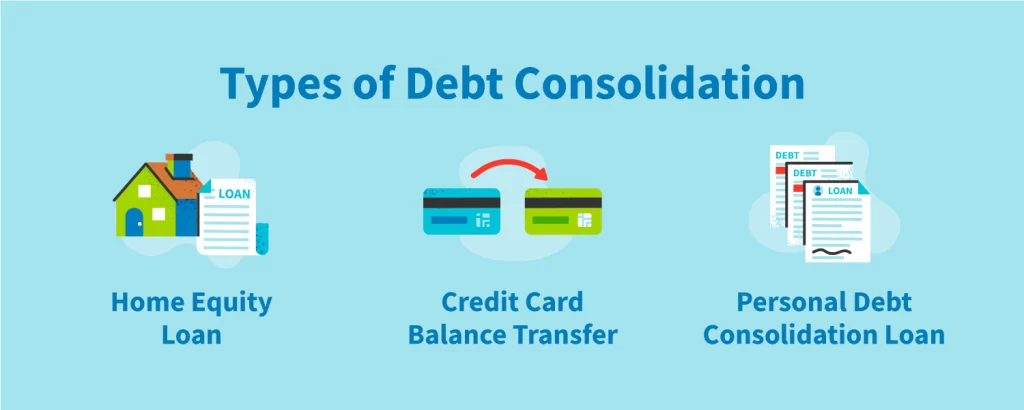

How to Consolidate Payment Gateway Debt

Initiating the debt consolidation process involves strategic steps. Businesses should evaluate their financial standing, identify outstanding debts, and choose a consolidation strategy that aligns with their goals. Whether through debt consolidation loans or debt settlement programs, selecting the right approach is crucial for successful consolidation.

Case Studies

Examining real-life case studies provides valuable insights into the effectiveness of payment gateway debt consolidation. Success stories from businesses that have successfully navigated the challenges of debt can serve as inspiration. By understanding the experiences of others, businesses can gain practical knowledge and also make informed decisions.

Tips for Selecting a Debt Consolidation Service

Choosing a reputable debt consolidation service is a critical step in the process. Businesses should carefully evaluate service providers, considering factors such as fees, reputation, and success rates. This section provides practical tips to guide businesses in selecting a service that aligns with their specific needs.

Future Trends in Payment Gateway Debt Management

The payment gateway landscape is continually evolving, influenced by technological advancements and changing consumer behavior. Exploring future trends in payment gateway debt management offers businesses a glimpse into upcoming challenges and opportunities. Staying ahead of the curve is essential for sustainable financial health.

Impact of Debt Consolidation on SEO

Maintaining a strong online presence is integral to a business’s success. This section explores how debt consolidation can positively impact SEO efforts. A stable financial foundation contributes to trustworthiness, which, in turn, enhances a business’s visibility in search engine rankings.

Real-life Experiences

Testimonials from businesses that have undergone payment gateway debt consolidation provide authentic narratives. By sharing their journeys and also outcomes, these businesses offer valuable perspectives on the challenges they faced and the positive transformations achieved through debt consolidation.

Common Misconceptions

Addressing misconceptions surrounding payment gateway debt consolidation is crucial for dispelling myths and also fostering informed decision-making. This section aims to debunk common myths, providing clarity on the process and its potential benefits.

Conclusion

In conclusion, payment gateway debt consolidation in India is a strategic move for businesses seeking financial stability and enhanced operational efficiency. By understanding the challenges, benefits, and steps involved, businesses can make informed decisions to secure their financial future.

FAQS

- Is debt consolidation suitable for all businesses?

- Debt consolidation is a viable option for many businesses, but its suitability depends on individual circumstances. Consulting with financial experts can help determine the best approach.

- How long does the debt consolidation process take?

- The duration of the debt consolidation process varies based on factors such as the amount of debt, chosen strategy, and creditor cooperation. On average, it may take several months to a few years.

- Can debt consolidation impact credit scores?

- While debt consolidation itself may not directly impact credit scores, the process may involve temporary dips. However, successful debt repayment can contribute to improved credit over time.

- Are there alternatives to debt consolidation for managing payment gateway debt?

- Yes, alternatives include debt settlement, negotiation with creditors, and also implementing stricter financial management practices. Choosing the right approach depends on the specific needs of the business.

- How can businesses avoid accumulating payment gateway debt in the future?

- Implementing proactive financial management, regularly reviewing payment gateway agreements, and staying informed about industry trends can help businesses prevent the accumulation of debt.