AUTHOR : PUMPKIN KORE

DATE : 06/12/2023

Introduction

Understanding Payment Gateways

Payment gateways[1] act as intermediaries between merchants and customers, facilitating secure online transactions[2]. In India, the landscape has witnessed significant changes, with downloadable software becoming a popular choice for businesses[3] of all sizes.Payment Gateway Downloadable Software in India[4]

Evolution of Payment Gateway Software in India

The journey of payment gateway software in India has been marked by technological[5] advancements and an increasing demand for seamless transaction experiences. From traditional [1]methods to modern downloadable solutions, the evolution has been transformative.[2]

Importance of Downloadable Software

Flexibility in Integration

One of the key advantages of downloadable payment gateway software is its flexibility[3] in integration. Businesses can seamlessly incorporate the software into their existing systems, ensuring a smooth transition without disrupting operations.

Customization Options

Downloadable software offers a range of customization options, allowing businesses [4]to tailor the payment gateway to their specific needs. This adaptability is crucial in catering to diverse industries and transaction[5] types.

Security Concerns Addressed

Contrary to concerns about security, downloadable payment gateway software addresses these issues comprehensively. Advanced encryption and security protocols ensure that customer data remains confidential and protected against potential threats.

Popular Payment Gateway Downloadable Software in India

Software stands out as a leading solution in the Indian market. With a robust feature set and user-friendly interface, it caters to the needs of both small businesses and large enterprises.

Features of ABC Payment Gateway Software

ABC Payment Gateway Software offers a unique set of features, including real-time transaction monitoring and multi-currency support. The adaptability it presents positions it as a prime selection for businesses undergoing expansion.

Choosing the Right Payment Gateway Software

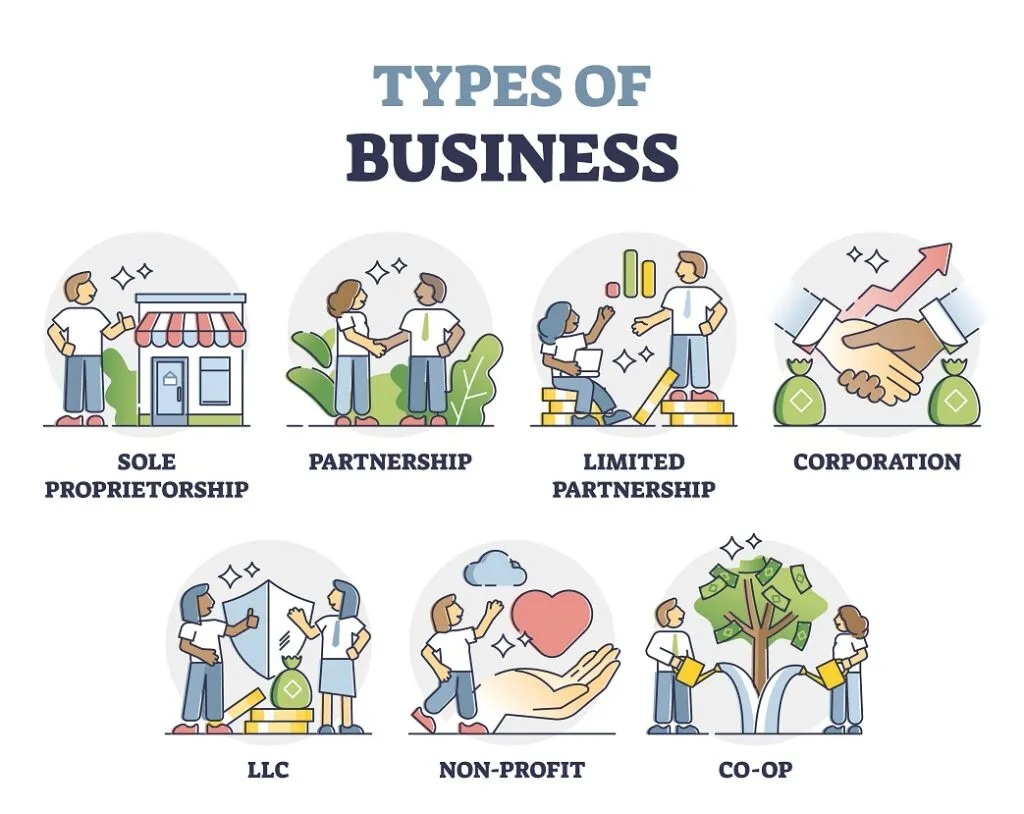

Consideration of Business Type and Size

Selecting the right payment gateway software begins with a thorough understanding of your business type and size. Small businesses may prioritize cost-effectiveness, while larger enterprises focus on scalability.

Integration with E-commerce Platforms

Compatibility with popular e-commerce platforms is a crucial consideration. Seamless integration ensures a hassle-free experience for both merchants and customers, enhancing the overall transaction process.

Security Features and Compliance

Security remains a top priority in the digital landscape. Choosing payment gateway software that complies with industry standards and prioritizes security features is non-negotiable.

Enhancing Customer Trust and Confidence

The interface design plays a crucial role in enhancing customer trust and confidence. Businesses that prioritize a positive user experience are more likely to build lasting relationships with their customer base.

Performance and Reliability

Speed and Transaction Efficiency

In the realm of the digital landscape, the essence lies in swift responsiveness, emphasizing the critical importance of speed. Payment gateway software that ensures swift transactions contributes to a positive customer experience, reducing the likelihood of abandoned carts and transaction failures.

Redundancy and Failover Mechanisms

Reliability is paramount in payment transactions. Software with built-in redundancy and failover mechanisms ensures uninterrupted service, even in the face of unexpected technical glitches.

Cost Considerations

Licensing and Subscription Models

Understanding the cost structure of payment gateway software is crucial for budgetary considerations. Whether opting for licensing or subscription models, businesses need clarity on the associated costs to make informed decisions.

Hidden Costs to Be Aware Of

Beyond the upfront costs, businesses should be aware of potential hidden costs. This section sheds light on common hidden expenses associated with payment gateway software, allowing businesses to plan accordingly.

Customer Support and Assistance

Responsive Customer Service

Exceptional customer support is a cornerstone of a successful payment gateway software provider. Quick response times and effective issue resolution contribute to a positive customer experience.

Online Resources and Documentation

Providing comprehensive online resources and documentation is instrumental in assisting businesses and users. Tutorials, FAQs, and user manuals empower users to navigate the software independently.

Security Measures in Payment Gateway Software

SSL Encryption and Data Protection

Security measures such as SSL encryption are non-negotiable in payment gateway software. This section explores the importance of encryption in safeguarding sensitive data and ensuring secure transactions.

Compliance with Industry Standards

Adherence to industry standards and regulations is paramount. Payment gateway software must comply with regulations to ensure legal and secure transactions, instilling confidence in both merchants and customers.

Integration with Emerging Technologies

The future of payment gateway software lies in integration with emerging technologies. Artificial intelligence, machine learning, and biometric authentication are poised to redefine the landscape.

Blockchain and Cryptocurrency Integration

The rise of blockchain technology opens new avenues for payment gateway software. Exploring the integration of cryptocurrencies can pave the way for innovative and secure transaction methods.

Conclusion

In conclusion, payment gateway downloadable software plays a pivotal role in transforming digital transactions. From enhancing security to providing a seamless user experience, the right software can significantly impact a business’s success.

FAQs

- Is downloadable payment gateway software suitable for small businesses?

- Yes, downloadable software often provides cost-effective solutions tailored to the needs of small businesses.

- What security measures should businesses prioritize in payment gateway software?

- SSL encryption, data protection, and compliance with industry standards are essential security measures.

- How can businesses address compatibility issues with existing systems?

- Understanding compatibility challenges and working closely with the software provider for seamless integration is key.

- Are there hidden costs associated with payment gateway software?

- Businesses should be aware of potential hidden costs, such as transaction fees and additional feature charges.

- What future trends can we expect in payment gateway software?

- Emerging trends include integration with artificial intelligence, machine learning, and the exploration of blockchain technology.