AUTHOR : SELENA GIL

DATE : 15/12/2023

Introduction

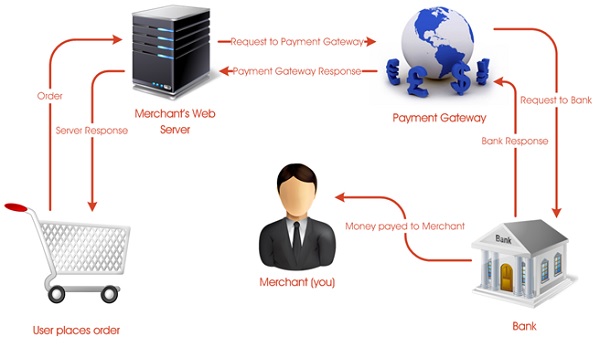

In the fast-paced world of e-commerce, the seamless flow of payments lies at the heart of successful transactions. Payment gateways serve as the crucial intermediaries between buyers and sellers in the online marketplace, Payment Gateway E-commerce Payment Services In India ensuring secure and efficient processing of payments.

Importance of Payment Gateways in E-commerce

Smooth and secure payment processing is the dorsum of any successful online business. The significance of payment gateways in enabling hassle-free transactions cannot be overstated Payment Gateway any Services In India.

Evolution of Payment Gateway Services in India

Early Challenges

India’s journey in establishing robust payment gateway services Merchant Payment Gateway faced initial hurdles, Real-Time Payment Processing primarily related to technological infrastructure and consumer trust.

Growth Factors

However, with technological advancements, Secure Payment Gateway increased digital literacy, and a surge in online transactions, payment gateway services in India have witnessed exponential growth.

Major Payment Gateway Players in India

Overview of Top Services

Players like Paytm, Razorpay, and Instamojo have emerged as frontrunners, offering diverse payment solutions victual to the varied needs of businesses.

Comparative Analysis

Each service exhibits distinct features, fee structures, and ease of integration, presenting businesses with a spectrum of choices.

Security Features in Indian Payment Gateways

Encryption and Safety Measures

The focus on cipher , SSL instrument and Payment Gateway E-commerce Payment Services In India two-factor authentication has surround Indian payment gateways, instilling trust among users.

Fraud Prevention Techniques

Implementing advanced fraud detection algorithms has been instrumental in curbing crooked activities, make certain secure transactions.

Integration of Payment Gateways in E-commerce Platforms

Seamless Integration Benefits

Effortless integration of payment gateways into e-commerce Payment Gateway Aggregator[1] platforms has streamlined checkout processes, enhancing user experience.

Challenges Faced in Integration

However, affinity issues and technical complexities have posed challenges, taxing continuous innovation for smoother integrations.

Impact of Government Regulations on Payment Gateways

Government regulations and policies significantly shape the operate of payment gateways, position innovation with security measures.

Future Trends and Innovations in Payment Gateway Services

As technology evolves, the future bond innovations like voice-enabled payments, AI-driven security enhancements, and blockchain integration.

Security Features in Indian Payment Gateways

Security remains a chief concern in the realm of digital transactions. In India, payment gateways have implemented robust security measures to ensure safe and reliable transactions for both businesses and consumers.

Encryption and Safety Measures

One of the foundational pillars of secure transactions iscipher . Indian payment gateways employ cutting-edge encryption technologies, such as Secure Socket Layer (SSL) certifications, to encrypt sensitive data during transmission. This encryption information, like credit card Seamless Checkout Solutions[2] numbers or personal details, from potential threats, ensuring that data remains personal and secure.

Fraud Prevention Techniques

Combatting fraudulent activities is another critical aspect. Payment gateways in India leverage sophisticated fraud detection systems powered by artificial intelligence and machine learning algorithms. These systems analyze transaction patterns, detect anomalies, and flag suspicious activities in real-time. This proactive approach has significantly reduced instances of fraud, bolstering trust among consumers.

E-commerce Growth in India

India’s e-commerce landscape has been on a trajectory of exponential growth. The advent of digital technology Subscription Billing Services[3] coupled with increasing internet penetration, has spurred this growth significantly. With the convenience of online shopping, consumers are increasingly turning to e-commerce platforms for their purchasing needs.

Key Features of Payment Gateways

One of the fundamental elements driving the success of e-commerce Digital Payment Options[4] transactions is the reliability and security of payment gateways. These gateways ensure that sensitive financial information remains encrypted and protected throughout the transaction process. Moreover, they offer seamless integration options, enabling businesses to easily incorporate payment solutions into their websites or applications.

Popular Payment Gateways in India

In the diverse Indian market, several payment gateways have gained prominence. From industry giants to specialized service providers, each offers a unique set of features catering to the specific needs of businesses and consumers. Some of the prominent names include Paytm, Razorpay, PayPal, and Instamojo, each with its own distinct advantages and services.

Challenges and Solutions

While payment gateways PCI DSS Compliant Payment Systems[5] strive for efficiency, they face challenges such as cybersecurity threats and transaction failures. However, continuous advancements in technology have led to the development of more robust security measures and enhanced protocols to diminish these risks. Additionally, customer support mechanisms have improved to address transaction disputes and ensure a smoother experience for users.

Conclusion

The landscape of payment gateway services in India has engage in remarkable evolution, provide food for to the burgeoning needs of the e-commerce industry. With robust security measures, innovative solutions, and regulatory support, these gateways are poised for further growth and transformation.

FAQs

- Are payment gateways in India secure for online transactions? Security measures like cipher and two-factor authentication ensure a high level of security.

- Which payment gateway service is best suited for small businesses in India? Services like Razorpay and Instamojo offer easy to use solutions tailored for small businesses.

- How do government regulations impact payment gateway services? Regulations ensure a balance between innovation and security, influencing service offerings.

- What are the upcoming trends in Indian payment gateway services? Innovations like voice-enabled payments and AI-driven security enhancements are on the horizon.

- What challenges do businesses face while integrating payment gateways? Compatibility issues and technical complexities often pose challenges during integration processes.