AUTHOR :HAANA TINE

DATE :27/12/2023

Introduction

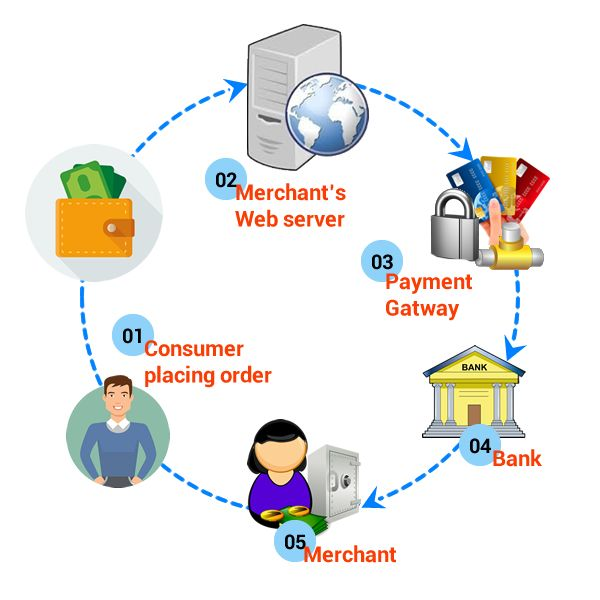

In the rapidly evolving[1] landscape of Digital commerce in India, the role of payment gateways[2] is more crucial than ever. This article delves into the dynamic realm of payment gateways, exploring their evolution, key features[3], popular options, and their impact on the burgeoning e-commerce[4] sector in the country.

Evolution of Payment Gateways in India

The journey of payment Openings in India mirrors the growth of online commerce[5]. From simple interfaces to sophisticated systems, these gateways have adapted to technological advancements, ensuring secure and efficient digital transactions.

Key Features of Payment Gateways

Security is paramount in the digital realm, and payment gateways in India prioritize it.Payment Gateway E-commerce Products in India Robust security measures, diverse integration options, and compatibility across platforms are key features that cater to the diverse needs of digital commerce businesses.

Popular Payment Gateways in India

Navigating the sea of payment gateways, a few names stand out. Razorpay, Paytm, CCAvenue, and Instamojo have become go-to choices for businesses. This section provides a comprehensive comparison, considering transaction fees, user interfaces, and customer support.

Comparison of Payment Gateways

Choosing the right payment gateway is a critical decision for digital commerce businesses. A comparative analysis covering transaction costs, user interface, and customer support helps businesses make informed decisions, ensuring a seamless payment experience for customers.

Challenges and Solutions

While payment gateways offer immense benefits, challenges such as security concerns, technical glitches, and regulatory compliance can arise.Payment Gateway E-commerce Products in India This section explores solutions to these challenges, ensuring a smooth and secure payment process.

Impact of Payment Gateways on E-commerce Growth

The integration of reliable payment Openings has had a transformative impact on Digital commercegrowth in India. Building customer trust, enhancing the user experience, and unlocking opportunities for expansion are among the significant contributions explored in this section.

Future Trends in Payment Gateways

Looking ahead, the future of payment Openings in India holds exciting prospects. The integration of AI and machine learning, the adoption of cryptocurrencies, and the exploration of biometric authentication are trends that signal a dynamic future.

Selecting the Right Payment Gateway for Your E-commerce Business

Choosing the right payment gateway is a strategic decision that requires careful consideration. Understanding business needs, scalability factors, and user reviews are key aspects covered in this section to aid businesses in making informed choices.

Case Studies

Real-world case studies spotlight the success stories and challenges faced by businesses using payment Openings. These cases provide valuable insights for entrepreneurs, showcasing the diverse experiences in the integration of payment gateways[1].

Tips for Smooth Payment Gateway Integration

Smooth integration is paramount for a seamless payment experience. This section provides practical tips, including thorough testing, regular updates, and user training, to ensure businesses navigate the integration process[2] with ease.

Security Measures for E-commerce Transactions

In an era of increasing cyber threats, implementing robust security measures is non-negotiable. SSL certification, two-factor authentication, and advanced fraud detection tools are explored as essential components of a secure e-commerce transaction[3] process.

Customer Experience and Satisfaction

A seamless payment process[4] contributes significantly to customer satisfaction. This section emphasizes the importance of prioritizing the user experience and continually improving based on customer feedback to build lasting relationships.

Evolving Regulatory Landscape

Navigating the regulatory landscape[5] is crucial for Digital commerce businesses. Compliance with RBI guidelines and addressing legal considerations ensures a smooth operation within the framework of the law, instilling trust among customers.

Conclusion

In conclusion, payment gateways are integral to the success of Digital commerce in India. They provide a secure and efficient means of conducting online transactions, fostering growth and innovation in the digital landscape. As technology continues to evolve, the future holds promising advancements for payment gateways, solidifying their role in the Digital commerce ecosystem.

FAQs:

- What is the role of payment gateways in Digital commerce?

- Payment gateways facilitate secure online transactions by acting as intermediaries between buyers and sellers.

- How do I choose the right payment gateway for my business?

- Consider your business needs, scalability, user reviews, and transaction costs when selecting a payment gateway.

- What are the emerging trends in payment gateways?

- Trends include AI and machine learning integration, cryptocurrency adoption, and biometric authentication.

- How do payment gateways contribute to Digital commerce growth?

- They enhance customer trust, provide a positive user experience, and open opportunities for business expansion.

- What security measures should Digital commerce businesses implement?

- SSL certification, two-factor authentication, and fraud detection tools are essential for ensuring secure transactions.