AUTHOR : JENNY

DATE : 22-12-2023

Introduction to Payment Gateways

In the digital era, the role of payment gateways for business growth tips in india in fostering business growth cannot be overstated. For businesses in India, embracing the right payment gateway strategy is a pivotal step toward success.

Importance of Payment Gateways for Business Growth

Efficient payment gateways play a vital role in enhancing customer satisfaction, streamlining transactions, and fostering trust. They are the cornerstone of online transactions, ensuring seamless monetary exchanges between buyers and sellers.

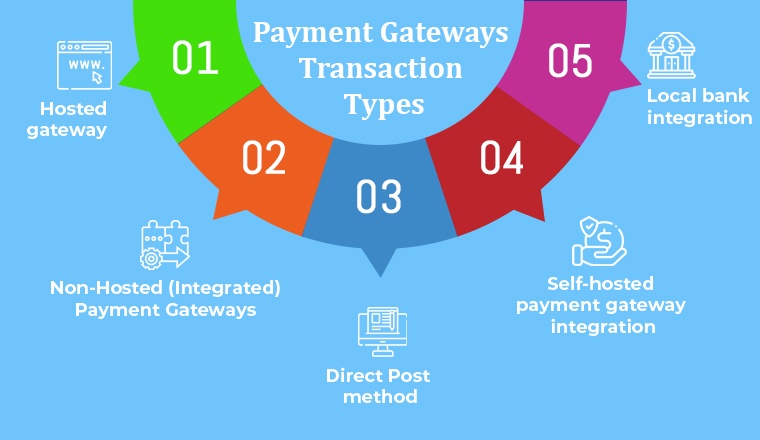

Types of Payment Gateways

Hosted Payment Gateways

Hosted gateways redirect customers to a separate page during checkout, offering simplicity and also security.

Choosing the Right Payment Gateway

Selecting an apt payment gateway for business[1] growth tips in India involves considering factors such as transaction fees, security measures, user experience, and compatibility with business systems. Comparative analysis of popular gateways like Paytm, Razorpay, and Instamojo can aid in decision-making.

Optimizing Payment Gateway for Business Growth

Streamlining Checkout Process

Simplified and also user-friendly checkouts reduce cart abandonment rates, Business Growth[2] enhancing sales conversion. Implementing robust security protocols instills confidence in customers, encouraging repeat transactions. Seamless integration with inventory management, CRM, and other systems streamlines operations, fostering efficiency.

Expanding Market Reach with Payment Gateways

Catering to Mobile Users

Mobile-optimized payment gateways for business growth strategy tap into the growing population of smartphone users, expanding market reach Aligning with e-commerce trends like omnichannel selling and also digital wallets[3] broadens business horizons.

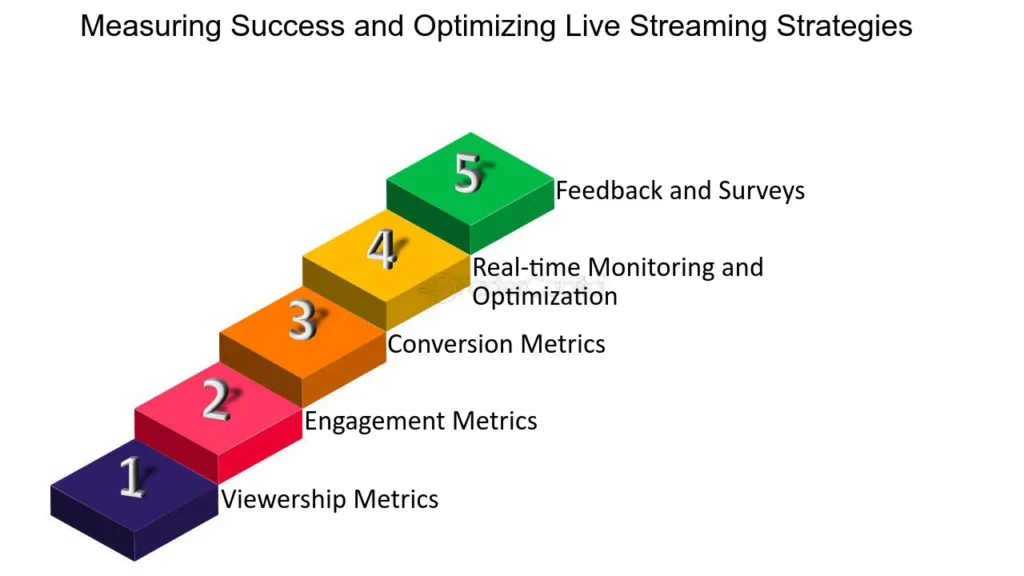

Measuring Success and Optimizing Further

Tracking and Analyzing Transactions

Data-driven insights derived from transaction analysis aid in strategizing for future growth[4]. Customer feedback serves as a valuable tool for refining payment gateway strategies, ensuring continuous improvement.

Expanding Market Reach with Payment Gateways

Tapping into E-commerce Trends

The e-commerce landscape in India is evolving rapidly, witnessing a surge in online shopping. Aligning payment gateways with emerging e-commerce trends[5] like omnichannel selling, digital wallets, and also one-click checkouts is essential for businesses looking to capitalize on this burgeoning market.

Catering to Mobile Users

India’s smartphone penetration is rising exponentially, making mobile-optimized payment gateways a crucial tool for reaching a vast audience. Seamless and secure mobile transactions are pivotal in capturing this growing segment of consumers who prefer the convenience of handheld devices for transactions.

Measuring Success and Optimizing Further

Tracking and Analyzing Transactions

Data-driven insights obtained from payment gateway analytics are invaluable for businesses. By tracking transaction patterns, identifying peak sales periods, and understanding consumer behavior, businesses can fine-tune their strategies for maximum efficiency and also growth.

Incorporating Customer Feedback

Feedback from customers regarding their payment experience is a goldmine for improvement. Understanding pain points, preferences, and suggestions enables businesses to refine their payment gateway strategies, ultimately enhancing customer satisfaction and also loyalty.

The adaptability of payment gateways to changing market dynamics plays a pivotal role in fostering business growth in India. Embracing user-friendly interfaces, robust security measures, and also staying abreast of technological advancements are key strategies for businesses aiming to leverage payment gateways for exponential growth.

In today’s competitive landscape, a well-optimized payment gateway not only facilitates transactions but also acts as a catalyst for business expansion. It’s an integral part of the customer journey, impacting brand perception and also loyalty.

Conclusion

Payment gateways in India serve as catalysts for business growth, enabling seamless transactions, fostering trust, and expanding market reach. Choosing and also optimizing the right gateway is paramount for sustained success in the competitive digital landscape.

FAQs

1. How do payment gateways contribute to business growth? Payment gateways streamline transactions, enhance user experience, and build trust, leading to increased sales and also market expansion.

2. Are there specific security measures businesses should prioritize in payment gateways? Yes, businesses should focus on SSL encryption, PCI compliance, and two-factor authentication to ensure secure transactions.

3. Which factors should businesses consider when selecting a payment gateway? Transaction fees, security features, ease of integration, and compatibility with business systems are key factors to consider.

4. How do payment gateways cater to mobile users? Mobile-optimized gateways offer responsive designs and convenient payment options, catering to users accessing businesses through smartphones.

5. Can payment gateways be customized for specific business needs? Yes, self-hosted and also API-integrated gateways offer customization options to align with unique business requirements.