AUTHOR : JENNY

DATE : 21-12-2023

In today’s digital era, where online investments are becoming increasingly popular, the role of payment gateways in guiding these financial endeavors cannot be overlooked. These gateways act as the facilitators for secure and seamless transactions, ensuring that investors can engage in financial activities conveniently and securely.

Understanding Payment Gateways

Payment gateways for investment guidance in india serve as the intermediary between financial transactions made online and the recipient of the funds. They encrypt sensitive information, authorize payments, and ensure the safe transfer of funds from the investor to the investment service provider.

Importance of Payment Gateways in Investment Guidance

In the realm of investment guidance, these gateways play a pivotal role in enabling users to access advisory services, purchase financial products, and execute trades efficiently. Their significance lies in providing a secure and also user-friendly interface that fosters trust and convenience for investors.

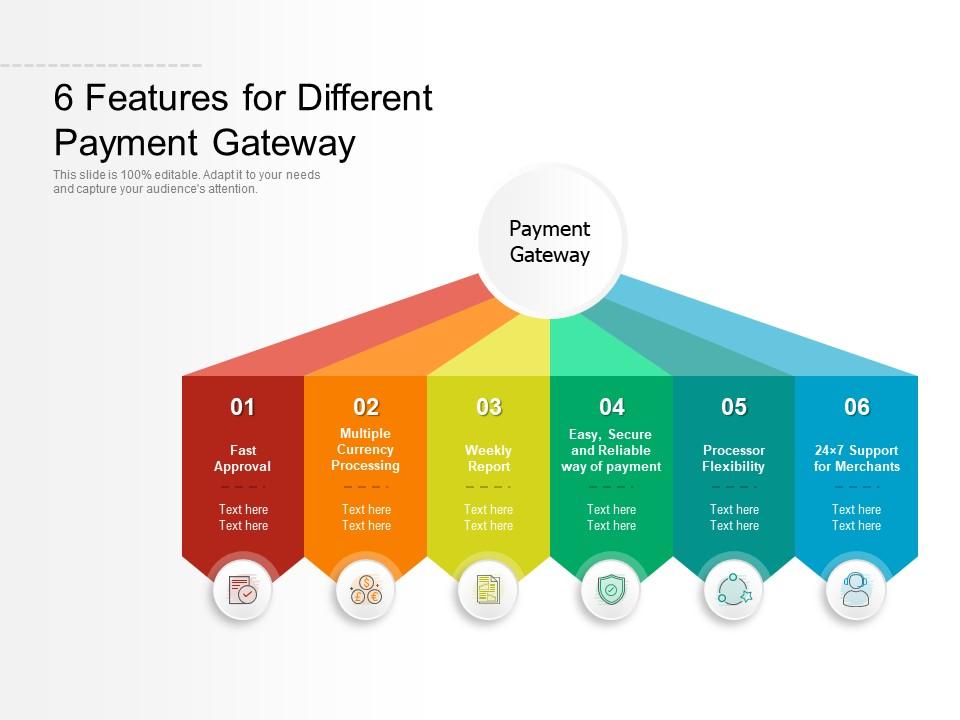

Key Features of Payment Gateways for Investment Guidance

Security Measures

Top-notch security protocols, including encryption and authentication, safeguard sensitive financial information, reassuring investors[1] about the safety of their transactions.

Compatibility and Integration

Effective integration with various investment platforms[2] and also seamless compatibility across devices enhance accessibility for investors.

Transaction Fees and Charges

Understanding the fee structures, including transaction charges and hidden fees, aids investors in making informed[3] decisions about their financial transactions.

User-Friendly Interface

Intuitive interfaces and easy navigation ensure a smooth transaction process, attracting more users to engage in investment activities[4].

Popular Payment Gateways in India for Investment Guidance

Several payment gateways in india[5] for investment guidance stand out in India’s financial landscape:

Razorpay

Known for its robust security measures and user-friendly interface, Razorpay is a favored gateway among investors.

PayU

With its widespread integration and flexible customization options, PayU caters to various investment platforms, offering convenience to users.

Instamojo

Instamojo’s seamless integration and also cost-effectiveness make it an attractive choice for those venturing into investment guidance.

CCAvenue

Recognized for its reliability and extensive support, CCAvenue remains a prominent payment gateway for investment-related transactions.

Factors to Consider When Choosing a Payment Gateway

Security Protocols

Prioritize gateways that prioritize the highest security standards to protect sensitive financial data.

Customization Options

Consider gateways that offer customization to align with the specific requirements of investment platforms.

Transaction Fees and Hidden Charges

Be mindful of the overall cost involved, including transaction fees and any hidden charges, to manage expenses effectively.

Customer Support and Reliability

Opt for gateways that offer reliable customer support, ensuring prompt assistance during any transactional issues.

How Payment Gateways Facilitate Investment Guidance

These gateways streamline financial transactions, making it easier for investors to engage in advisory services, purchase financial products, and access various investment platforms. Their user-friendly interfaces enhance accessibility and encourage more participation in investment endeavors.

Challenges and Solutions in Payment Gateway Integration for Investment Guidance

Security Concerns and Risk Mitigation

Constant vigilance and adherence to stringent security protocols help mitigate risks associated with online transactions.

Technical Glitches and Troubleshooting

Efficient troubleshooting mechanisms and also technical support systems resolve issues promptly, minimizing disruptions during transactions.

Regulatory Compliance and Legal Considerations

Adhering to regulatory frameworks and staying updated on legal requirements ensure compliance and build trust among investors.

Leveraging Advanced Security Measures

Encryption Protocols

Payment gateways employ advanced encryption techniques such as SSL (Secure Socket Layer) to encode sensitive information, ensuring that financial data remains secure during transmission.

Two-Factor Authentication

Implementing two-factor authentication adds an extra layer of security, requiring users to provide two forms of identification before accessing their accounts or completing transactions.

Tailored Solutions for Investment Platforms

API Integration

API (Application Programming Interface) integration enables seamless connections between payment gateways and investment platforms, allowing for real-time transactions and also data synchronization.

Customized Checkout Experience

Offering customizable checkout options allows investment platforms to tailor the payment process according to their users’ preferences, enhancing the overall user experience.

Transparency in Transaction Costs

Clear Fee Structures

Payment gateways that maintain transparent fee structures empower investors with a clear understanding of the charges involved in their transactions, fostering trust and reliability.

Cost-Effective Solutions

Gateway providers offering competitive pricing and flexible plans cater to a wider range of investors, especially those seeking cost-effective solutions in their investment journey.

The Evolution of Payment Gateways in Investment Guidance

Mobile Wallet Integration

The integration of mobile wallets within payment gateways has revolutionized the investment landscape, allowing users to access and manage their investments conveniently through their smartphones.

Blockchain Technology Integration

The utilization of blockchain technology in payment gateways offers enhanced security and transparency, further bolstering investor confidence in online transactions.

Enhancing Investor Confidence

Fraud Prevention Mechanisms

Robust fraud prevention measures, such as real-time monitoring and anomaly detection, instill confidence in investors by actively mitigating potential risks.

Regulatory Compliance

Adhering to regulatory standards and compliance requirements ensures that payment gateways operate within legal frameworks, fostering trust and also reliability among investors.

Conclusion

As the financial landscape continues to evolve, payment gateways serve as the bridge that facilitates secure and efficient transactions in the realm of investment guidance. Their role in providing advanced security, seamless integration, and transparent transactions contributes significantly to empowering investors and fostering a robust investment ecosystem in India.

FAQs

- How do payment gateways safeguard against fraudulent activities? Payment gateways employ various mechanisms such as real-time monitoring, encryption, and two-factor authentication to prevent and detect fraudulent activities, ensuring secure transactions.

- What role does API integration play in investment guidance through payment gateways? API integration enables investment platforms to connect seamlessly with payment gateways, facilitating real-time transactions and data synchronization, enhancing the overall investment experience.

- Are there any emerging trends in payment gateways for investment guidance? Yes, the integration of mobile wallets and blockchain technology within payment gateways represents the emerging trends, offering enhanced accessibility, security, and also transparency for investors.

- How can investors ensure the security of their transactions through payment gateways? Investors should opt for gateways with robust security measures like SSL encryption, two-factor authentication, and a track record of compliance with regulatory standards.