AOUTHR : RUBBY PATEL

DATE : 20/12/23

Introduction

In the dynamic landscape of digital transactions , a payment gateway stands as a crucial element for businesses seeking success in India. This article dives into the intricacies of payment gateways tailored for the Indian market, exploring key strategies that lead to triumph.

Key Features of Successful Payment Gateways

User-Friendly Interface Ensuring a seamless user experience is paramount. Successful payment gateways boast interfaces that are intuitive and easy to navigate.

Security Measures In a world rife with cyber threats, security is non-negotiable. The article delves into the security features that set apart a reliable payment gateway.

Compatibility with Multiple Payment Methods India[1] is diverse in its payment preferences. A successful gateway accommodates a spectrum of payment methods, from cards to digital wallets.

Tailoring Payment Solutions for Indian Businesses

Understanding the Indian Market Navigating the complexities of the Indian market requires a nuanced approach. This section explores the importance of understanding local nuances. Localized Payment Options To truly resonate with the Indian consumer, payment gateways must offer localized options. This includes regional languages and familiar payment methods.

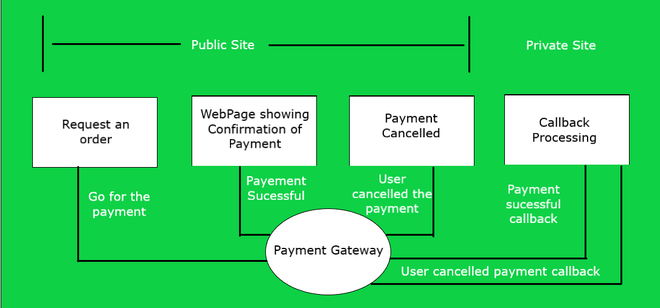

Integration with E-commerce Platforms

Streamlining the Checkout Process For e-commerce success, the checkout process must be swift and user-friendly. The article discusses strategies to streamline this crucial step. Compatibility with Popular E-commerce Platforms[2] Integrating seamlessly with leading e-commerce platforms enhances accessibility. This section explores the compatibility factor.

Mobile-Friendly Payment Solutions

Rise of Mobile Commerce in India The exponential growth of mobile commerce necessitates payment gateways to prioritize mobile-friendliness. Insights into this trend are provided here. Importance of Mobile Optimization in Payment Gateways[3] The article emphasizes the significance of mobile optimization, considering the increasing reliance on smartphones for transactions.

Cost-Effective Solutions for Small Businesses

Affordable Transaction Fees[4] Small businesses thrive on cost-effective solutions. success strategies This section discusses transaction fees and their impact on emerging startups. Support for Emerging Startups Successful payment gateways recognize the potential of startups and offer support tailored to their unique needs.

Ensuring Regulatory Compliance

Navigating the Legal Landscape in India Adhering to regulations is crucial. This part outlines the legal considerations businesses strategies[5] must navigate for seamless operations.

Staying Updated on Regulatory Changes Regulations evolve, and businesses must stay ahead. The article sheds light on strategies to remain updated on regulatory changes

Customer Support and Reducing Transaction Failures

Importance of Responsive Customer Support Responsive customer support is a differentiator. This section emphasizes the role of customer service in ensuring transaction success.

Strategies to Minimize Transaction Failures Transaction failures can be detrimental. The article provides insights into strategies to minimize these failures and enhance customer satisfaction.

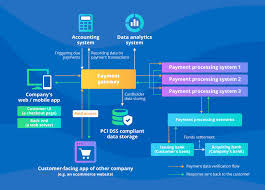

Data Analytics and Business Insights

Utilizing Payment Data for Business Growth Payment data is a goldmine for insights. This section explores how businesses can leverage data for strategic growth.

Analytics Tools for Merchants An overview of analytics tools available to merchants for informed decision-making.

Case Studies of Successful Payment Gateway Implementations

Showcase of Indian Businesses Thriving with Effective Payment Gateways Real-world examples demonstrate the impact of successful payment gateway implementations on Indian businesses.

Learning from Success Stories Extracting lessons from success stories to guide businesses in their payment gateway choices.

Challenges and Solutions

Overcoming Technical Challenges Technical glitches can impede operations. This part explores common technical challenges and solutions.

Addressing Security Concerns Security remains a top concern. The article addresses potential security issues and their resolutions.

Future Trends in Payment Gateways for India

Emerging Technologies A glimpse into the future, exploring technologies set to shape the landscape of payment gateways in India.

Anticipating Future Market Needs Adapting to the evolving needs of the market is vital. This section discusses strategies for anticipating and meeting future demands.

Conclusion

In conclusion, the success of a business in India hinges on selecting the right payment gateway. This article has outlined key strategies, emphasizing the importance of user-friendliness, security, localization, and adaptability to future trends.

FAQs

Q1: How do I choose the right payment gateway for my business? A: Consider factors like user-friendliness, security, and compatibility with your business model.

Q2: Are there any hidden fees associated with payment gateways? A: Transparently review transaction fees and contractual terms to uncover any potential hidden costs.

Q3: What security measures should I look for in a payment gateway? A: Prioritize gateways with encryption, tokenization, and robust authentication mechanisms.

Q4: Can I use multiple payment gateways for my business? A: Yes, but assess the compatibility with your business model and the convenience for your customers.

*Q5: How often should I update my payment gateway to stay