Name: Buddy Kim

Date: 19/12/23

Introduction

In today’s fast-paced world, the need for efficient and secure payment access has become paramount, especially in specialized sectors like vehicle relocation. As businesses in India embrace the digital age, the demand for a reliable payment infrastructure in the vehicle relocation industry has witnessed a significant upswing.

Definition of Payment Gateway

The Need for Specialized Payment Access

A payment gateway acts as a bridge between customers and service providers, facilitating online transactions securely. The vehicle relocation process involves intricate logistics and financial transactions, making a robust payment gateway crucial for smooth operations.

Vehicle relocation transactions present unique challenges, including the need for real-time tracking and secure payment processing.

Security Concerns

Data breaches, unauthorized access, and identity theft remain significant challenges for payment gateways in credit counseling. Ensuring robust encryption, secure authentication protocols, and compliance with regulations is essential to safeguard user information and maintain trust.

Features of an Ideal Payment Gateway for Vehicle Relocation

Multi-Currency Support

An ideal payment gateway for Car Relocation Process[1] offer secure transactions, multi-currency support, and easy integration with service platforms. Additionally, features like real-time payment tracking, fraud prevention, and user-friendly interfaces enhance the overall customer experience.

Multi-currency support allows payment gateways to process transactions in various currencies, making them ideal for global businesses. This feature eliminates the need for currency conversions, ensuring seamless payments for users across different countries.

Transparent Transaction Process

Popular Payment Access in India

A transparent transaction process ensures that users have clear visibility into all payment details, including fees and charges. Vehicle Shifting[2] This builds trust, minimizes disputes, and enhances the overall user experience by promoting accountability and clarity.

In India, popular payment methods include UPI (Unified Payments Interface), digital wallets like Paytm and Google Pay, and credit/debit cards. These methods are widely accepted due to their convenience, security, and ease of use, catering to the growing demand for cashless transactions.

Advantages and Disadvantages

How Payment Access Simplify Transactions

Payment gateways offer advantages like secure transactions, global accessibility, and seamless user experiences. However, they also have drawbacks, such as potential technical glitches, transaction fees, and dependency on internet connectivity, which can affect reliability in certain situations.

Payment access simplifies transactions[3] by enabling quick, secure, and seamless digital payments. It eliminates the need for physical cash, reduces processing time, and provides users with multiple payment options, ensuring convenience and efficiency in every transaction.

Real-time Tracking and Notifications

Security Measures in Payment Access

Real-time tracking and notifications keep users updated on the status of their transactions instantly. This feature enhances transparency, boosts user confidence, and helps promptly address any issues that may arise during the payment process.

Secure payment systems[4] implement robust security measures like encryption, multi-factor authentication, and tokenization to safeguard user data. These features protect against fraud, unauthorized access, and data breaches, ensuring secure and reliable transactions.

Two-Factor Authentication

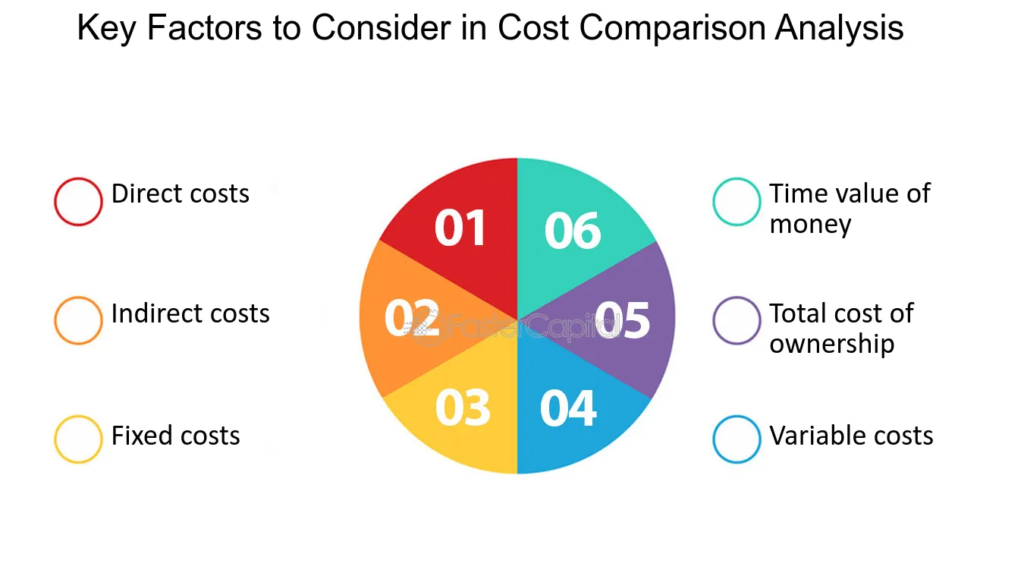

Cost Factors and Comparisons

Two-factor authentication (2FA) adds an extra layer of security by requiring users to verify their identity through two methods, such as a password and a one-time code sent to their phone. This significantly reduces the risk of unauthorized access and enhances transaction safety.

When evaluating payment gateways, it’s essential to consider factors like transaction fees, setup costs, and monthly charges. Comparing these costs helps businesses choose a gateway that aligns with their budget and transaction volume while ensuring value for money and efficient service.

Additional Charges

User Experience and Reviews

Additional charges in payment gateways can include transaction fees, currency conversion fees, and service or maintenance fees. These extra costs can impact the overall expense for businesses, so it’s important to review the terms carefully to avoid unexpected expenses and budget effectively.

User experience and reviews play a crucial role in choosing Payment Gateway in India[5], as they provide insights into ease of use, reliability, and customer support. Positive reviews often indicate a user-friendly interface and efficient service, while negative feedback can highlight potential issues or limitations to consider.

Ratings and Feedback

Future Trends in Payment Access for Vehicle Relocation

Ratings and feedback from users offer valuable perspectives on the performance and reliability of a payment gateway. High ratings and positive feedback usually reflect satisfaction with features, security, and customer service, while low ratings can indicate areas needing improvement or potential drawbacks to watch for.

Technological Advancements

The future of payment access for vehicle relocation is set to be shaped by advancements like blockchain technology, which promises enhanced security and transparency. Integration of AI for personalized payment solutions, real-time tracking, and seamless multi-currency support will improve user experience. Additionally, mobile wallet adoption and contactless payment methods will become more widespread, offering convenience and faster transactions for customers.

Predictions for the Industry

The payment access industry for vehicle relocation is expected to see significant growth driven by technological advancements. We can anticipate increased adoption of blockchain for secure and transparent transactions and the integration of AI for improved user experiences and predictive analytics. Mobile payments and contactless transactions will become the norm, enhancing convenience and efficiency. Additionally, with the rise of fintech solutions, payment gateways will become more customizable and user-friendly, catering to evolving consumer needs.

Case Studies

Case studies provide real-world examples of how payment access solutions impact the vehicle relocation industry. For instance, Company A integrated a blockchain-based payment system, resulting in improved transaction transparency and reduced fraud. Similarly, Company B adopted AI-powered payment gateways, enhancing user experience by offering personalized payment options and real-time tracking. These case studies illustrate how adopting innovative payment technologies can streamline processes, increase trust, and drive growth within the industry.

Lessons Learned

Lessons learned from the implementation of payment access solutions in the vehicle relocation industry highlight the importance of thorough testing and security measures. Companies have discovered that integrating reliable, user-friendly platforms can greatly enhance customer satisfaction. However, it’s also clear that managing costs and being transparent about additional fees is crucial for maintaining trust. Additionally, businesses have learned that staying adaptable and responsive to technological advancements is key to staying competitive in a rapidly evolving market.

Streamlined Financial Operations

Streamlined Financial Operations refers to the process of optimizing financial workflows to enhance efficiency, accuracy, and cost-effectiveness within an organization. This involves automating repetitive tasks, integrating financial systems, and adopting tools or software to simplify processes like invoicing, payroll, budgeting, and reporting.

Challenges in Implementing Payment Access

Implementing payment access, whether for businesses or digital platforms, comes with several hurdles that require careful planning and execution. Some of the key challenges include:

- Regulatory Compliance

Different countries and regions have unique regulations surrounding payment systems. Navigating compliance requirements, such as PCI DSS for data security or KYC norms for user verification, can be complex and time-consuming. - Integration with Multiple Payment Gateways

Offering diverse payment options requires seamless integration with multiple gateways. This can involve technical difficulties and compatibility issues between systems. - Fraud Prevention and Security

Ensuring secure transactions while preventing fraud is critical. Companies must invest in robust security measures like encryption, tokenization, and real-time fraud detection systems, which can be costly and require regular updates. - User Experience Optimization

Creating a seamless, user-friendly payment experience is vital. Complicated interfaces, slow transaction processing, or limited payment options can frustrate users and lead to transaction drop-offs. - Cost Management

Implementing and maintaining payment systems often involves high costs, including transaction fees, infrastructure investment, and ongoing support. Balancing these costs while maintaining profitability is a challenge. - Global Accessibility

Expanding payment access to global users requires accommodating diverse currencies, languages, and regional payment preferences. Overcoming these logistical and technical barriers demands significant resources.

Addressing these challenges effectively requires a combination of advanced technology, skilled personnel, and a user-focused approach to ensure secure, efficient, and widely accessible payment systems.

Tips for Choosing the Right Payment Gateway

Assessing Business Needs

Choosing the right payment gateway involves assessing your business needs, transaction volume, and target market. Look for features like robust security, multi-currency support, and seamless integration with your existing systems. Prioritize gateways with low transaction fees, fast processing times, and excellent customer support to ensure a smooth and secure payment experience.

Seeking Customization Options

When seeking customization options in a payment gateway, look for features that allow you to tailor the checkout experience to match your brand, such as custom logos, colors, and layout. Ensure the gateway supports flexible integrations and adaptable payment flows to meet your unique business needs. Customization enhances user experience and strengthens brand identity.

Conclusion

In conclusion, selecting the right payment gateway is a critical decision that impacts your business’s efficiency, security, and customer satisfaction. By prioritizing features such as robust security, seamless integration, and customization options, you can create a smooth and reliable payment experience. Whether you’re catering to a local audience or expanding globally, the right gateway will align with your goals, simplify operations, and enhance trust. Thoughtful selection ensures your business is well-equipped to handle transactions and grow effectively in a competitive market.

FAQs

- Q: Are all payment gateways suitable for vehicle relocation transactions? A: Not necessarily. Businesses should opt for specialized payment gateways that cater to the unique challenges of the vehicle relocation industry.

- Q: How can businesses overcome resistance to technological change when implementing payment access? A: Effective communication, employee training programs, and showcasing the benefits of the new system can help overcome resistance.

- Q: Is SSL encryption sufficient for securing payment transactions? A: While SSL encryption is crucial, implementing additional security measures like two-factor authentication adds an extra layer of protection.

- Q: What role do customer testimonials play in choosing a payment gateway? A: Customer testimonials provide insights into the real-world experiences of businesses using a particular payment gateway, aiding in decision-making.

- Q: How can businesses stay updated on future trends in payment access for vehicle migration? A: Regularly monitoring industry publications, attending conferences, and networking with professionals can help businesses stay informed about future trends.