Name: Buddy Kim

Date: 20/12/23

In the fast-paced realm of digital transactions, payment gateways[1] have become the backbone of seamless financial operations. In India, where the digital revolution is rapidly transforming the business landscape, industrial partnerships in the payment gateway sector are playing a pivotal role in shaping the future. Let’s dive into the evolution, challenges, and impact of payment gateway partnerships in the Indian context.

Evolution of Payment Gateways in India

India’s journey in the payment gateway landscape is marked by significant milestones. From traditional cash transactions to the era of digital wallets, the evolution has been swift. Technological advancements, such as the implementation of UPI (Unified Payments Interface) and biometric authentication, have propelled the country into a new era of financial transactions.

The Role of Industrial Partnerships

In the dynamic world of payment gateways, industrial partnerships[2] refer to collaborations between financial institutions, technology companies, and e-commerce platforms to provide a seamless and secure payment experience. These partnerships are crucial for fostering innovation, sharing resources, and expanding the reach of digital transactions.

Challenges and Solutions in Payment Gateway Partnerships

While the potential for growth is immense, payment gateway partnerships[3] in India face regulatory challenges. Striking a balance between innovation and compliance is key. Payment Gateway Industrial Partnerships In India Strategies like proactive engagement with regulators and continuous monitoring of industry changes can help navigate these challenges.

Impact on E-commerce and Business Growth

The symbiotic relationship between payment gateway providers and e-commerce businesses has fueled the growth of online transactions. User-friendly interfaces, quick payment processing, Payment Gateway Industrial Partnerships In India and secure transactions have contributed to the success of businesses operating in the digital space.

Key Players in Payment Gateway Partnerships

Several companies in India have emerged as key players in payment gateway collaborations. Their unique features, such as advanced analytics, customizable solutions, and competitive pricing, set them apart in the market.

Security Measures in Industrial Partnerships

Ensuring the security of online transactions is paramount. Payment gateway partnerships[4] prioritize the implementation of robust security measures, including encryption technologies and multi-factor authentication, to safeguard user data.

User-Friendly Interfaces

In the competitive landscape of payment gateways, user experience is a differentiator. Innovations in interfaces, such as one-click payments and voice-activated transactions, are enhancing customer satisfaction and loyalty.

Mobile Payment Solutions

The rise of mobile payments has further catalyzed industrial partnerships[5]. Collaborations between payment gateway providers and mobile wallet companies have led to the development of convenient and efficient mobile payment solutions.

Future Trends in Payment Gateway Collaborations

Looking ahead, the future of payment gateway collaborations in India is promising. Trends such as blockchain integration, AI-driven fraud detection, and contactless payments are set to revolutionize the industry.

Global Comparisons

Comparing India’s payment gateway partnerships with global counterparts provides valuable insights. Learning from successful models around the world can inspire innovative approaches and strategies in the Indian context.

Consumer Trust and Confidence

Building and maintaining consumer trust is a cornerstone of successful payment gateway partnerships. Transparency, secure technologies, and effective communication are vital for establishing and nurturing trust.

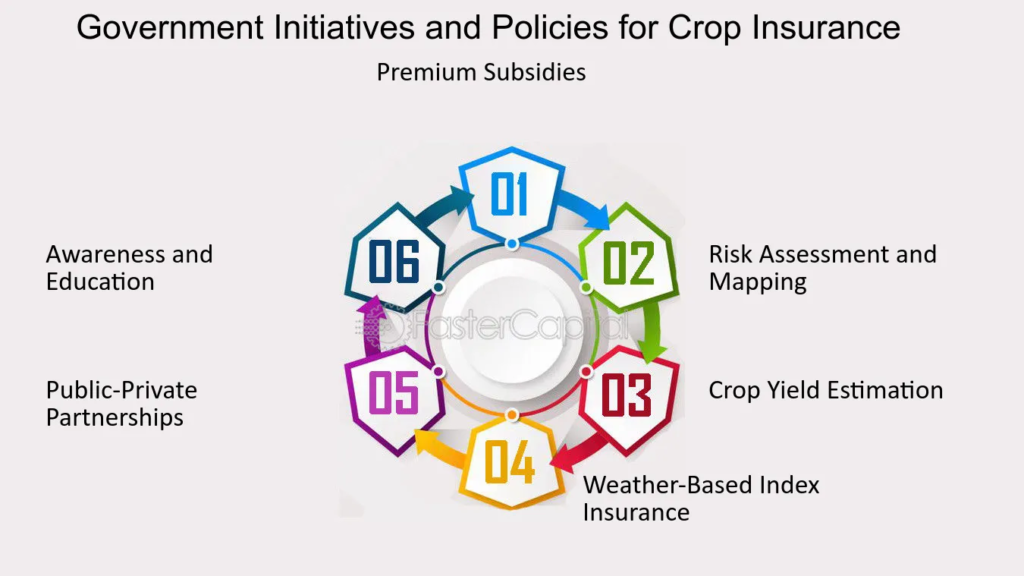

Government Initiatives and Policies

Government initiatives and supportive policies play a crucial role in fostering payment gateway partnerships. A collaborative approach between the public and private sectors is essential for sustained growth in the digital payment ecosystem.

Sustainability in Payment Gateway Partnerships

As environmental consciousness grows, sustainability is becoming a key consideration in payment gateway collaborations. Green initiatives and corporate social responsibility efforts contribute to the industry’s long-term viability.

Conclusion

In conclusion, payment gateway industrial partnerships in India are instrumental in shaping the digital financial landscape. The evolution, challenges, and impact on businesses underscore the need for collaborative and innovative approaches. As we move forward, ensuring secure, user-friendly, and sustainable partnerships will be the key to unlocking new avenues for growth.

Frequently Asked Questions (FAQs)

- How do payment gateway partnerships benefit e-commerce businesses?

- Payment gateway partnerships enhance user experience, ensuring quick and secure transactions, which, in turn, boosts customer satisfaction and loyalty.

- What security measures are implemented in payment gateway collaborations?

- Robust security measures, including encryption technologies and multi-factor authentication, are employed to safeguard user data and ensure secure transactions.

- What role do government initiatives play in fostering payment gateway partnerships?

- Government initiatives and supportive policies are crucial in creating a conducive environment for collaborative efforts, promoting sustained growth in the digital payment ecosystem.

- How are mobile payment solutions impacted by industrial partnerships?

- Collaborations between payment gateway providers and mobile wallet companies lead to the development of efficient and convenient mobile payment solutions.

- What are the future trends in payment gateway collaborations in India?

- Future trends include blockchain integration, AI-driven fraud detection, and the rise of contactless payments, revolutionizing the payment gateway industry.