AUTHOR : SOFI PARK

DATE : 20/12/2023

Introduction

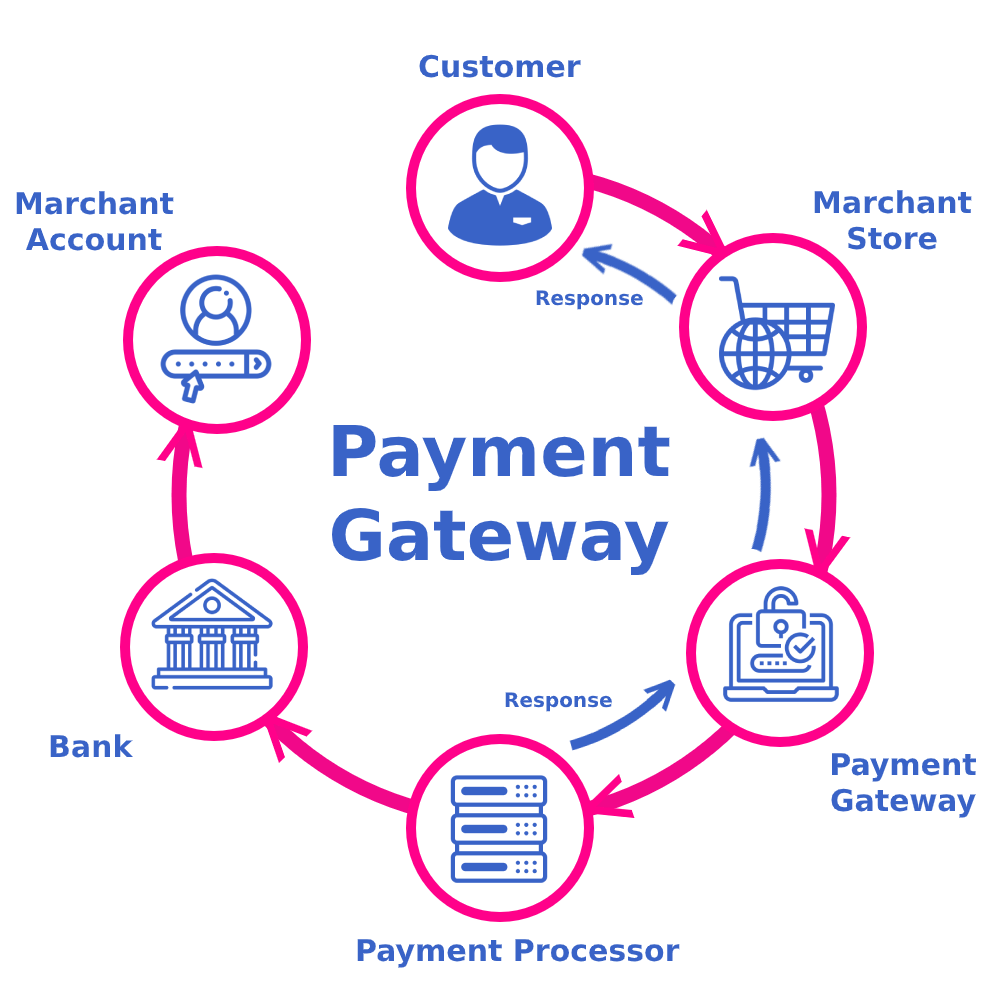

Payment gateways B2B Payments act as broker that facilitate secure online transactions between businesses. In the context of inter-business transactions in India, the role of payment gateways has become supreme. As businesses increasingly rely on digital channels for financial transactions, understanding the evolution and nuances of payment gateways becomes crucial Transactions In India.

Evolution of Payment Gateways in India

The journey of payment gateways in India has been marked by significant highlight. From the early days of online transactions defined by skepticism to the current era where digital payments are the norm, the evolution has been remarkable. Technological creation have played a pivotal role in shaping the efficiency and security of payment Inter-Business gateways.

Key Features of Payment Gateways for Inter-Business Transactions

Security Measures

Security is a primary concern in inter-business transactions, and payment Inter-Business gateways address this through robust cipher and suspicion protocols. Understanding these security measures is vital for businesses to instill trust in their digital transactions.

Transaction Speed

In the business world, time is money. Payment Transactions In India ensure swift and perfect transactions, Afford to the overall efficiency of inter-business interactions. We explore how transaction speed impacts business operations positively.

Compatibility with Various Businesses

Different industries have unique transaction needs. Payment gateways[1] cater to this diversity by offering custom solutions, making them united with a wide range of businesses. We delve into the importance of this flexibility Payment Management System.

Popular Payment Gateways in India

India boasts a diverse array of payment gateways. E-commerce payment system Understanding the strengths and weaknesses of these gateways is crucial for businesses to make informed decisions. We conduct a comparative analysis to aid businesses in choosing the most suitable payment gateway for their inter-business transactions[2].

Challenges in Inter-Business Transactions

While payment gateways[3] offer numerous advantages, Secure payment systems challenges persist. Security concerns, technical glitches, and regulatory challenges can pose obstacles. We examine these challenges in detail and discuss strategies to overcome them.

How Payment Gateways Facilitate Smooth Transactions

Real-time Processing

The real-time processing capability of payment gateways is a game-changer in inter-business transactions[4]. We explore how this feature enhances the overall efficiency of financial dealings between businesses.

Automated Reconciliation

Manual reconciliation can be time-consuming and prone to errors. Payment gateways automate the reconciliation process, Digital Payments[5] ensuring accuracy and saving valuable time for businesses. We analyze the impact of automated reconciliation on business operations.

Benefits for Small and Medium Enterprises (SMEs)

SMEs form the backbone of the Indian economy. Payment gateways offer specific advantages for these enterprises, such as cost-effectiveness and increased market reach. We delve into how SMEs can leverage payment gateways for growth.

The Role of Digital Wallets

Digital wallets have become integral to the payment ecosystem. We explore how the integration of digital wallets with payment gateways provides businesses with convenient and efficient transaction options.

Future Trends in Payment Gateways

As technology continues to evolve, payment gateways are poised to undergo further transformations. Integration with artificial intelligence and Encryption technology is on the horizon. We discuss these future trends and their potential impact on inter-business transactions.

Ensuring Compliance and Security

Adhering to regulations is certain in the world of finance. We highlight the importance of businesses Secure compliance with regulatory standards and Apply additional measures to enhance the security of their transactions.

User Experience and Interface Design

The user experience of payment gateways significantly influences their effectiveness. We explore how a user-friendly interface contributes to the perfect execution of inter-business transactions.

Educating Businesses on Payment Gateway Best Practices

Knowledge is power. We discuss the importance of teaching businesses on best practices related to payment gateways through workshops, training programs, and online resources.

Global Perspectives on Inter-Business Transactions

To gain a comprehensive understanding, we compare the state of inter-business transactions in India with other countries. Drawing lessons from global practices can provide valuable insights for the Indian business landscape.

Conclusion

payment gateways have emerged as needful tools for assist efficient inter-business transactions in India. From Confirm security to enabling real-time processing, the impact of payment gateways is certain. As businesses continue to embrace digitalization, the role of payment gateways is set to grow exponentially.

FAQ

- How do payment gateways enhance the security of inter-business transactions?

Payment gateways employ robust encode and authentication protocols to ensure the security of inter-business transactions. These measures protect sensitive financial information from unauthorized access.

- What role do digital wallets play in inter-business transactions?

Digital wallets, when integrated with payment gateways, provide businesses with convenient and efficient transaction options. They offer a seamless way for businesses to send and receive payments.

- What challenges do businesses face in adopting payment gateways for inter-business transactions?

Common challenges include security concerns, technical glitches, and navigating regulatory requirements. Overcoming these challenges requires a proactive approach and staying informed about the evolving landscape.

- How can SMEs benefit from using payment gateways?

SMEs can benefit from payment gateways by enjoying cost-effective solutions and expanding their market reach. The efficiency and convenience of digital transactions contribute to the growth of small and medium enterprises.

- What are the future trends in payment gateways for inter-business transactions?

The future of payment gateways involves integration with artificial intelligence and blockchain technology. These advancements aim to further enhance the speed, security, and overall user experience of inter-business transactions.