Author : Sweetie

Date : 27/12/2023

Introduction

In the fast-paced world of e-commerce, the role of payment gateways[1] has become increasingly crucial. These digital intermediaries facilitate secure online transactions, ensuring that businesses and consumers alike can engage in financial exchanges with confidence. Let’s delve into the evolution, current landscape, and future trends of payment gateway internet products in India.

Evolution of Payment Gateways in India

Early Challenges

In the nascent stages of e-commerce in India, businesses faced challenges in facilitating online payments. Limited technology and security concerns posed obstacles to the growth of digital transactions.

Technological Advancements

Over the years, technological advancements have transformed the payment landscape. The integration of robust security measures and user-friendly interfaces has made online payments seamless[2] and secure.

Current Landscape

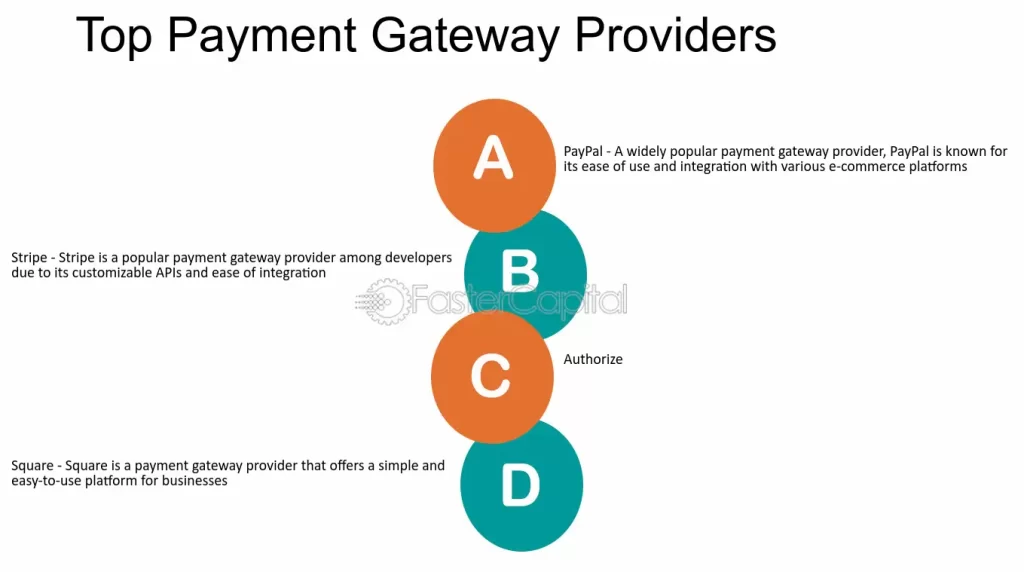

Today, India boasts a diverse landscape of payment gateway providers, each offering unique features and services. From traditional banking solutions to fintech startups, the market is vibrant and competitive.

Popular Payment Gateway Providers

XYZ Payment Solutions : With a user-friendly interface and a range of features, XYZ Payment Solutions[3] stands out as a leading player. Merchants appreciate the easy integration options and the positive user experience.

ABC Finance Gateway: Offering a variety of services and flexible integration options, ABC Finance Gateway caters to the diverse needs of businesses. From small startups to large enterprises, it provides solutions for all.

Integration of Payment Gateways

Seamless Integration Strategies

Businesses today benefit from seamless integration strategies that minimize disruptions to the user experience. Quick and easy integrations enhance the efficiency of online transactions. Payment Gateway Internet Products in India.

Benefits for E-commerce Businesses

The integration of payment gateways brings several benefits to e-commerce businesses, including faster transaction processing, enhanced security, and improved customer satisfaction.

Security Measures in Payment Gateways

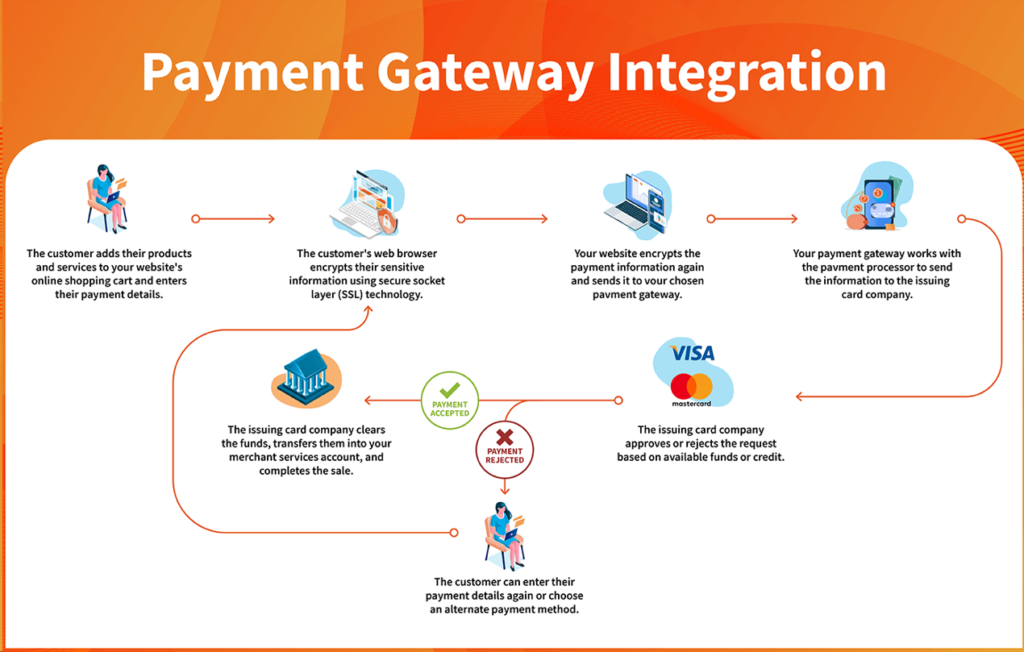

SSL Encryption

Secure Socket Layer (SSL) encryption is a standard security protocol that ensures the confidentiality and integrity of data during online transactions[4].

Two-Factor Authentication

Implementing two-factor authentication adds an extra layer of security, reducing the risk of unauthorized access to sensitive information.

Compliance Standards

Adherence to regulatory compliance standards is crucial for payment gateway providers. Meeting these standards ensures trust and reliability in the eyes of both businesses and consumers.

Role of Payment Gateways in Online Transactions

Authorization Process

Payment gateways play a crucial role in authorizing online transactions, verifying the authenticity of the payment and ensuring the availability of funds. Payment Gateway Internet Products in India

Transaction Settlement

Once authorized, payment gateways facilitate the settlement of transactions, ensuring that funds are transferred securely from the buyer to the seller.

Challenges Faced by Payment Gateway Providers

Fraud Prevention

Preventing fraudulent transactions is an ongoing challenge for payment gateway providers. Advanced fraud detection mechanisms are essential to safeguard against unauthorized activities.

Transaction Delays

While the aim is to provide swift transactions, occasional delays may occur due to technical issues or security checks. Balancing speed and security is a constant challenge.

Regulatory Compliance

Adhering to ever-evolving regulatory standards poses a challenge for payment gateway providers. Staying abreast of changes is essential to maintain trust and legality.

Future Trends in Payment Gateways

Blockchain Technology

The integration of blockchain technology is poised to revolutionize payment gateways, offering enhanced security, transparency, and efficiency.

Contactless Payments

The rise of contactless payments, driven by technological innovations like NFC, is shaping the future of transaction methods.

AI-driven Security Measures

Artificial intelligence is being increasingly employed to detect and prevent fraudulent activities, adding a layer of intelligence to security protocols.

Impact of Payment Gateways on Small Businesses

Accessibility

Payment gateways have democratized online transactions, providing small businesses with the opportunity to reach a global audience.

Cost-Effective Solutions

The availability of cost-effective payment gateway solutions has empowered small businesses to compete on a level playing field with larger counterparts.

Comparing Indian and Global Payment Gateway Trends

Unique Features in Indian Market

The Indian market exhibits unique features, such as the dominance of digital wallets[5] and the integration of UPI-based payment systems.

Global Best Practices

While there are regional distinctions, global best practices in payment gateway security and user experience are influencing the Indian market.

Customer Trust and Payment Gateways

Building Trust through Secure Transactions

Establishing trust is paramount in the world of online transactions. Payment gateways contribute significantly by ensuring the security and integrity of financial data.

Customer Feedback and Ratings

Customer feedback and ratings play a pivotal role in building trust. Positive experiences shared by users contribute to the credibility of payment gateway providers.

Tips for Choosing the Right Payment Gateway

Understanding Business Needs

Businesses should carefully assess their unique requirements and choose a payment gateway that aligns with their specific needs.

Cost Considerations

While cost is a crucial factor, businesses should also consider the value-added features and security measures provided by payment gateway providers.

Technical Support

Responsive and effective technical support is essential for resolving issues promptly and ensuring uninterrupted transactions.

The Future Landscape of Payment Gateways in India

Predictions and Projections

Experts predict a continued evolution of payment gateways in India, with a focus on enhancing security, expanding features, and embracing emerging technologies.

Emerging Technologies

The integration of emerging technologies, including biometrics and advanced encryption, is expected to shape the future landscape of payment gateways.

Conclusion

In conclusion, payment gateways have become the backbone of online transactions in India. The evolution, challenges, and future trends highlight the dynamic nature of this industry. Choosing the right payment gateway is a critical decision for businesses looking to thrive in the digital economy.

Frequently Asked Questions

- In what ways do payment gateways safeguard the security of online transactions?

Payment gateways employ SSL encryption, two-factor authentication, and comply with regulatory standards to ensure the security of online transactions. - What role does blockchain technology play in the future of payment gateways?

Blockchain technology is expected to enhance security, transparency, and efficiency in payment gateways, revolutionizing the industry. - Why is customer feedback crucial for payment gateway providers?

Customer feedback builds trust and credibility. Positive experiences shared by users contribute to the reputation of payment gateway providers. - How can small businesses benefit from payment gateways?

Payment gateways provide accessibility and cost-effective solutions, empowering small businesses to compete globally. - What should businesses consider when choosing a payment gateway?

Businesses should consider their unique needs, cost, and technical support when choosing a payment gateway that aligns with their requirements.