AUTHOR : ISTELLA ISSO

DATE : 28/02/2024

Introduction

With the growing digital landscape in India, the trend of mobile app downloads has witnessed an unprecedented surge. This surge is significantly influenced by the increasing reliance on mobile apps for various services, from shopping to communication. One integral aspect that contributes to this digital evolution is the presence of secure and efficient payment gateway mobile apps. This article delves into the realm of payment gateway mobile app downloads in India, exploring their importance, challenges, and impact on businesses.

The Need for Payment Gateways in Mobile Apps

The paradigm shift towards digital payments has become more evident in recent years. The convenience and speed offered by mobile apps have made them the preferred choice for transactions. Payment gateways play a pivotal role in ensuring these transactions are secure, reliable, and seamless. In a country where digital payments are gaining traction, having robust payment gateways integrated into mobile apps becomes imperative.

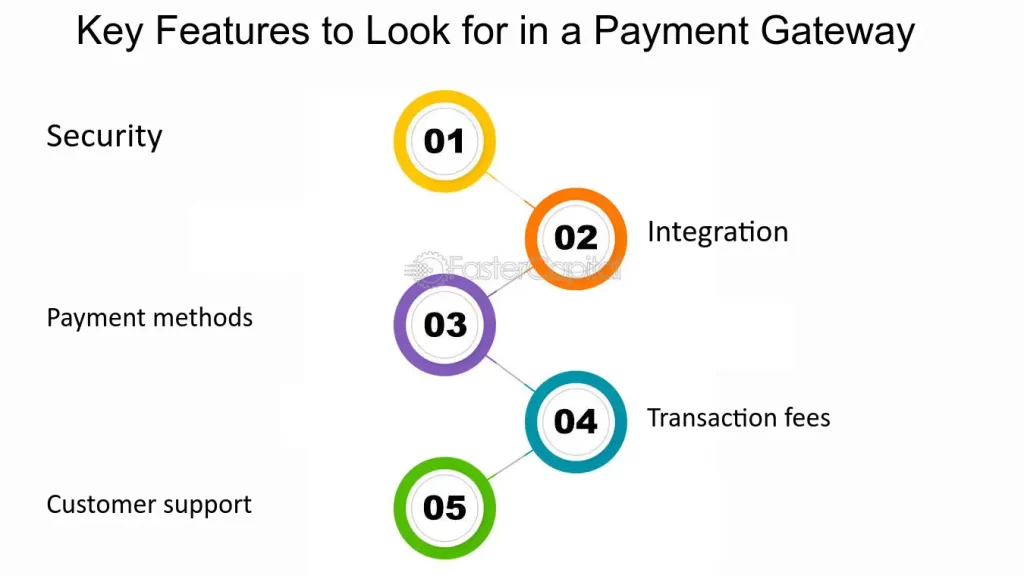

Key Features of a Successful Payment Gateway Mobile App

For a payment gateway mobile app to succeed, it must possess certain key features. A user-friendly interface tops the list, ensuring a smooth and intuitive experience for users. The integration of various payment methods, from credit cards to digital wallets, caters to diverse user preferences. Additionally, stringent security measures and encryption protocols instill confidence in users regarding the safety of their financial information.

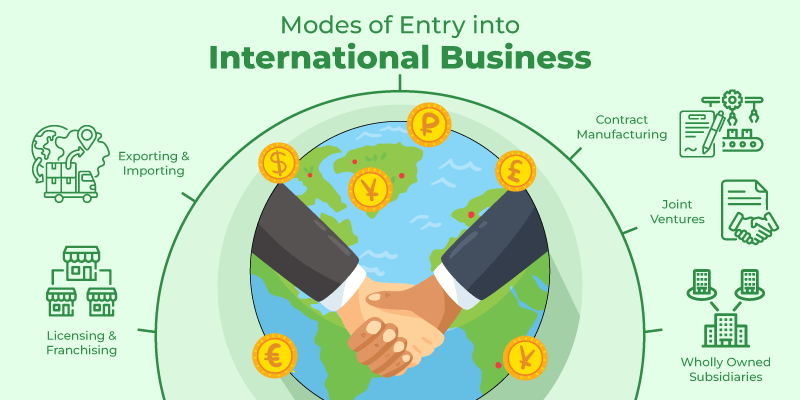

Popular Payment Gateways in India

In the vast landscape of payment gateways [1], several have gained prominence in India. Paytm, Google Pay, and PhonePe are among the widely used options. A comparative analysis of these gateways reveals variations in features, transaction limits, and user base, allowing users to choose based on their specific needs.

Challenges and Solutions

Despite the convenience they offer, payment gateway mobile apps face challenges such as technical glitches, network issues, and security concerns. However, continuous advancements in technology and proactive measures by companies ensure these challenges are being addressed. Solutions range from regular updates to enhanced customer support [2]mechanisms.

Impact on E-commerce

The symbiotic relationship between payment gateway mobile apps and the e-commerce [3] sector is undeniable. The ease of completing transactions through mobile apps has led to a significant uptick in online shopping. Statistics show a direct correlation between the rise in mobile app downloads and the surge in online transactions, indicating a profound impact on the e-commerce landscape.

User Experience and Reviews

Positive user experiences and favorable reviews play a crucial role in the success of payment gateway mobile apps. Users rely on the feedback of their peers when choosing a payment gateway, emphasizing the importance of seamless transactions and prompt customer [4] support. App developers and companies strive to provide a positive user experience to enhance their app’s reputation.

Security Concerns

Security is paramount when dealing with financial transactions. Payment gateway mobile apps implement robust security measures, including encryption, two-factor authentication, and secure sockets layer (SSL) protocols. This ensures the confidentiality and integrity of user data, addressing common security concerns [5] associated with online transactions.

Future Trends in Payment Gateway Mobile Apps

Looking ahead, the future of payment gateway mobile apps holds exciting prospects. Technological advancements such as blockchain integration, biometric authentication, and artificial intelligence are expected to shape the landscape. Additionally, the rise of contactless payments and the internet of things (IoT) will further redefine the user experience.

Government Regulations and Compliance

The Indian government has established a regulatory framework to govern payment gateways, ensuring transparency, security, and fair practices. Compliance with these regulations is mandatory for mobile apps offering payment gateway services. Adherence to government standards instills trust among users, fostering a secure digital payment ecosystem.

Advantages for Businesses

Businesses stand to gain significantly by integrating payment gateways into their mobile apps. Increased revenue, an expanded customer base, and improved customer satisfaction are among the advantages. Mobile apps equipped with efficient payment gateways enhance the overall user experience, contributing to the success of businesses in the digital landscape.

Case Studies

Real-life examples illustrate the positive impact of incorporating payment gateways. Businesses that have successfully implemented secure and user-friendly payment gateways report increased customer loyalty and higher conversion rates. These case studies serve as inspiration for other businesses considering the integration of payment gateways into their mobile apps.

Tips for Developers

Developers play a crucial role in the success of payment gateway mobile apps. Tips for seamless integration include rigorous testing, staying updated with security protocols, and adapting to evolving user preferences. By prioritizing user experience and incorporating the latest technologies, developers can ensure the success of payment gateway mobile apps.

The Role of Marketing in Increasing Downloads

Effectively marketing payment gateway mobile apps is essential for increasing downloads and user adoption. Social media campaigns, strategic partnerships, and incentivizing users contribute to the app’s visibility. Marketing efforts should focus on highlighting the app’s features, security measures, and user benefits.

Conclusion

In conclusion, the surge in payment gateway mobile app downloads in India is a testament to the evolving digital landscape. The symbiotic relationship between mobile apps, payment gateways, and e-commerce has reshaped the way transactions are conducted. As technology continues to advance, the future holds promising trends that will further enhance the efficiency and security of payment gateway mobile apps.

FAQs

- Are payment gateway mobile apps safe to use?

- Yes, payment gateway mobile apps implement robust security measures to ensure the safety of user transactions.

- What is the most widely used payment gateway in India?

- How do payment gateway mobile apps impact businesses?

- Integrating payment gateways into mobile apps enhances user experience, leading to increased revenue and customer satisfaction.

- What future trends can we expect in payment gateway mobile apps?

- Future trends include blockchain integration, biometric authentication, and the rise of contactless payments.

- Do developers play a crucial role in the success of payment gateway mobile apps?

- Yes, developers are pivotal in ensuring seamless integration, security, and staying updated with industry trends.