Author : Sweetie

Date : 25/12/2023

Introduction

However, for entrepreneurs[1] grappling with bad credit in India, securing a payment gateway can be a formidable challenge. In this article, we’ll explore the intricacies of payment gateways, the impact of bad credit, and effective strategies[2] for businesses facing this dilemma.

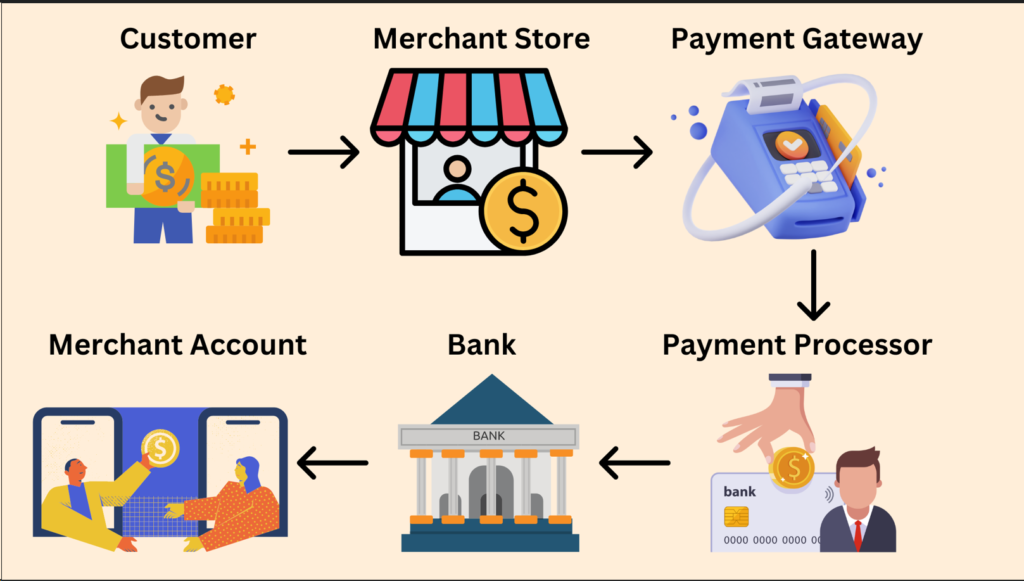

Definition of a Payment Gateway

At its core, a payment gateway is a technology[3] that facilitates online transactions by connecting a merchant’s website to the bank. It ensures that customers can securely make payments for goods or services[4]. For businesses, especially those operating in the digital realm, a seamless and efficient payment gateway is indispensable.

Importance of Payment Gateways for Businesses

Payment gateways play a crucial role in building trust[5] with customers. They provide a secure environment for financial transactions, fostering a positive shopping experience. Moreover, in a world where online shopping is the norm, businesses with effective payment gateways have a competitive edge.

Challenges of Obtaining a Payment Gateway with Bad Credit in India

Despite the evident advantages of having a payment gateway, entrepreneurs with bad credit face unique challenges. Financial institutions are often hesitant to provide payment gateways to businesses with a less-than-stellar credit history. This reluctance stems from the higher perceived risk associated with such enterprises.

Understanding Bad Credit

Explanation of Bad Credit

Bad credit is a financial condition where an individual or business has a poor credit history. This may result from delayed payments, defaults on loans, or other financial missteps. In India, understanding the nuances of bad credit is crucial for businesses seeking to improve their financial standing.

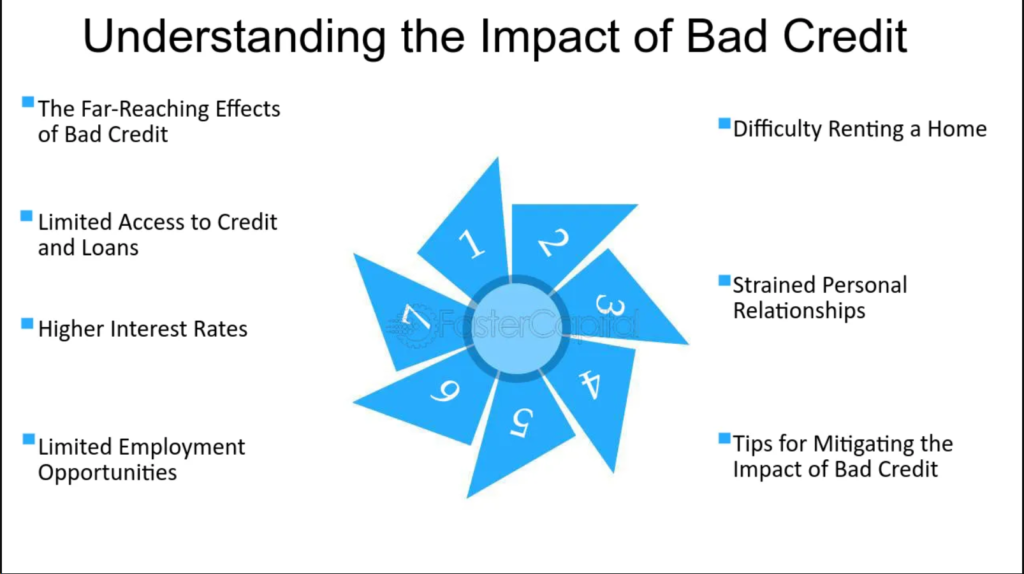

Impact of Bad Credit on Business Operations

The repercussions of bad credit extend beyond the financial realm. Businesses may find it challenging to secure loans, lines of credit, or, as in our case, a payment gateway. This hinders growth and limits opportunities for expansion.

Common Reasons for Bad Credit in India

Several factors contribute to bad credit in the Indian business landscape. Economic downturns, unforeseen crises, or even mismanagement of finances can lead to a tarnished credit history. Recognizing these factors is the first step toward rectifying the situation.

Importance of Payment Gateways

Seamless Online Transactions

In the digital age, customers expect smooth and secure online transactions. A reliable payment gateway ensures that payments are processed seamlessly, reducing the risk of transaction failures and customer dissatisfaction.

Boosting Customer Trust

Trust is paramount in any business relationship. An efficient payment gateway not only safeguards financial transactions but also enhances the overall trustworthiness of a business. Customers are more likely to make purchases when they feel their financial information is secure.

Expanding Business Reach

Payment gateways open doors to a global customer base. By enabling businesses to accept payments from different regions and currencies, they facilitate international expansion. This is particularly relevant for Indian businesses aiming to tap into the global market.

Challenges in Obtaining Payment Gateway with Bad Credit

Stricter Approval Criteria

For businesses with bad credit, payment gateway providers often impose stricter approval criteria. This includes rigorous background checks, financial assessments, and a more thorough vetting process.

Higher Processing Fees and Transaction Rates

To mitigate the perceived risk, payment gateway providers may charge businesses with bad credit higher processing fees and transaction rates.

Limited Options for Businesses with Bad Credit

The pool of payment gateway providers willing to work with businesses with bad credit is limited. This scarcity leaves entrepreneurs with fewer choices, often forcing them to settle for less favorable terms.

Strategies to Improve Credit Score

Reviewing and Understanding Credit Reports

The first step toward improving bad credit is a thorough review and understanding of credit reports. Identifying errors, discrepancies, or areas of improvement lays the foundation for a strategic credit repair plan.

Timely Repayment of Debts

Consistent and timely repayment of debts is crucial for rebuilding credit. By honoring financial commitments, businesses demonstrate their commitment to financial responsibility, earning trust from creditors.

Exploring Credit Repair Options

Several credit repair options are available, including working with credit counseling agencies or negotiating with creditors. Exploring these avenues can lead to the development of a tailored strategy for credit improvement.

Alternative Payment Solutions

Digital Wallets

In the absence of a traditional payment gateway, businesses can explore alternative payment solutions like digital wallets. These platforms offer a convenient way for customers to make online payments without the need for a formal gateway.

UPI Payments

Unified Payments Interface (UPI) has gained prominence in India as a reliable and secure payment method. Integrating UPI into the business model provides an alternative channel for online transactions.

E-commerce Platforms with Integrated Payment Gateways

Some e-commerce platforms come with integrated payment gateways. Utilizing these platforms can be a practical solution for businesses facing challenges in obtaining standalone payment gateways.

Choosing the Right Payment Gateway

Researching Available Options

Thorough research is essential when choosing a payment gateway. Businesses should consider factors such as transaction fees, security features, and customer support. Reading reviews and seeking recommendations can guide decision-making.

Reading Terms and Conditions

Before committing to a payment gateway, it’s crucial to read and understand the terms and conditions. This includes details on fees, contract[1] duration, and any additional requirements or restrictions imposed by the provider.

Negotiating with Payment Gateway Providers

In some cases, negotiation is possible. Businesses should explore opportunities to negotiate terms with payment gateway providers, especially when faced with challenges due to bad credit.

Importance of Security Measures

SSL Certificates and Data Encryption

Security is paramount in online transactions. Businesses must prioritize payment gateways that employ SSL certificates and robust data encryption[2] to protect sensitive customer information.

Two-Factor Authentication

Implementing two-factor authentication adds an extra layer of security to payment processes. This feature enhances the overall integrity of the transaction system.

PCI DSS Compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is non-negotiable. Businesses must ensure that their chosen payment gateway adheres to these industry standards for data security[3].

Future Trends in Payment Gateways

Emerging Technologies in Payment Processing

The landscape of payment gateways is continually evolving. Entrepreneurs should stay informed about emerging technologies such as blockchain and artificial intelligence, which may reshape the future of online transactions.

Impact of Digital Transformation on Payment Gateways

The ongoing digital[4] transformation has a profound impact on payment gateways. As businesses embrace new technologies, payment processes are expected to become more efficient, secure, and seamless.

Opportunities for Businesses with Bad Credit

Future trends in payment gateways may bring new opportunities for businesses with bad credit[5]. Innovations in risk assessment and a broader acceptance of diverse business profiles could lead to more inclusive financial solutions.

Conclusion

In conclusion, the journey of obtaining a payment gateway with bad credit in India is undoubtedly challenging, but not insurmountable. By understanding the intricacies of bad credit, exploring alternative payment solutions, and choosing the right payment gateway with a focus on security, businesses can overcome these hurdles. The evolving landscape of payment gateways also presents opportunities for growth and expansion.

FAQs

- Can I get a payment gateway with bad credit in India?

- While challenging, it’s not impossible. Exploring alternative solutions and improving your credit score can increase your chances.

- What are the key security measures for payment gateways?

- SSL certificates, data encryption, two-factor authentication, and PCI DSS compliance are crucial for a secure payment gateway.

- How long does it take to improve a bad credit score?

- The timeline varies, but consistent efforts in timely debt repayment and credit repair strategies can yield positive results over time.

- Are there payment gateways specifically designed for businesses with bad credit?

- While options are limited, some providers may be willing to work with businesses on improving credit.

- What role do emerging technologies play in the future of payment gateways?

- Emerging technologies like blockchain and AI are expected to bring efficiency and security enhancements to payment processing.