AUTHOR : ZOYA SHAH

DATE : 26-12-2023

In today’s fast-paced financial landscape, the concept of debt consolidation[1] has gained significant traction, especially in a country like India. As individuals strive to manage their finances efficiently, the role of a reliable payment gateway in the debt consolidation process becomes paramount.

Introduction to Payment Gateway for Debt Consolidation

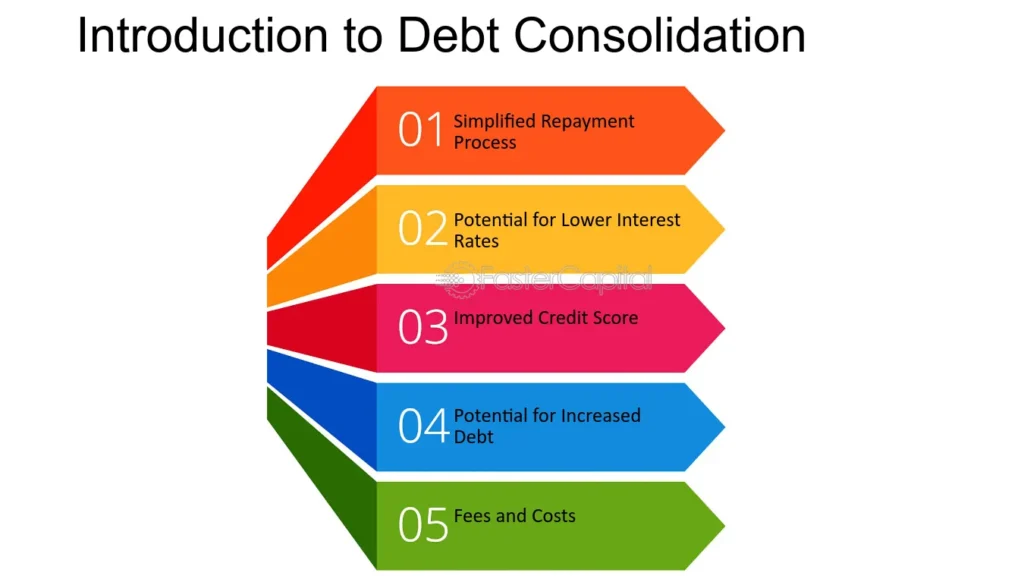

Debt consolidation involves merging multiple debts into a single, more manageable payment, streamlining financial transactions and simplifying the repayment process for individuals. In this process, a robust payment gateway[2] plays a crucial role in facilitating secure and seamless transactions. Understanding the significance of a reliable payment gateway is essential for anyone navigating the realm of debt consolidation.

The Significance of a Reliable Payment Gateway

Ensuring the security of financial transactions[3] is a top priority for individuals consolidating their debts. A trustworthy payment gateway not only provides a secure channel for transactions but also contributes to building trust among users. This trust is a cornerstone for a successful debt consolidation journey.

Best Debt Consolidation Practices in India

Before delving into the world of payment gateways, it’s crucial to grasp the best debt consolidation practices in India. From the survey of debt consolidation in the Indian context to the benefits it offers, a comprehensive understanding sets the stage for informed decision-making.

Key Features of an Ideal Payment Gateway for Debt Consolidation

When considering payment portal for debt consolidation, certain features stand out. Compatibility with various payment methods, robust security measures, and a user-friendly interface are key elements that define an ideal payment gateway in this context.

Comparing Popular Payment Gateways in India

India boasts several payment portal, each with its unique features and offerings. A thorough analysis of these gateways, including their pros and cons, is essential for individuals seeking the best fit for their debt consolidation journey.

Integrating Payment Gateways with Debt Consolidation Platforms

Seamless integration of payment gateways with debt consolidation platforms enhances the overall user experience. A well-integrated system provides convenience to users, streamlining the debt consolidation process.

Ensuring Data Privacy and Security

Privacy and security are paramount when dealing with financial information. Encryption technologies and compliance with data protection regulations ensure the confidentiality of user data throughout the debt consolidation process.[4]

User Experience and Interface Design

The impact of a user-friendly interface on customer satisfaction cannot be overstated. Navigational simplicity not only enhances the user experience but also contributes to the overall success of debt consolidation efforts.

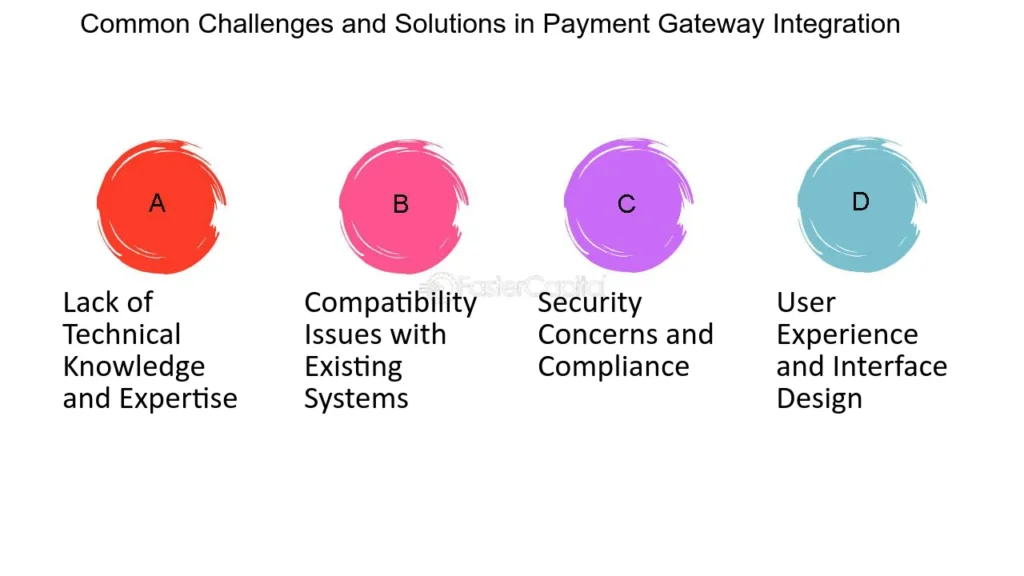

Challenges in Payment Gateway Integration

Despite the benefits, integrating payment gateways with debt consolidation platforms comes with its challenges. Addressing common issues and concerns is crucial for ensuring a smooth and trouble-free experience for users.

Cost Considerations for Debt Consolidation Payment Gateways

Understanding the pricing structures of payment portal is vital. Beyond the surface costs, users must be aware of potential hidden fees that could impact the overall affordability of debt consolidation.

Real-life Success Stories

Highlighting actual success stories with debt consolidation payment portal adds a human touch to the decision-making process. Testimonials from satisfied users provide valuable insights into the effectiveness of different payment portal[5].

Future Trends in Payment Gateways for Debt Consolidation

The landscape of payment gateways is continually evolving. Examining future trends and technological advancements provides users with a glimpse into what to expect in the coming years.

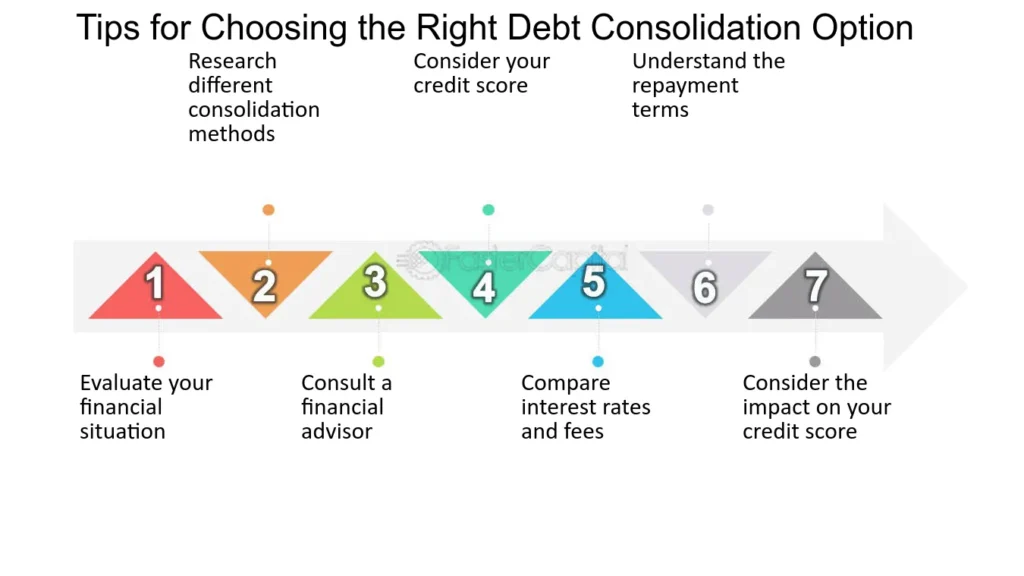

Tips for Choosing the Right Payment Gateway for Debt Consolidation

Choosing the right payment gateway requires careful consideration of various factors. From compatibility with specific needs to customization options, users can benefit from practical tips for making an informed decision.

Common Misconceptions About Payment Gateways

Dispelling myths surrounding payment gateways is crucial. Educating users about the reality of security and usability helps address common misconceptions, fostering a more informed user base.

Conclusion

In conclusion, a reliable payment gateway is a linchpin in the world of debt consolidation in India. Its role in ensuring secure transactions, building trust, and enhancing the overall user experience cannot be overstated. As individuals navigate the complexities of debt consolidation, choosing the right payment gateway is a decision that warrants careful consideration.

FAQs

- Are all payment portal equally secure for debt consolidation?

- Security levels may vary, and it’s essential to choose a gateway with robust encryption and compliance measures.

- How do payment portal contribute to the success of debt consolidation?

- Payment gateways streamline transactions, enhance user experience, and build trust among individuals consolidating their debts.

- Can I use any payment gateway with any debt consolidation platform?

- Compatibility varies, and it’s advisable to choose a payment gateway that seamlessly integrates with the chosen debt consolidation platform.

- What are the hidden costs associated with payment portal for debt consolidation?

- Hidden costs may include transaction fees, currency conversion charges, and other miscellaneous charges. It’s crucial to review the pricing structure thoroughly.

- How do future trends in payment portal impact debt consolidation practices?

- Future trends may introduce innovative features and technologies, potentially better the efficiency and effectiveness of debt consolidation.