AUTHOR : ZOYA SHAH

DATE : 25-12-2023

In the ever-evolving landscape of online transactions,[1] the fusion of payment gateways and credit inquiries [1]plays a pivotal role in shaping the financial ecosystem[2] in India. Understanding the intricate dance between these two elements is crucial for businesses and consumers alike.

I. Introduction

In today’s digital age, payment gateways[3] have become synonymous with seamless financial transactions. Simultaneously, credit inquiries in India hold significant weight in determining an individual’s financial [4]standing. Let’s explore how the amalgamation of payment gateways and credit inquiries is influencing the financial landscape.

II. Understanding Payment Gateways

Payment gateways serve as digital bridges that facilitate secure online transactions.[5] They ensure the swift and secure transfer of funds between the buyer and the seller. Understanding their functionality and types is key to grasping their connection with credit inquiries.

III. Credit Inquiries in India

Credit inquiries, commonly known as credit checks, are inquiries made by businesses or lenders to assess an individual’s creditworthiness. In the Indian context, credit inquiries play a crucial role in various financial transactions, influencing decisions related to loans, credit cards, and other financial products.

IV. Integration of Payment Gateways and Credit Inquiries

The seamless integration of payment gateways and credit inquiries is a delicate dance. Businesses utilize credit inquiries to make informed decisions while ensuring the security of user information. Striking the right balance is paramount for a positive user experience.

V. Popular Payment Gateways in India

India boasts a plethora of payment gateways, each offering unique features and services. Understanding their relationship with credit inquiries provides insights into how user data is managed and utilized in the online transaction process.

VI. Challenges and Solutions

While the integration of payment gateways and credit inquiries offers numerous benefits, challenges can arise. Addressing issues such as data security and user privacy is essential. This section explores potential challenges and effective strategies to overcome them.

VII. Benefits for Consumers

For consumers, the symbiosis of payment gateways and credit inquiries translates to streamlined transactions and enhanced security measures. Additionally, Payment Gateway On Credit Inquiry In India it plays a role in managing and improving credit scores, offering long-term financial benefits.

VIII. Industry Trends and Innovations

The landscape of payment gateways and credit inquiries is dynamic. Staying abreast of the latest trends and innovations is vital for businesses aiming to provide efficient and secure financial solutions.

IX. Regulatory Landscape

Government regulations play a crucial role in shaping the practices of payment gateways and credit inquiries in India. This section delves into the existing regulations, compliance requirements, and their impact on businesses and consumers.

X. Case Studies

Real-world examples provide insights into successful integrations and challenges faced by businesses in managing payment gateways and credit inquiries. Examining these case studies offers practical lessons for businesses.

XI. The Future of Payment Gateways and Credit Inquiries

Anticipating the future involves understanding technological[2] advancements and potential changes in the industry. Exploring collaborative efforts and partnerships sheds light on the trajectory of payment gateways[3] and credit inquiries.

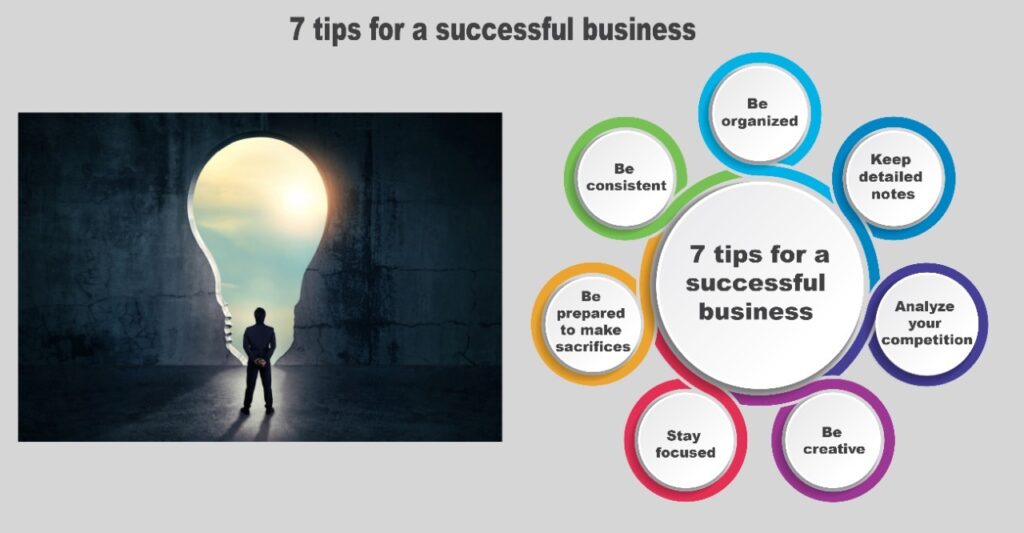

XII. Tips for Businesses

For businesses[4] navigating the intersection of payment gateways and credit inquiries, practical tips can make a significant difference. This section offers guidance[5] on choosing the right payment gateway, managing credit inquiries responsibly, and building trust with users.

XIII. Expert Opinions

Insights from industry experts provide a deeper understanding of the symbiotic relationship between payment gateways and credit inquiries. Their opinions on the future of these elements offer valuable guidance for businesses and consumers alike.

XIV. Conclusion

In conclusion, the intertwining of payment gateways and credit inquiries shapes the financial landscape in India. Emphasizing the importance of this relationship, businesses are encouraged to adapt to the evolving trends and leverage the symbiosis for mutual growth.

FAQs

- How do payment gateways impact credit inquiries in India? Payment gateways can influence credit inquiries by providing valuable transaction data to assess an individual’s creditworthiness.

- What are the key challenges businesses face in integrating payment gateways and credit inquiries? Challenges include data security concerns, privacy issues, and the need for seamless integration to ensure a positive user experience.

- Can using popular payment gateways positively affect a user’s credit score? Yes, responsible and timely transactions through popular payment gateways can contribute to a positive credit score.

- How do government regulations in India safeguard users’ information in payment transactions? Government regulations set guidelines for data protection, ensuring that users’ information is handled responsibly by payment gateways.

- What role do industry trends play in shaping the future of payment gateways and credit inquiries? Industry trends reflect technological advancements, user preferences, and regulatory changes, shaping the future of payment gateways and credit inquiries.