AUTHOR : KHOKHO

DATE : 23/12/2023

Introduction

In the dynamic landscape of financial technology, the role of payment gateways in credit recovery has become increasingly pivotal, especially in a country like India. As the financial sector witnesses rapid digital transformation, the integration of payment gateways has proven to be a game-changer in the recovery of credit and managing financial assets effectively.

Evolution of Payment Gateways in India

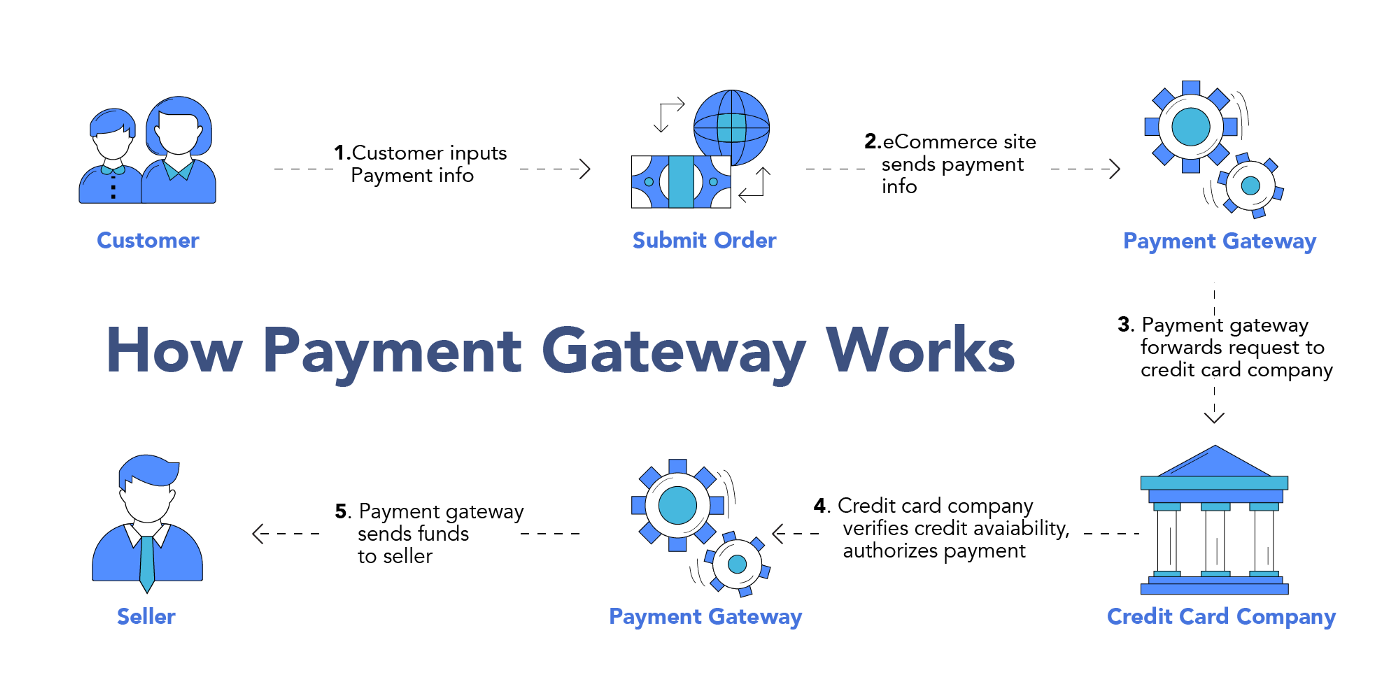

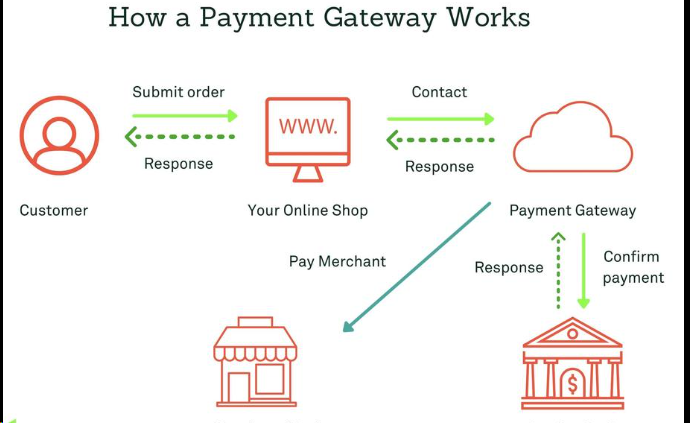

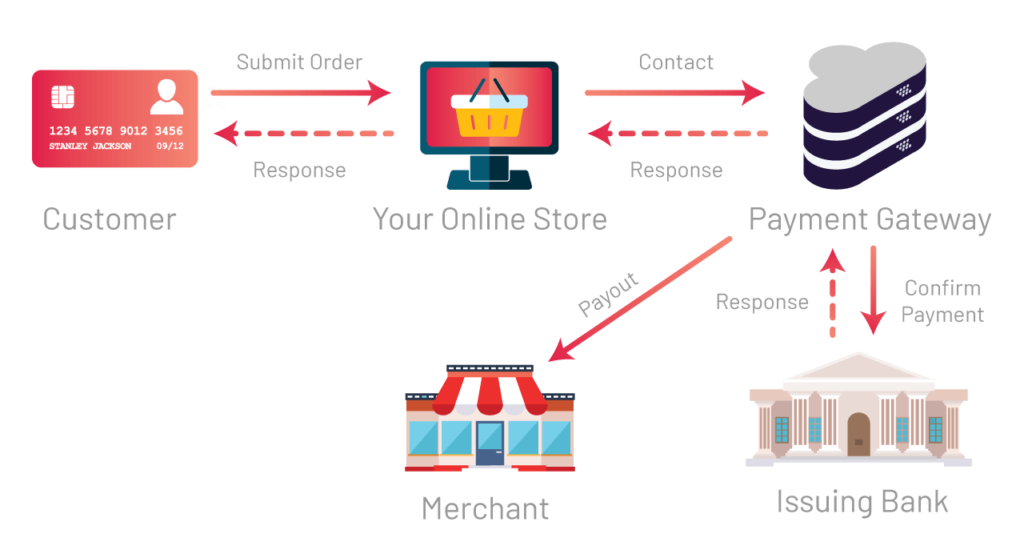

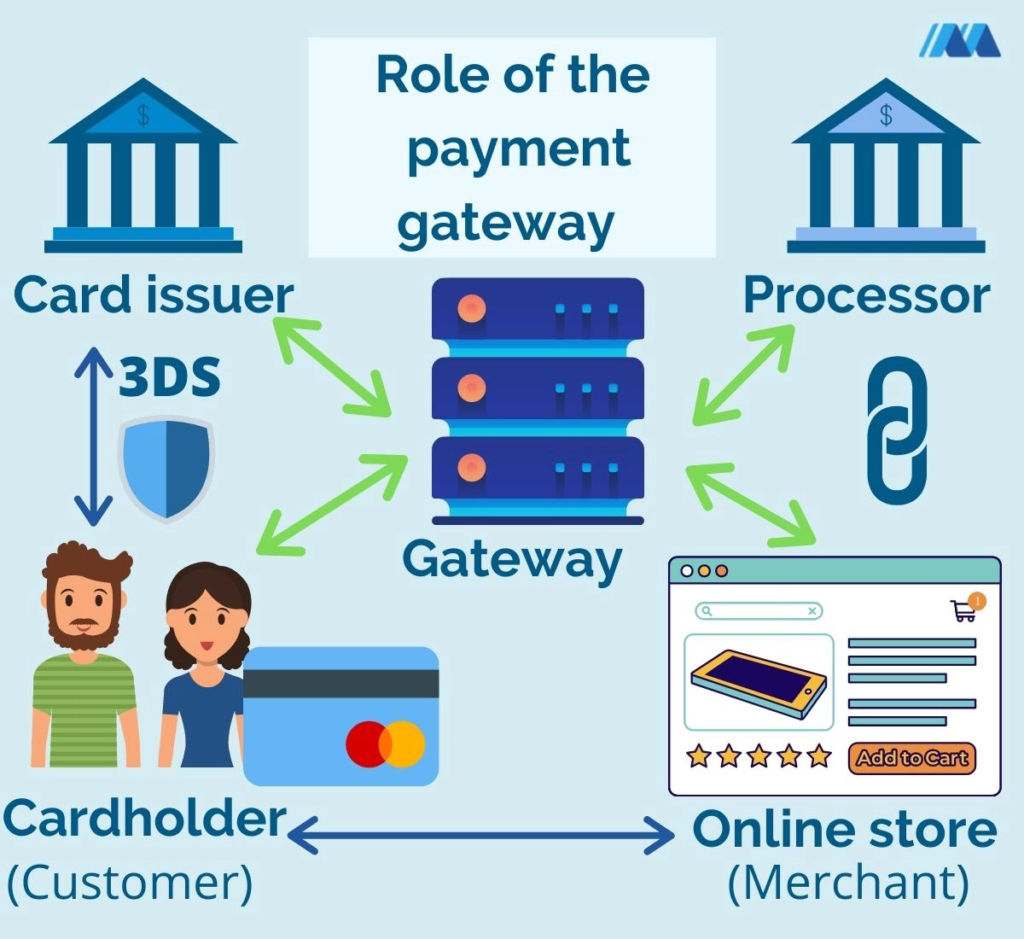

In the early stages, payment gateways were primarily used for facilitating online transactions. However, with technological advancements and the surge in digital payments, these gateways evolved to play a crucial role in the credit recovery process. The seamless integration of payment gateways with debt collection systems has significantly streamlined and automated the credit recovery mechanism.

Role of Payment Gateways in Credit Recovery

Payment gateways are now an integral part of credit recovery[1] processes, offering a level of automation that was once thought impossible. By integrating with debt collection systems, payment gateways enable financial institutions to set up automated repayment schedules, reducing the workload on manual collection efforts.

Challenges in Credit Recovery Process

Despite the advancements, the credit recovery process faces challenges such as non-performing assets (NPAs) and regulatory hurdles. Non-performing assets can impede the efficiency of the Credit history[2] recovery process, and navigating through regulatory requirements poses additional challenges.

Innovative Solutions Through Payment Gateways

To address these challenges, payment gateways bring innovative solutions to the table. Data analytics plays a crucial role in assessing the risk associated with each debtor, allowing financial institutions to tailor repayment plans that suit the borrower’s financial situation.

Benefits of Integrating Payment Gateways in Credit Recovery

The integration of Customer Payment Recovery[3] in credit recovery brings forth several benefits. It enhances transparency in transactions, ensuring that both the lender and borrower have a clear understanding of the repayment process. Moreover, the use of payment gateways expedites the recovery process by facilitating faster and more secure transactions.

Case Studies: Successful Implementation

Several organizations in India have successfully implemented payment gateways in their Debt Recovery Process[4]. These case studies serve as examples of how the integration of technology can lead to more efficient credit recovery, benefiting both financial institutions and borrowers.

Security Measures in Payment Gateways

Security is a top priority in Payment system[5] gateways, considering the sensitive nature of financial transactions. Encryption, secure protocols, and robust fraud detection systems ensure that the credit recovery process remains secure and trustworthy.

Adoption and Trends in India

The adoption of payment gateways in credit recovery is on the rise in India. Financial institutions are recognizing the advantages and are increasingly incorporating these technologies into their operations. Emerging trends indicate a positive trajectory for credit recovery through payment gateways.

User-Friendly Interfaces for Borrowers

The success of payment gateways in credit recovery is also contingent on user-friendly interfaces for borrowers. Ensuring easy navigation and developing mobile-friendly applications contribute to a positive user experience, encouraging timely repayments.

Cost-Effectiveness for Financial Institutions

Financial institutions benefit from the integration of payment gateways in credit recovery through a reduction in operational costs. The efficiency brought about by automation leads to increased revenue as borrowers adhere to timely repayment schedules.

Future Prospects and Innovations

Looking ahead, the future of credit recovery through payment gateways holds exciting prospects. Artificial intelligence is expected to play a more significant role in predicting borrower behavior, while blockchain technology offers enhanced security, reducing the risk of fraud in transactions.

Regulatory Compliance and Standards

Adherence to regulatory guidelines, especially those set by the Reserve Bank of India (RBI), is crucial for the seamless functioning of payment gateways in credit recovery. Financial institutions must adopt international best practices to maintain compliance and build trust.

Challenges Faced by Users

While payment gateways( bring numerous advantages, usersmay face challenges in understanding the process. Addressing common user concerns and providing transparent information can bridge the gap and ensure a smoother credit recovery experience.

Conclusion

In conclusion, the integration of payment gateways in credit recovery has revolutionized the financial landscape in India. From enhancing transparency to providing innovative solutions, these gateways have become indispensable for efficient credit management. As technology continues to advance, the synergy between payment gateways and also credit recovery processes is poised to shape the future of the financial industry.

FAQs

- How do payment gateways contribute to credit recovery in India?

- Payment gateways streamline the credit recovery process by automating repayment schedules and enhancing transparency in transactions.

- Are there any security concerns with using payment gateways for credit recovery?

- Payment gateways prioritize security, employing encryption, secure protocols, and fraud detection systems to ensure a secure credit recovery process.

- What benefits do financial institutions gain from integrating payment gateways in credit recovery?

- Financial institutions experience cost-effectiveness, reduced operational costs, and increased revenue through the efficient credit recovery facilitated by payment gateways.

- How can users navigate the challenges associated with payment gateways in credit recovery?

- Users can overcome challenges by understanding the process, seeking transparent information, and being aware of the user-friendly interfaces provided by financial institutions.

- What is the future outlook for credit recovery through payment gateways in India?

- The future holds exciting prospects with the incorporation of artificial intelligence and blockchain technology, further enhancing the efficiency and security of credit recovery processes.