AUTHOR : ZOYA SHAH

DATE : 25-12-2023

In today’s fast-paced world, managing multiple debts can be a daunting task. Individuals often find themselves juggling various financial responsibilities, leading to stress and confusion. Fortunately, the advent of payment gateways has brought a transformative solution to the realm of debt consolidation assistance in India.

Introduction

Payment gateway[1]s serve as the digital checkpoints that enable secure and efficient financial transactions over the internet. Their role extends beyond facilitating online shopping; they play a crucial part in streamlining payment processes in various sectors, including debt consolidation.

Debt Consolidation in India

India, like many other countries, grapples with the challenge of individuals facing multiple debts. Whether it’s loans, credit card bills, or other financial obligations[2], managing these debts can become overwhelming. Debt consolidation offers a viable solution by combining multiple debts into a single, more manageable payment.

Role of Payment Gateways in Debt Consolidation

Payment gateways act as the backbone of debt consolidation[3] services. They ensure that financial transactions between debtors and creditors are secure and seamless. This not only simplifies the payment process but also adds a layer of confidentiality to sensitive financial information.

Popular Payment Gateways in India

In the Indian context, several payment gateways have gained widespread popularity. From traditional banks to third-party platforms, these gateways provide a range of options for users to conduct their financial transactions[4] securely.

Integration of Payment Gateways in Debt Assistance Services

The integration of payment gateways into debt assistance services is a critical aspect of ensuring the success of debt consolidation plans. Users benefit from the convenience of making payments through a secure channel, and creditors receive timely and accurate payments.

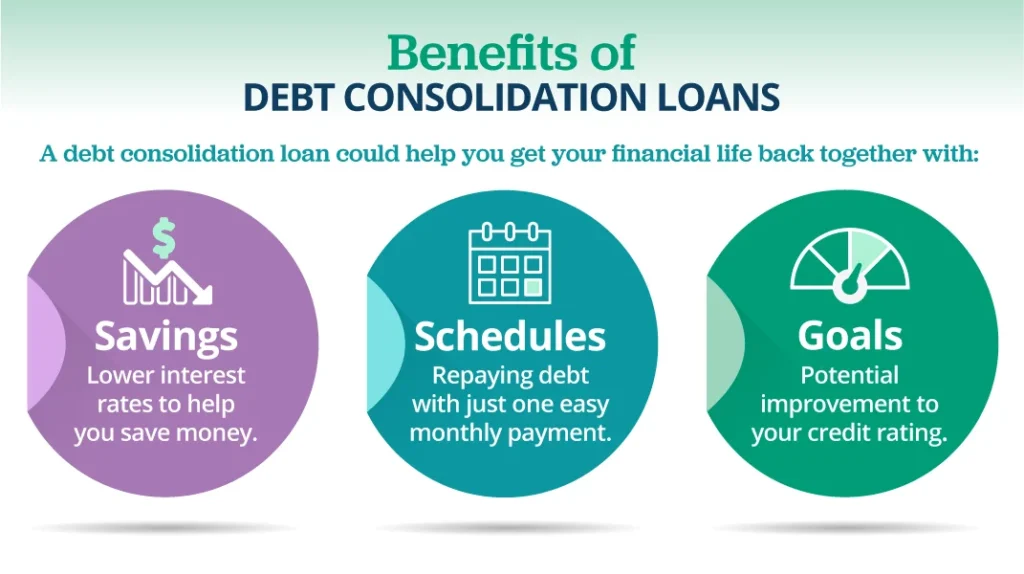

Benefits of Using Payment Gateways in Debt Consolidation

The advantages of incorporating payment gateways into debt consolidation processes are manifold. Improved financial transparency allows individuals to track their payments effectively, leading to better financial management[5].

User Experience and Interface

A user-friendly interface is paramount when it comes to payment gateways for debt consolidation. A seamless experience ensures that users can navigate through the payment process with ease, reducing the chances of errors and enhancing overall satisfaction.

Security Measures in Payment Gateways

Security is a paramount priority when dealing with intricate financial transactions, where the integrity of each transaction is of utmost importance.Payment gateways employ robust encryption and data protection measures to safeguard users’ sensitive information, building trust and confidence in the system.

Challenges and Solutions

While payment gateways offer numerous benefits, challenges may arise. From technical glitches to user errors, addressing these challenges promptly ensures a smooth and reliable payment process for users.

Case Studies

Real-life examples illustrate the effectiveness of payment gateways in debt consolidation. Successful stories showcase the positive impact on individuals’ financial lives, encouraging others to explore this option.

Future Trends in Payment Gateways for Debt Consolidation

As technology undergoes continual evolution, payment gateways likewise advance, adapting to the dynamic landscape of financial transactions and incorporating cutting-edge features to ensure seamless and secure transaction experiences for users. Future trends include innovations in artificial intelligence, blockchain, and enhanced security features, shaping a more advanced and also efficient debt consolidation landscape.

Choosing the Right Payment Gateway for Debt Consolidation

Selecting the appropriate payment gateway is crucial for a successful debt consolidation journey. Factors such as security, user interface, and transaction fees should be considered when making this decision.

Impact on Credit Scores

Understanding how payment gateways influence credit scores is essential for individuals undergoing debt consolidation. While the process itself does not directly impact credit scores, maintaining timely payments is crucial for a positive credit history.

Educational Resources for Users

Empowering users with knowledge about payment gateways and debt consolidation is key. Providing resources and educational materials ensures that individuals make informed decisions about their financial well-being.

Conclusion

In conclusion, the integration of payment gateways into debt consolidation assistance in India marks a significant step toward a more streamlined and secure financial future. Users are encouraged to explore the available options, choose the right payment gateway, and embark on a journey towards financial freedom.

Frequently Asked Questions

- Are payment gateways safe for debt consolidation transactions?

- Absolutely. Payment gateways employ advanced security measures to protect your financial information during debt consolidation transactions.

- How do payment gateways impact my credit score during debt consolidation?

- Payment gateways themselves do not directly impact your credit score. However, timely payments facilitated by these gateways contribute to a positive credit history.

- Can I choose my preferred payment gateway for debt consolidation?

- In many cases, yes. Debt consolidation services often provide options for users to select their preferred payment gateway based on security and also convenience.

- What happens if there is an error in my payment through a gateway?

- Most payment gateways have customer support services to address any issues promptly. Reach out to them for assistance in case of errors.

- How can I stay informed about the latest trends in payment gateways for debt consolidation?

- Keep yourself updated through financial news, online forums, and resources provided by debt consolidation services.