AUTHOR :HAANA TINE

DATE :25/12/2023

Introduction

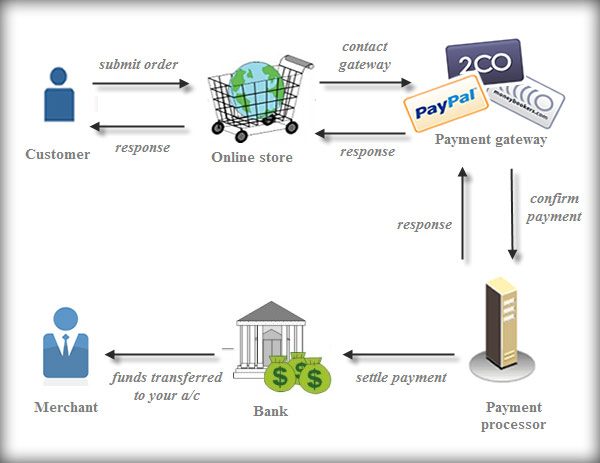

Debt consolidation[1], a financial strategy gaining traction in India, involves combining multiple debts into a single, more manageable payment[2]. This not only simplifies the repayment process[3] but can also lead to potential cost savings[4]. One integral component of this process is the use of payment gateways[5], which play a pivotal role in facilitating seamless transactions and ensuring the security of sensitive financial information.

Understanding Debt Consolidation in India

In the diverse landscape of Indian finance, debt consolidation serves as a lifeline for those navigating through various loans and credit lines. This section delves into the definition and purpose of debt consolidation, explores popular methods employed in the Indian context.

Key Features of an Effective Payment Gateway for Debt Consolidation

For a payment gateway to be effective in the realm of debt consolidation, certain key features are non-negotiable. This section outlines the importance of a user-friendly interface, integration with multiple payment methods.

Top Debt Consolidation Payment Gateways in India

Choosing the right payment gateway is a critical decision for those embarking on a debt consolidation journey.

How Payment Gateways Impact the Debt Consolidation Industry

The integration of payment gateways in debt consolidation not only simplifies transactions but also brings about a positive transformation in the industry.Payment Gateway on Debt Consolidation Solutions in India

Trends and Innovations in Debt Consolidation Payment Gateways

As technology continues to evolve, payment gateways in the debt consolidation sector are not far behind. This part of the article highlights emerging trends, including mobile app integration and also the use of artificial intelligence in debt management.

Challenges in the Integration of Payment Gateways for Debt Consolidation

Despite their numerous benefits, the integration of payment gateways into the debt consolidation process comes with its own set of challenges. Navigating regulatory hurdles and also overcoming technological barriers are explored in this section.

Case Studies: Successful Implementation of Payment Gateways

Real-life examples offer valuable insights into the positive outcomes of integrating payment gateways into debt consolidation strategies. This section presents case studies, sharing success stories

Tips for Choosing the Right Payment Gateway for Debt Consolidation

Choosing the right payment gateway[1] is a crucial decision that should align with individual needs and preferences. This section provides practical tips, including the consideration of specific requirements, evaluation of security features, and also the importance of reading user reviews.

Future Outlook: The Evolution of Payment Gateways in Debt Consolidation

The landscape of payment gateways in debt consolidation is ever-evolving. This part of the article discusses emerging technologies and also thenoffers predictions for the future, giving readers a glimpse into what to expect in the dynamic world of financial technology[2].

Expert Opinions on Payment Gateways and Debt Consolidation

Insights from financial experts and also industry perspectives provide a well-rounded view of the significance of payment gateways in debt consolidation[3]. This section features opinions from experts in the field, offering valuable perspectives for readers seeking a comprehensive understanding.

How Payment Gateways Impact Credit Scores in Debt Consolidation

The impact of payment gateways on credit scores[4] is a critical consideration for individuals in debt consolidation. This section explores the positive and then negative effects, along with practical tips for maintaining a good credit score throughout the consolidation process.

Common Misconceptions about Payment Gateways in Debt Consolidation

As with any financial tool, payment gateways[5] in debt consolidation are subject to myths and misconceptions. This section addresses common misconceptions, providing clarity and debunking myths to ensure readers have accurate information.

Conclusion

In conclusion, the integration of payment gateways into debt consolidation solutions in India brings about a paradigm shift in how individuals manage their finances. The significance of user-friendly interfaces, security measures, and the overall impact on the industry cannot be overstated. As readers navigate the complexities of debt consolidation, informed decision-making, and a proactive approach to choosing the right payment gateway are paramount.

FAQs

- Q: Can I use any payment gateway for debt consolidation, or are there specific ones recommended for this purpose? A: While many payment gateways can facilitate transactions, it’s advisable to choose one with features tailored to the unique needs of debt consolidation, such as user-friendly interfaces and robust security measures.

- Q: How do payment gateways impact my credit score during debt consolidation? A: Payment gateways play a role in timely and efficient debt repayment, which can positively influence your credit score. However, it’s essential to understand the nuances to ensure a positive impact.

- Q: Are there any regulatory concerns when using payment gateways for debt consolidation in India? A: Yes, navigating regulatory hurdles is a challenge. It’s crucial to choose payment gateways that comply with relevant regulations to ensure a smooth debt consolidation process.

- Q: What future trends can we expect in payment gateways for debt consolidation? A: The future holds innovations like mobile app integration and the use of artificial intelligence, transforming the user experience and efficiency of debt consolidation through payment gateways.