AUTHOR :HAANA TINE

DATE :25/12/2023

Introduction

Consolidating debt is a financial tactic[1] aimed at merging numerous outstanding debts into a solitary and easily handled payment. With the advent of online platforms[2], this process has become more accessible and convenient. One of the key elements[3] contributing to the success of online debt consolidation[4] is the integration of efficient payment gateways[5].

Understanding Online Debt Consolidation

Online debt consolidation is a financial practice that allows individuals and businesses to merge their outstanding debts into a single payment. This approach simplifies financial management, reduces interest rates, and provides a clear pathway to debt freedom.

Challenges in Traditional Debt Consolidation

Traditional methods of debt Combining often involve lengthy paperwork and complex approval processes. The lack of user-friendly interfaces can be a barrier, discouraging individuals from pursuing debt Combining.

The Role of Payment Gateways in Streamlining Debt Consolidation

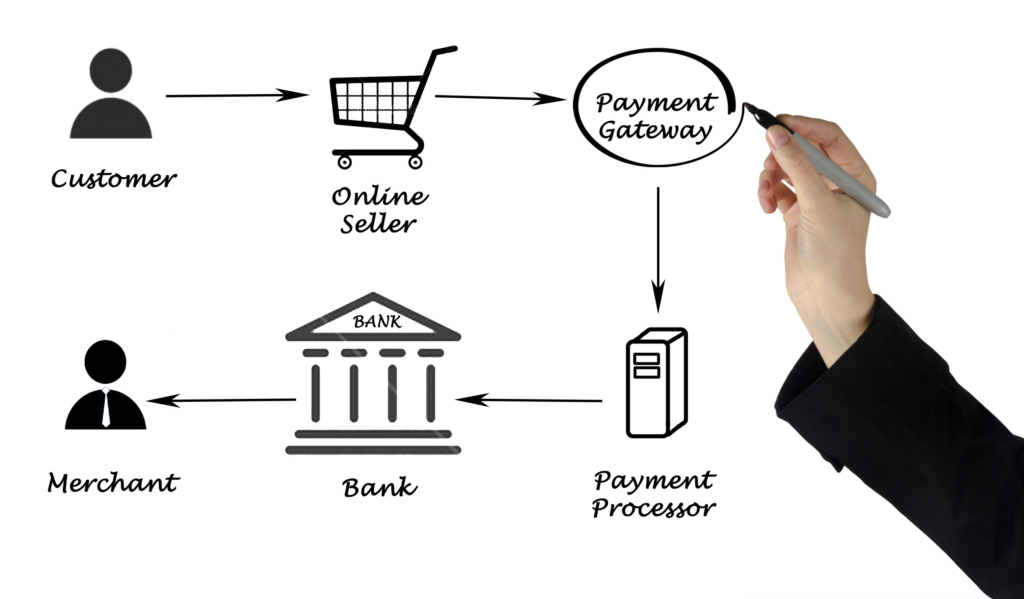

Payment gateways play a pivotal role in the online debt consolidation process by ensuring secure and efficient transactions. With real-time processing capabilities, users experience quick and hassle-free debt repayments.

Popular Payment Gateways in India

In the Indian financial landscape, several payment gateways have gained prominence. From established players to innovative newcomers, each platform offers unique features that cater to the diverse needs of users.

Paytm

Paytm stands as a frontrunner in the payment gateway domain, providing a seamless experience for users engaging in online debt Combining.

Its ease-of-use interface and broad approval render it the favored selection among users.

Razorpay

Razorpay’s robust technology and comprehensive features make it a popular choice among businesses for debt Combining transactions. The platform’s reliability and scalability contribute to its growing user base.

Instamojo

Instamojo’s focus on simplicity and inclusivity makes it an ideal payment gateway for individuals seeking a straightforward debt consolidation process.Payment Gateway on Online Debt Combining in India Its commitment to user satisfaction sets it apart in the market.

Integration of Payment Gateways in Debt Consolidation Platforms

The success of online debt Combining platforms heavily depends on the integration of payment gateways that prioritize user experience.Payment Gateway on Online Debt Combining in India Streamlining the repayment process and ensuring a user-friendly interface are key factors in the selection of payment gateways.

Security Measures in Online Debt Consolidation

Security is a paramount concern in online financial transactions. Payment gateways employed in debt Combining platforms implement advanced security measures, such as SSL encryption and two-factor authentication, to safeguard user information.

User Experiences with Payment Gateways in Debt Consolidation

The satisfaction of users who have undergone the debt Combining process with integrated payment gateways is a testament to the effectiveness of these platforms. Positive testimonials and success stories highlight the impact of streamlined transactions on overall customer satisfaction.

Future Trends in Online Debt Consolidation and Payment Gateways

As technology continues to evolve, the future holds exciting possibilities for online debt Combiningand payment gateways. Advancements such as AI-driven financial advice and blockchain[1]-based security measures are expected to enhance user experiences further.

SEO Benefits for Debt Consolidation Websites

Optimizing online debt Combining platforms for search engines is crucial for attracting users in need of financial solutions[2]. Implementing effective SEO strategies ensures visibility and accessibility.

Common Misconceptions about Payment Gateways in Debt Consolidation

Misconceptions about the security and reliability of payment gateways[3] can hinder users from exploring online debt Combining options. Dispelling myths and providing accurate information is essential in building trust.

Case Studies of Successful Debt Consolidation with Seamless Payment Gateway Integration

Real-world examples of individuals and businesses benefiting from online debt consolidation with integrated payment gateways provide valuable insights. Case studies showcase the positive impact on financial stability and debt management[4].

Tips for a Smooth Debt Consolidation Process

Guiding users through the debt consolidation[5] process is essential for a positive experience. Offering tips and precautions ensures that individuals make informed decisions and navigate the journey successfully.

Conclusion

In conclusion, the integration of payment gateways in online debt Combining platforms plays a pivotal role in transforming the financial landscape. The convenience, security, and user satisfaction offered by these gateways contribute to making debt Combining a viable and accessible option for individuals and businesses alike.

FAQs

- What is online debt consolidation, and how does it work?

- Online debt Combining is a financial strategy that involves combining multiple debts into a single, more manageable payment. It works by streamlining the repayment process and often reducing interest rates.

- How do payment Doorways enhance the debt Combining experience?

- Paymentgateways ensure secure and real-time processing of debt repayments, making the overall experience quick and hassle-free for users.

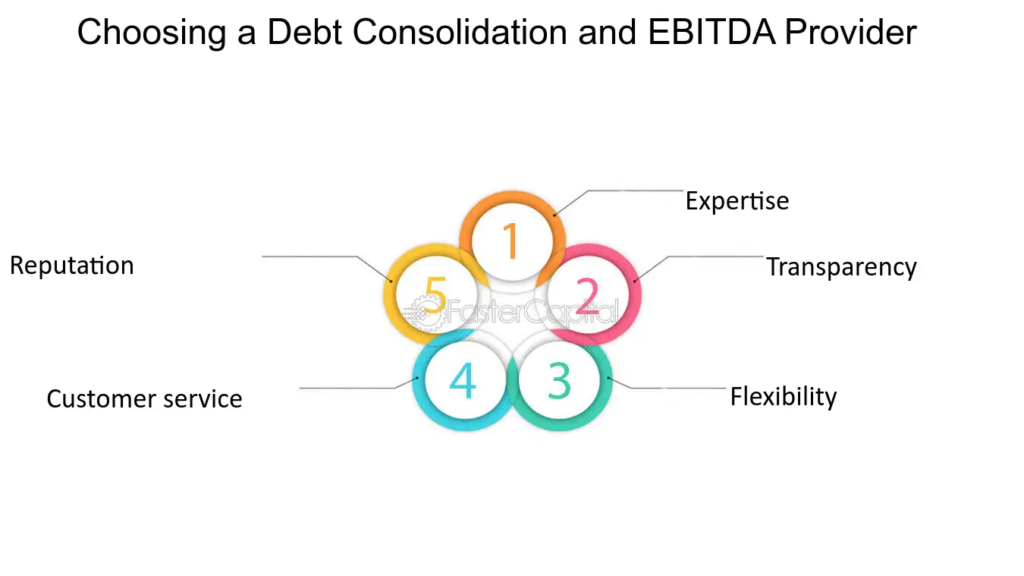

- What factors should I consider when choosing a payment gateway for debtCombining?

- Factors to consider include transaction fees, security features, integration capabilities, and user reviews.

- Are there any security risks associated with using payment Doorways for debt Combining?

- Payment gateways implement advanced security measures, such as SSL encryption and two-factor authentication, to mitigate security risks.

- How can I optimize my debt Combining website for search engines?

- Implementing effective SEO strategies, including keyword optimization and quality content creation, can enhance the visibility of debt consolidation websites.