author : nora

date : 26-12-23

Introduction

A. Definition of Online Debt Consolidation

Online debt consolidation refers to the strategic process of combining multiple debts into a single, manageable payment. This approach aims to simplify financial obligations and also reduce the burden on individuals facing debt-related challenges.

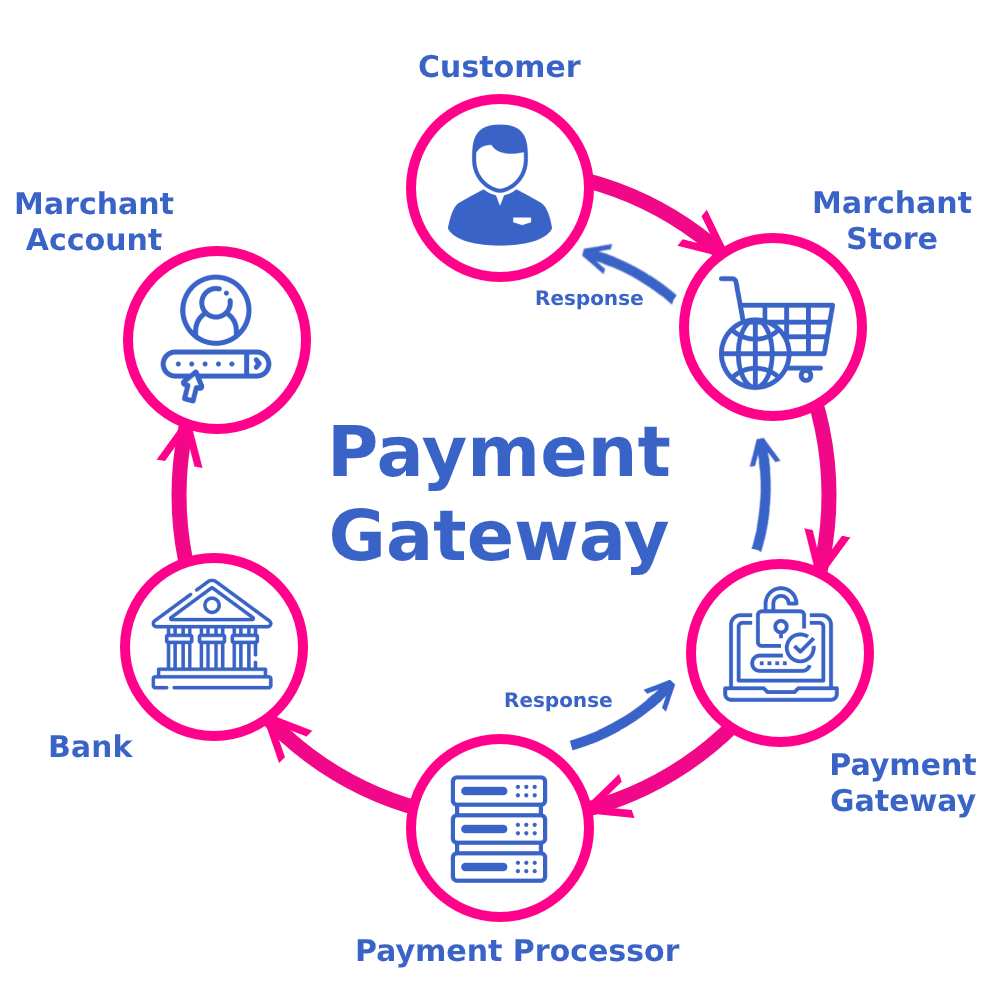

B. Significance of Payment Gateways in Debt Consolidation

Payment gateways play a crucial role in facilitating the seamless transfer of funds during online debt consolidation. Their secure and also efficient operation ensures that financial transactions occur smoothly, enhancing the overall debt consolidation[1] experience

. The Need for Online Debt Consolidation in India

A. Rising Debt Issues

India has witnessed a surge in personal debts necessitating effective solutions for debt management[2]. Online debt consolidation emerges as a viable option to address this growing concern.

B. Benefits of Consolidating Debt Online

The online approach offers convenience and accessibility allowing individuals to manage their debts from the comfort of their homes. Additionally, it provides a structured plan for debt repayment, helping individuals regain financial control

. Understanding Payment Gateways

A. Definition and Functionality

Payment gateway on Online debt consolidation in india are digital platforms that facilitate the secure transfer of funds between debtors and creditors. Their encryption protocols ensure the confidentiality and integrity of financial transactions payment gateway on Online debt consolidation in india

B. Importance in Online Financial Transactions

In the context of online debt consolidation, payment gateways[3] act as the backbone, ensuring that funds move seamlessly between accounts. Their role goes beyond mere transaction facilitation, encompassing data security and also user trust payment gateway on Online debt consolidation in india

. Challenges in Online Debt Consolidation

A. Security Concerns

While payment gateways prioritize security, concerns about data breaches and online fraud remain. Addressing these challenges is essential to building trust in online debt consolidation platforms.

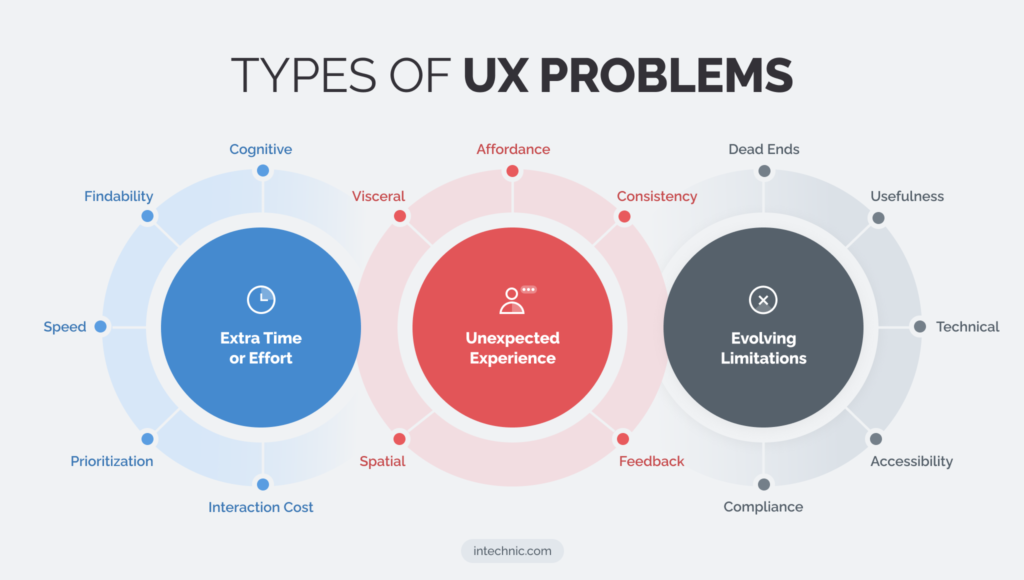

B. User Experience Issues

Ensuring a smooth and user-friendly interface is crucial for the success of online debt consolidation. Overcoming technical glitches and enhancing the overall user experience are key considerations.

. Choosing the Right Payment Gateway for Debt Consolidation

A. Factors to Consider

Selecting an appropriate payment gateway involves considering factors such as security features, transaction fees, and compatibility with the debt consolidation platform.

B. Popular Payment Gateways in India

Several payment gateways have gained prominence in the Indian market. Understanding their strengths and limitations helps individuals make informed choices during the debt consolidation process.

. Streamlining the Debt Consolidation Process

A. Integrating User-Friendly Interfaces

Ensuring that users can navigate the online debt consolidation platform effortlessly contributes to a positive experience. Streamlining the process encourages individuals to take proactive steps towards debt management.

B. Enhancing Security Measures

Continuous improvements in security protocols and encryption technologies are imperative to address evolving cybersecurity threats. Collaborations with cybersecurity experts can further enhance the robustness of online debt consolidation platforms.

. Case Studies: Successful Online Debt Consolidation through Payment Gateways

A. Real-life Examples

Examining real-life case studies provides insights into the positive outcomes of online debt consolidation facilitated by efficient payment gateways.

B. Positive Outcomes

Successful debt consolidation stories underscore the efficacy of online platforms[4] and the role of payment gateways in achieving financial stability.

Future Trends in Payment Gateways for Debt Consolidation

A. Technological Advancements

Anticipated technological developments in payment gateways are expected to enhance the efficiency and security of online debt consolidation processes[5].

B. Anticipated Developments

Keeping abreast of future trends ensures that individuals can leverage the latest technologies for more effective debt management.

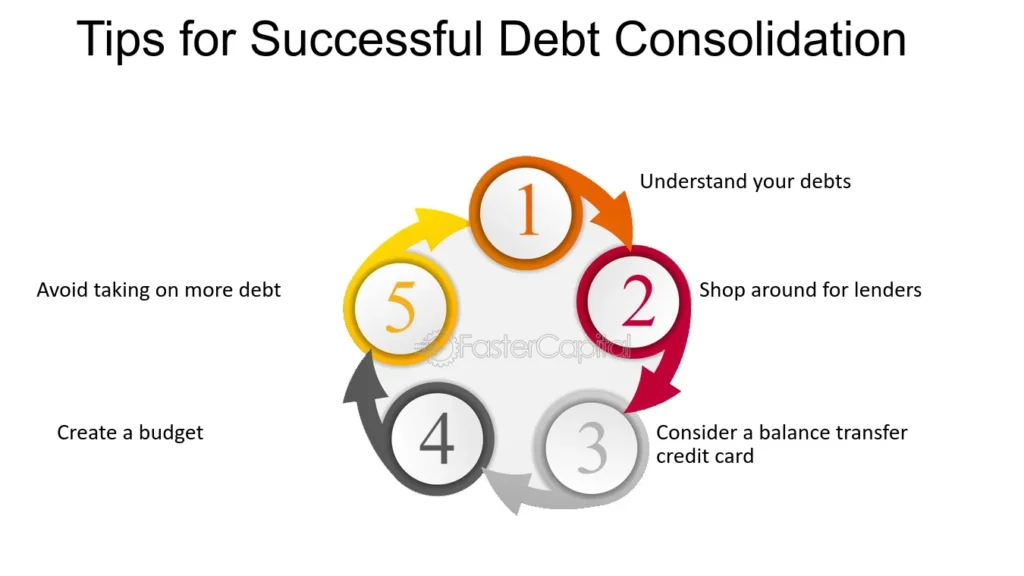

. Tips for a Smooth Debt Consolidation Experience

A. Maintaining Financial Discipline

Consolidating debt is not a one-time solution; it requires individuals to maintain financial discipline and also adhere to the repayment plan.

B. Seeking Professional Advice

Consulting financial experts can provide personalized guidance, helping individuals make informed decisions about debt consolidation and payment gateway selection. XI. The Role of Financial Institutions in Online Debt Consolidation (Continued)

B. Ensuring Regulatory Compliance

Financial institutions play a pivotal role in the online debt consolidation landscape by ensuring adherence to regulatory standards. Collaborating with reputable financial entities adds an extra layer of credibility and regulatory compliance to the entire process.

. Conclusion

A. Recap of Key Points

In summary, the combination of online debt and secure payment gateways offers a practical solution to the challenges posed by rising personal debts in India. The strategic integration of technology and financial expertise paves the way for a more accessible approach to debt management.

B. Emphasizing the Future of Online Debt Consolidation

As technology continues to evolve, the future of online debt looks promising. Innovations in payment gateways and increased collaboration between financial institutions and online platforms are intended to further refine and enhance the user experience.

FAQs

1. How secure are online debt consolidation transactions?

Online debt transactions are secured through advanced encryption protocols, measures of payment, and the integrity of financial information.

2. Can anyone consolidate debt online, regardless of the amount?

Yes, online debt consolidation is a flexible solution that can be adapted to various financial situations. However, it depends on individual circumstances, and professional advice is

3. Are payment gateways the same for all debt consolidation platforms?

No, different debt consolidation platforms may integrate different payment gateways based on their specific features and requirements. It’s crucial to choose a platform that aligns with individual needs.

4. How long does the online debt consolidation process typically take?

The online debt process can vary depending on factors such as the amount of debt, the chosen platform, and individual financial circumstances. Generally, the process aims to be efficient to provide timely relief.

5. What steps can individuals take to prevent online fraud during debt consolidation?

To prevent online fraud while in debt, individuals should ensure the security of their personal information, use secure networks, and regularly monitor their financial accounts for any suspicious activity.