AUTHOR : BABLI

DATE : 23/12/23

Introduction

In today’s dynamic financial landscape, managing outstanding debt has become a critical aspect of personal and business finance. As individuals and organizations grapple with the complexities of debt reward the role of payment gateways has emerged as a game-changer. In this article, we will delve into the intricate relationship between payment access and outstanding debt in India, exploring the current scenario, advantages, challenges, and the future direction.

The Current Scenario of Outstanding Debt in India

Statistics and Trends

Recent statistics reveal a surge in outstanding debt across various sectors in India. Understanding these trends is crucial for discharge effective debt management strategies. Borrowers face a myriad of challenges, from negotiate complex compensation structures to dealing with the psychological burden of debt. Payment entrance offer solutions that address these challenges head-on.

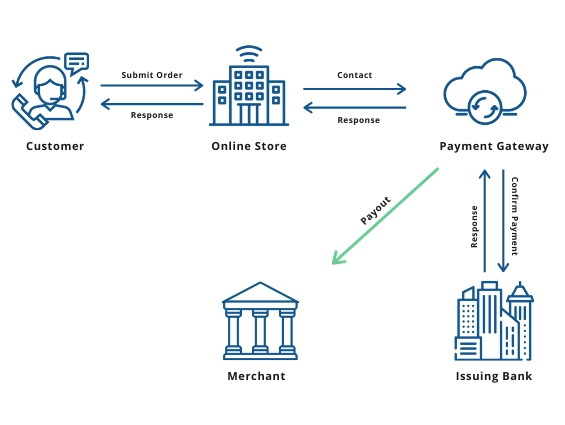

Role of Payment Gateways in Debt Management

Streamlining Debt Repayments

Payment gateways[1] simplify the debt repayment process, providing borrowers with user-friendly interfaces that enable them to make timely payments with ease.

Enhancing Security Measures

Popular Payment Gateways Used for Debt Repayments

Security is paramount in financial transactions. Payment gateways employ cutting-edge encryption and authentication protocols, ensuring the safety of sensitive financial information.

An in-depth analysis of popular payment gateways reveals the features and capabilities that make them suitable for managing outstanding debt[2].

Integrating Payment Gateways in Debt Collection Processes

Ensuring Seamless Integration

From customizable payment plans to integration with financial management tools, the features of payment gateways are diverse and tailored to the needs of debtors and creditors.

Effective integration of payment gateways into debt collection processes[3] is essential for a seamless experience. This involves collaboration between financial institutions, debt collection agencies, and also technology providers.

Customization for Debt Collection Agencies

Debt collection agencies can benefit from customized solutions provided by payment gateways enhancing their ability to recover outstanding External debt[4] efficiently.

Addressing Concerns and Misconceptions

Accessibility for All Demographics

One common concern is the security of online transactions. Payment gateways employ robust security measures to safeguard against unauthorized access and data breaches. Ensuring that Digital Payment Methods[5] are accessible to individuals across all demographics is crucial for widespread adoption. This involves addressing issues related to digital literacy and connectivity.

Future Trends and Innovations

Evolving Technologies in Payment Gateways

The future of payment gateways involves the integration of emerging technologies such as blockchain and artificial intelligence, further enhancing the efficiency and security of transactions.

As payment gateways continue to evolve, predictions indicate a shift towards a more digitized and also automated debt management landscape. Examining case studies of organizations that have successfully implemented payment gateways provides insights into the tangible benefits of this approach.

Positive Impacts on Debt Recovery

Tips for Choosing the Right Payment Gateway for Debt Repayment

Improved efficiency, reduced operational costs, and enhanced customer satisfaction are among the positive impacts observed in successful debt recovery stories.

Choosing the right payment gateway involves considering factors such as transaction fees, security features, and compatibility with existing financial systems.

Comparative Analysis of Available Options

The Regulatory Landscape

A comparative analysis of available payment gateways helps debtors and also creditors make informed decisions based on their specific needs.

Compliance Requirements

Government Initiatives in Promoting Digital Payments

Understanding and complying with regulatory requirements is essential for the seamless operation of payment gateways in the debt management ecosystem.

Government initiatives play a crucial role in promoting the adoption of digital payment gateways for debt repayment, contributing to financial inclusion.

Challenges and Solutions in Implementing Payment Gateways for Debt

Overcoming Resistance to Change

Resistance to change is a common challenge. Education and awareness campaigns can help overcome this resistance, highlighting the benefits of digital debt management. Technical challenges, such as system integration issues, can be addressed through collaboration between technology providers and financial institutions.

Conclusion

In conclusion, the integration of payment gateways in managing outstanding debt in India offers a range of benefits, from enhanced security to streamlined processes. Encouraging the widespread adoption of payment gateways requires collaborative efforts from financial institutions, regulatory bodies, and technology providers. This shift towards digitization is not only inevitable but also essential for the future of efficient debt management.

FAQs

- Q: Are payment gateways secure for managing debt transactions?

- A: Yes, payment gateways employ advanced security measures to ensure the confidentiality and integrity of financial transactions.

- Q: How can payment gateways benefit debt collection agencies?

- A: Payment gateways offer customized solutions for debt collection agencies, enhancing their efficiency in recovering outstanding debts.

- Q: What factors should individuals consider when choosing a payment gateway for debt repayment?

- A: Individuals should consider transaction fees, security features, and compatibility with their existing financial systems when choosing a payment gateway.

- Q: How do payment gateways contribute to financial inclusion in India?

- A: Payment gateways contribute to financial inclusion by providing accessible and user-friendly solutions for individuals across all demographics.

- Q: What is the future outlook for payment gateways in debt management?

- A: The future involves the integration of emerging technologies, making payment gateways more efficient and automated in debt management processes.