AUTHOR : ZOYA SHAH

DATE : 25-12-2023

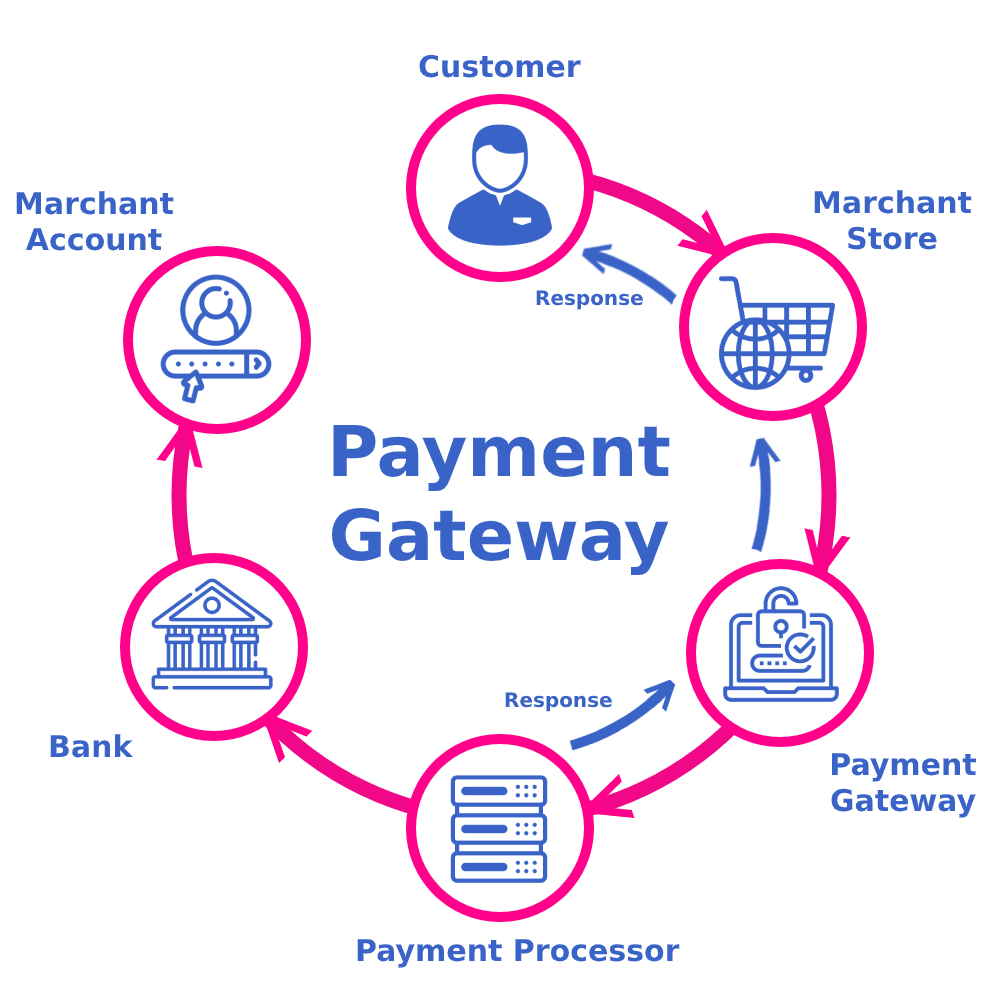

In the dynamic financial landscape of India, personal loans have become a popular tool for individuals seeking to consolidate their debts. This article explores the crucial role of payment gateways[1] in the context of personal loan debt consolidation. As financial technologies evolve, the integration of secure and efficient payment gateways has become paramount in check a seamless and successful debt consolidation[2] process.

Introduction

Personal loans have emerged as a lifeline for many in India, especially those dealing with multiple debts. The need for effective debt consolidation solutions has led to a growing demand for personal loans. However, the success of debt consolidation heavily relies on the efficiency of payment portal.

Understanding Debt Consolidation

Debt consolidation involves combining multiple high-interest debts into a single, more manageable payment[3] This strategy not only simplifies the repayment process but also often results in lower interest rates. For individuals navigating financial challenges, debt consolidation through personal loans offers a viable solution.

Personal Loans in India

The financial landscape in India has witnessed a surge in the popularity of personal loans. With quick approvals and minimal documentation, personal loans have become a preferred choice for those seeking financial flexibility. The ease of accessibility has made personal loans an attractive option for debt consolidation. payment gateway on Personal loan for debt consolidation in india

Significance of Payment Gateways

Payment portal play a pivotal role in the financial sector, check secure and smooth transactions. In the context of personal loan debt merging, a reliable payment gateway becomes the bridge between borrowers and lenders. Its role extends beyond mere transaction processing, encompassing the entire debt reward journey.

Features of an Ideal Payment Gateway for Personal Loans

When choosing a payment gateway for personal loan debt consolidation, certain features are non-negotiable. Security measures, such as encryption and fraud prevention, are paramount. A user-friendly interface and seamless integration[4] capabilities contribute to a positive borrower experience.

Challenges in the Current Payment Gateway System

Despite the advancements in payment gateway technology, challenges persist. Security concerns, including the risk of data breaches, and technical glitches can hinder the effectiveness of the debt consolidation process. Addressing these challenges is crucial for fostering trust among borrowers. payment gateway on Personal loan[5] for debt consolidation in india.

Innovations in Payment Gateways for Debt Consolidation

In response to the challenges, the financial industry has witnessed innovative solutions. Blockchain technology is gaining fame for its ability to enhance security and transparency in transactions. Biometric authentication adds an extra layer of protection, check that only authorized individuals can access sensitive financial information.

Choosing the Right Payment Gateway for Personal Loan Consolidation

The plethora of payment gateway options can be overwhelming for borrowers. Factors such as security, ease of use, and integration capabilities should guide the decision-making process. A comparison of popular payment portal in the context of personal loan debt consolidation can assist borrowers in making informed choices.

User Experience and Accessibility

The user experience provided by a payment gateway significantly impacts borrowers. A mobile-friendly interface ensures accessibility for individuals on the go. As personal loans aim to provide financial relief, the ease of navigating through payment processes adds to the overall appeal of debt consolidation.

Impact of Payment Gateways on Debt Repayment

Timely payments facilitated by efficient payment portal contribute to improved credit scores. Reduced financial stress, thanks to streamlined debt repayment processes, enables borrowers to regain control of their financial well-being. The impact of payment gateways extends beyond transactions, influencing the broader financial health of individuals.

Future Trends in Payment Gateways for Debt Consolidation

As technology continues to advance, the future of payment portal in personal loan debt consolidation looks promising. Integration with artificial intelligence is expected to enhance the accuracy of financial transactions and security measures. Innovations in the payment gateway landscape will likely shape the future of debt consolidation.

Case Studies

Examining successful debt consolidation stories can provide valuable insights into the effectiveness of payment portal. Real-world examples showcase how the right choice of a payment gateway can make a substantial difference in the debt repayment journey. These case studies offer practical guidance for individuals considering personal loans for debt consolidation.

Expert Opinions on Payment Gateways in Personal Loans

Financial experts play a crucial role in guiding individuals through the complex landscape of personal loans and debt consolidation. Their perspectives on the selection of payment portal can offer valuable advice for borrowers. Recommendations from experts contribute to informed decision-making.

Tips for Using Payment Gateways Responsibly

While payment portal simplify the debt consolidation process, responsible usage is essential. Setting up automatic payments ensures timely repayments, preventing any negative impact on credit scores. Regularly monitoring transactions adds an extra layer of security, allowing borrowers to detect and address any anomalies promptly.

Conclusion

In conclusion, the role of payment gateways in personal loan debt consolidation cannot be overstated. These technological tools serve as the backbone of seamless and secure financial transactions, influencing the success of debt repayment journeys. As individuals in India navigate the complexities of debt consolidation, choosing the right payment gateway becomes a crucial decision for a brighter financial future.

Frequently Asked Questions

- Q: Are personal loans the only option for debt consolidation in India?

- A: While personal loans are popular, other options like balance transfer and debt management plans also exist.

- Q: How do payment portal contribute to credit score improvement?

- A: Timely payments facilitated by payment portal positively impact credit scores, reflecting responsible financial behavior.

- Q: Can I use any payment gateway for personal loan repayments?

- A: It’s advisable to use the payment gateway recommended or integrated by the