AUTHOR : ZOYA SHAH

DATE: 23-12-2023

In the ever-evolving landscape of digital transactions[1], payment gateways play a pivotal role in facilitating secure and seamless financial exchanges.[1] However, the increasing complexity of online transactions [2]has led to a surge in challenges, prompting the emergence of specialized recovery services, particularly in a tech-savvy country like India.

Payment Gateway Basics

Payment gateways act as intermediaries between merchants and financial institutions,[3] ensuring the secure transfer of funds. In essence, they authorize and process transactions, safeguarding sensitive information during the online payment process. The reliability of a payment gateway [4] is crucial for businesses and consumers alike.

Challenges in Payment Transactions

The digital realm is not without its pitfalls. Security concerns,[5] fraud, and technical glitches are common issues faced by both businesses and consumers in the payment ecosystem. These challenges necessitate a robust system for recovery, ensuring that losses are minimized, and trust is maintained.

Emergence of Recovery Services

The growing complexity of payment transactions has given rise to the need for specialized recovery services. These services are designed to address and rectify issues arising from failed transactions, unauthorized access, or other payment-related problems. In India, the demand for such services has seen a significant uptick.

Payment Gateway Recovery Services in India

India, with its burgeoning digital economy, has witnessed a surge in the demand for payment gateway recovery services. Various companies have entered the market, offering tailored solutions to businesses and individuals grappling with payment-related challenges.

How Recovery Services Work

Recovery services follow a meticulous process to rectify payment issues. From identifying the root cause of a failed transaction to employing advanced technologies for resolution, these services play a crucial role in salvaging potentially detrimental situations.

Benefits of Using Recovery Services

The benefits of utilizing recovery services extend beyond mere issue resolution. Enhanced security measures, minimized financial losses, and improved customer trust are among the advantages that businesses and consumers can enjoy by opting for these specialized services.

Choosing the Right Recovery Service Provider

Selecting the right recovery service provider is a critical decision for businesses. Factors such as expertise, success rates, and compliance with regulations should be carefully considered. Case studies showcasing successful recoveries can provide valuable insights.

Regulatory Framework in India

Given the sensitive nature of financial transactions, the regulatory framework in India plays a vital role in governing payment gateways and recovery services. Understanding and complying with these regulations is imperative for service providers in the industry.

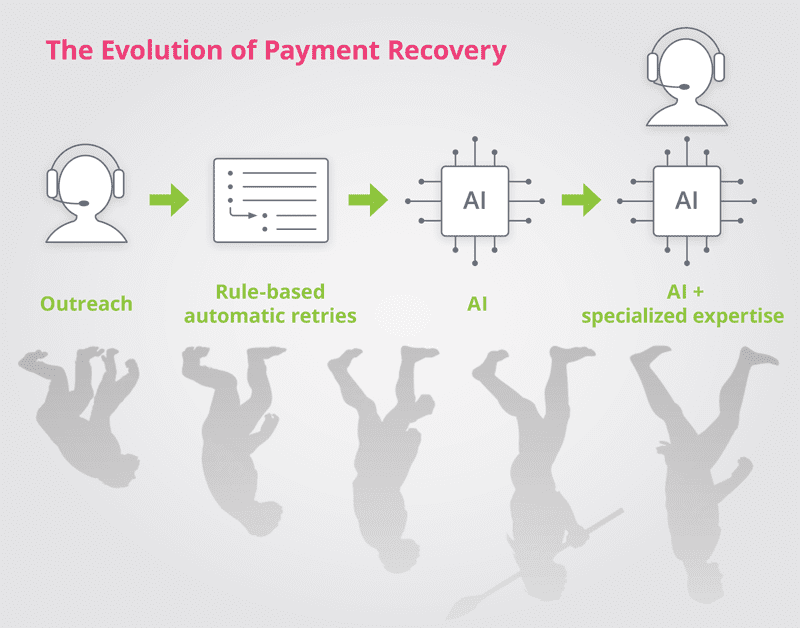

Industry Trends and Innovations

The payment gateway recovery services industry is not immune to technological advancements. Current trends, such as the use of artificial intelligence and blockchain, are shaping the landscape and influencing the strategies employed by service providers.

Success Stories

Highlighting success stories is instrumental in demonstrating the efficacy of payment gateway recovery services. Real-life cases where businesses and consumers have benefited from these services serve as testimonials to their importance in the digital age.

Challenges Faced by Recovery Service Providers

While recovery services offer solutions to payment-related challenges, providers face their own set of obstacles. Legal challenges, technological hurdles, and the ever-evolving nature of online transactions pose continuous challenges that require adept navigation.

Future of Payment Gateway Recovery Services in India

As technology continues to advance, the future of payment gateway recovery services in India holds exciting possibilities. Anticipated developments [2]include more sophisticated recovery algorithms, increased collaboration with financial institutions,[3] and enhanced security measures.

Consumer Awareness and Education

Enhancing consumer awareness is crucial for the effective utilization of recovery services. Educating consumers about the importance of secure online transactions and the availability of recovery services can contribute to a safer digital ecosystem.

Conclusion

In conclusion, the intertwining of payment gateways [4]and recovery services is integral to the smooth functioning of the digital economy. As India witnesses a surge in online transactions, the role of recovery services becomes increasingly crucial. Choosing the right recovery service provider,[5] understanding regulatory frameworks, and staying abreast of industry trends are paramount for businesses and consumers alike.

FAQs

- Q: Are recovery services only for businesses, or can individuals benefit from them too? A: Recovery services cater to both businesses and individuals, providing tailored solutions to address payment-related issues.

- Q: How long does the process of payment recovery typically take? A: The duration of payment recovery varies depending on the nature of the issue, but reputable service providers aim for swift resolutions.

- Q: Are recovery services effective in preventing future payment issues? A: While recovery services primarily focus on resolving existing issues, their expertise often includes recommendations for preventing future problems.

- Q: Is it mandatory for businesses to comply with specific regulations when using recovery services? A: Yes, businesses should ensure compliance with relevant regulations governing payment gateways and recovery services to avoid legal implications.

- Q: Can recovery services guarantee 100% success in resolving payment issues? A: While recovery services strive for high success rates, the complexity of some issues may impact the guarantee of a 100% resolution.