AUTHOR: NORA

DATE: 28-12-23

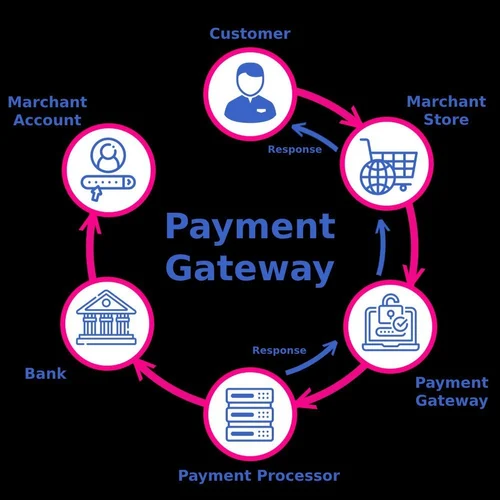

In the fast-paced digital landscape[1] of India, where online transactions[1] have become the norm, the role of payment gateways is more crucial than ever. From the early challenges of establishing secure online payments to the current plethora[2] of options available[5] the evolution of payment gateways [3]in India has been remarkable.

Evolution of Payment Gateways in India

Early Challenges and Solutions

In the nascent stages, online transactions faced skepticism due to security concerns[4]. Early payment gateways tackled these issues by implementing robust[2] encryption and authentication measures.[3]

Adoption of Digital Payments

As the Indian population embraced digitalization, the demand for efficient payment[4] gateways [4] surged. The evolution was marked by the widespread adoption of digital payment methods, leading to a significant shift in consumer behavior.[5]

Key Features of Payment Gateways

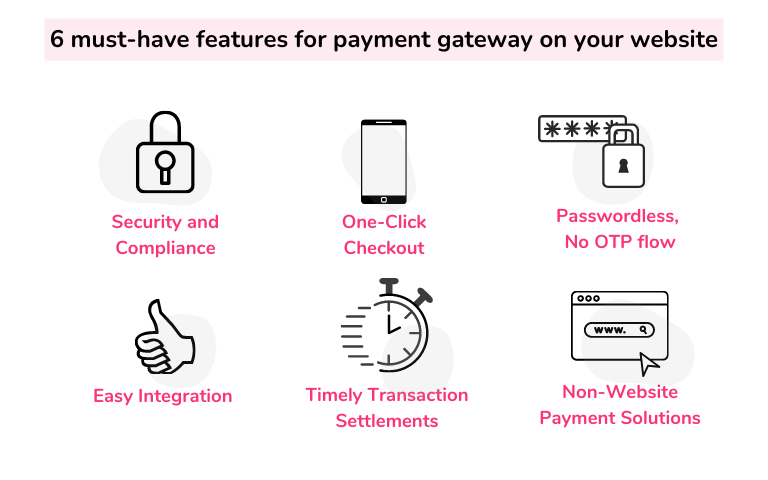

Security Measures

One of the paramount features of payment gateways is the implementation of advanced security protocols. Users can now transact online with confidence, knowing their sensitive information is safeguarded.

User-Friendly Interfaces

Payment gateways have evolved to provide seamless and user-friendly interfaces. The emphasis on simplicity ensures a smooth transaction process for both businesses and consumers.

Integration Options

Businesses can integrate payment gateways into various platforms, including websites and mobile applications. This flexibility caters to the diverse needs of businesses across industries.

Popular Payment Gateways in India

Overview of Leading Platforms

Several payment gateways dominate the Indian market, each offering distinct advantages. Platforms like Paytm, Razorpay, and Instamojo have gained prominence for their reliability and efficiency.

Unique Features of Each Gateway

Paytm stands out for its widespread acceptance, while Razorpay excels at developer-friendly solutions. Instamojo, on the other hand, is known for its simplicity and cost-effectiveness.

Benefits of Using Payment Gateways

Convenience for Businesses

Businesses benefit from the convenience of instant transactions, reducing their reliance on traditional banking processes. This efficiency contributes to the growth of e-commerce and other online services.

Enhanced Customer Experience

Payment gateways enhance the overall customer experience by providing quick and secure payment options. This contributes to customer satisfaction and loyalty.

Fraud Prevention

Advanced fraud prevention measures implemented by payment gateways protect both businesses and consumers from unauthorized transactions and cyber threats.

Challenges and Solutions

Issues Faced by Users and Businesses

Common challenges include technical glitches, payment failures, and security concerns. However, innovative solutions continually address these issues to improve the overall user experience.

Innovative Solutions in the Industry

Payment gateways actively invest in innovative technologies, such as biometric authentication and artificial intelligence, to stay ahead of evolving cyber threats and ensure a seamless transaction process.

How to Choose the Right Payment Gateway

Factors to Consider

Businesses must consider factors like transaction fees, security features, and integration options when selecting a payment gateway. Case studies provide insights into successful implementations.

Case Studies of Successful Implementations

Examining real-world examples of businesses that have successfully integrated payment gateways offers valuable lessons for others seeking the right solution for their needs.

Trends in Online Payment Products

Emerging Technologies

The industry is witnessing the emergence of cutting-edge technologies like blockchain and contactless payments, shaping the future of online transactions in India.

Future Outlook for Payment Gateways

As technology continues to advance, payment gateways are expected to evolve further, catering to the changing needs and preferences of businesses and consumers alike.

Impact on E-commerce in India

Role in the Growth of Online Businesses

Payment gateways play a pivotal role in the exponential growth of e-commerce in India. The seamless transaction experience they offer contributes to the success of online businesses.

Consumer Trust and Preferences

The trust built through secure and efficient transactions influences consumer preferences, leading to increased reliance on online payment gateways.

Regulatory Framework

Government Regulations and Compliance

Stringent government regulations ensure the security and legality of online transactions. Compliance with these regulations is essential for the operation of payment gateways in India.

Impact on the Payment Gateway Industry

Government regulations shape the landscape of the payment gateway industry, influencing its growth trajectory and ensuring consumer protection.

Case Studies

Success Stories of Businesses Using Payment Gateways

Exploring case studies of businesses that have flourished with the integration of payment gateways provides valuable insights into best practices and potential challenges.

Lessons Learned and Best Practices

Businesses can learn from the experiences of others to streamline their processes and make informed decisions when incorporating payment gateways.

The Future of Payment Gateways in India

Anticipated Developments

Anticipated developments include the integration of emerging technologies, increased customization options, and a continued focus on user experience.

Potential Challenges and Opportunities

While challenges such as cybersecurity threats may arise, they present opportunities for the industry to innovate and enhance security measures.

Conclusion

In conclusion, payment gateways have become indispensable in the realm of online transactions in India. From addressing early challenges to becoming facilitators of seamless digital payments, their evolution is a testament to the dynamic nature of the digital landscape.

FAQs

What is a payment gateway?

A payment gateway is a secure online service that facilitates the authorization of payment transactions between businesses and customers. It ensures the secure transfer of sensitive information during online purchases.

How secure are online transactions?

Online transactions through payment gateways are highly secure due to advanced encryption and authentication measures. These technologies protect user information and minimize the risk of unauthorized access.

Can businesses use multiple payment gateways?

Yes, businesses have the flexibility to integrate multiple payment gateways based on their requirements. This approach provides redundancy and ensures a seamless payment experience for customers.

What challenges do payment gateways face?

Payment gateways may encounter challenges such as technical glitches, payment failures, and cybersecurity threats. However, continuous innovation and proactive measures help address these challenges.

Are there any transaction limits?

Transaction limits vary among payment gateways and may depend on factors such as user verification and business type. It’s essential for businesses and users to be aware of these limits.