AUTHOR : JAYOKI

DATE : 20/12/2023

Introduction

In the ever-evolving landscape of global trade, payment gateways have emerged as components, revolutionizing how financial transactions are conducted. This article delves into the dynamic intersection of payment gateway technologies and trade negotiations[1], with a particular focus on India.

The Evolution of Payment Gateways

In the not-so-distant past, traditional payment systems dominated the financial landscape. Negotiations In India However, the advent of digital payment gateways has transformed the way businesses operate and engage in international Payment Gateway trade.

Significance of Payment Gateways in Trade Negotiations

Payment gateways Trade Negotiations In India play a pivotal role in facilitating seamless cross-border transactions, addressing the complex financial requirements of trade negotiations. Their ability to ensure swift and secure international payments contributes significantly to the efficiency of global commerce.

Challenges Faced in Indian Trade Negotiations

Despite the advantages, trade negotiations in India encounter challenges related to security concerns in digital transactions[2] The exact amount of the transaction is debited from Jane’s checking account and regulatory complexities surrounding payment .

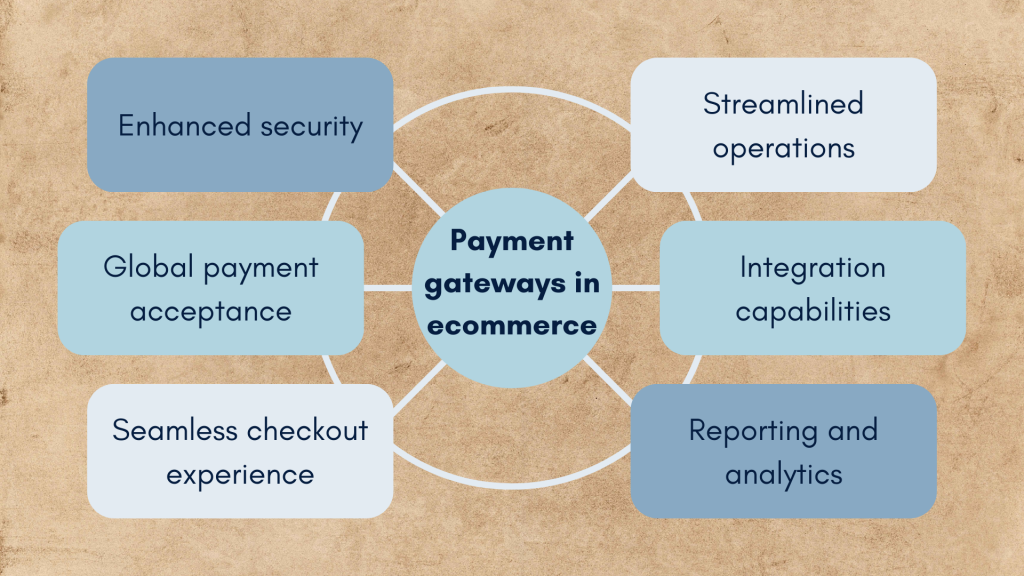

Role of Payment Gateways in E-commerce Growth

The exponential growth of e-commerce in India is closely tied to the proliferation of payment gateway E-commerce, providing secure and convenient solutions for online transactions.

Integration of Payment Gateways in Various Sectors

Payment gateways are not limited to the realm of e-commerce. They have various sectors, including financial services, retail, and hospitality, streamlining financial interactions in diverse industries A payment gateway is a tool businesses use to confirm their customer’s credit and debit card details, making them vital for offline or online.

Prominent Payment Gateway Providers in India

Key players in the payment gateway industry in India offer a range of services, each with unique features and offerings that cater to the specific needs of businesses and consumers payment gateway or a provider that offers cross-border payments. But with so many different options to choose from,.

Government Initiatives and Policies

The Indian government has implemented regulatory measures to promote digital transactions and has introduced incentives to support the growth of payment gateway Service[3] providers.

Technological Advancements in Payment Gateways

Advancements in technology, particularly the integration of blockchain, have the security features of payment gateways, addressing concerns related to fraud and data breaches Payment Systems.

Impact of Payment Gateways on Small Businesses

Payment gateways[4] have democratized financial transactions for small businesses, providing accessibility and cost-effective solutions that contribute to their growth and competitiveness.

Consumer Trust and Confidence in Payment Gateways

Building consumer trust is crucial for the international payment gateways[5]. . International payment systems offer a variety of features aimed at specific types of businesses and use case Security measures and user-friendly interfaces play a vital role in fostering confidence among users.

Future Trends in Payment Gateway Trade Negotiations

The future holds exciting possibilities for payment , with the integration of artificial intelligence and potential advancements in blockchain technology shaping the next phase of their evolution. international payment gateways focus on card payments but collecting funds via international bank payments has advantages and is becoming more popular.

Global Comparison of Payment Gateway Practices

A comparative analysis of payment gateway practices worldwide highlights diverse approaches, offering valuable insights and lessons for India to enhance its trade negotiation processes If you need to collect international payments in your business, you’ll need.

Successful Implementation of Payment Gateways in Trade

Examining case studies of successful implementation provides practical examples that showcase the positive impact of payment gateways on trade negotiations.

Conclusion

In conclusion, payment gateways have become in the realm of trade negotiations in India. Their role in facilitating secure, swift, and efficient financial transactions is paramount. As technology continues to evolve, so will the landscape of payment gateways, presenting new opportunities and challenges.

FAQs

- How secure are payment gateways for international transactions?

- Payment gateways employ robust security measures, including encryption and authentication protocols, ensuring the safety of international transactions.

- What government incentives exist to promote the use of payment gateways in India?

- The Indian government offers various incentives, such as tax benefits and subsidies, to encourage businesses and consumers to adopt digital payment gateways.

- How do payment gateways contribute to the growth of small businesses?

- Payment gateways provide small businesses with affordable and accessible financial solutions, enabling them to compete in the digital marketplace.

- Can payment gateways address the regulatory challenges in Indian trade negotiations?

- While challenges exist, payment gateways play a role in shaping regulatory discussions and adapting to ensure compliance with evolving standards.

- What role does artificial intelligence play in the future of payment gateways?

- Artificial intelligence is expected to enhance the capabilities of payment gateways, offering advanced fraud detection and personalized user experiences.