AUTHOR : SELENA GIL

DATE : 20/12/2023

Introduction

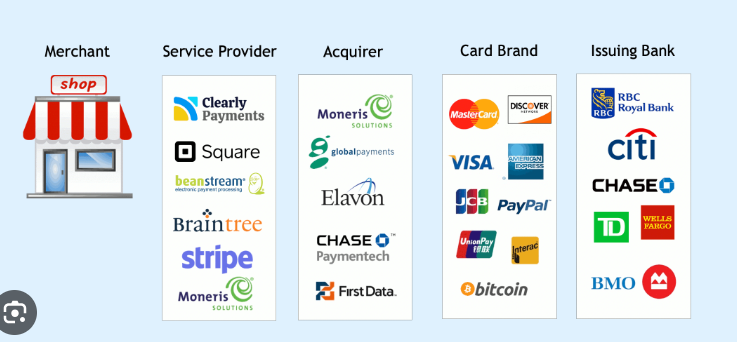

In a digitally-driven economy, payment gateways serve as pivotal conduits facilitating secure online transactions. These gateways essentially act as intermediaries, authorizing payments between merchants and customers, ensuring swift and secure financial exchanges..

Evolution of Payment Gateway Vendor Relationships

The evolution of payment gateway vendor relationships in India has been a transformative journey. Initially, the landscape was limited, but with technological advancements and market demands, relationships in India between vendors expanded, diversifying their roles and offerings.

Key Players in the Indian Payment Gateway Industry

The Indian payment gateway Vendor industry boasts a myriad of players, each contributing distinctively to the ecosystem. Companies like Paytm, Razor pay, and others have revolutionized digital transactions, offering innovative solutions and customer-centric approaches.

Challenges Faced by Payment Gateway Vendors

Despite the rapid growth, payment gateway Vendor Relationships encounter multifaceted challenges. Regulatory complexities, security concerns, and the competitive market pose significant hurdles in sustaining healthy vendor relationships.

Strategies for Successful Vendor Relationships

Successful vendor relationships hinge on collaborative strategies and technological innovations. Embracing a forward-thinking approach and integrating cutting-edge technology are pivotal for longevity and growth Merchant Payment Gateway[1].

Role of Trust and Security in Vendor Relationships

Trust and security form the bedrock of successful vendor relationships. Vendor risk management[2] prioritize stringent security measures and build trust through reliable services, fostering enduring relationships with stakeholders.

Government Regulations and Impact on Vendor Relationships

Government regulations significantly impact vendor relationships. Compliance requirements and regulatory changes often shape the strategies and dynamics within the payment industry ecosystem[3] . All suppliers and third parties should be evaluated for risks associated with website access and permissions, specifically managing cookies,

Payment Gateway Vendor Partnerships

Collaborations among payment gateway vendors are instrumental in fostering innovation and addressing challenges collectively. However, navigating partnerships comes with its own set of complexities and advantages payment gateway provider[4].

Customer-Centric Approaches in Vendor Relationships

All suppliers and third parties should be evaluated for risks associated with website access and permissions, specifically managing cookies, online payment APIs[4] Enhancing user experience and ensuring customer satisfaction are paramount. Vendors invest in customer-centric approaches, providing seamless transaction experiences and robust customer support.

Data Privacy Concerns in Vendor Relationships

Amid digital transactions, All suppliers and third parties should be evaluated for risks associated with website access and permissions, specifically managing cookies, safeguarding sensitive data is imperative. Payment gateway vendors prioritize data protection measures to ensure the privacy and security of customer information.

Future Trends and Innovations

The future of payment gateway vendor relationships in India holds promise. Emerging technologies like blockchain and AI are set to revolutionize the landscape, shaping new trends and possibilities.

Global Comparison of Vendor Relationships

Contrasting approaches to vendor relationships globally offer valuable insights. Understanding global dynamics assists in adopting best practices and fostering growth within the Indian market.

Case Studies of Successful Vendor Relationships

Examining successful collaborations in the Indian market provides practical insights into building robust and enduring vendor relationships, showcasing effective strategies and outcomes. Extensions created by cybercriminals and installed on a third-party site may, for example, expose your organization’s data. Decentralized systems and service providers may represent cloud security risks.

The Importance of Adaptability in Vendor Relationships

In a constantly evolving market, adaptability is key. Extensions created by cybercriminals and installed on a third-party site may, for example, expose your organization’s data. Decentralized systems and service providers may represent cloud security risks. Payment gateway vendors must remain agile and responsive to changes, ensuring they meet evolving consumer demands effectively.

Are payment gateways in India safe?

Ensuring the safety of transactions is a top priority for payment gateways in India. These gateways employ robust encryption methods and security protocols to safeguard sensitive information during transactions. Additionally, they often comply with industry standards and regulations to maintain a secure environment for financial exchanges.

How do vendor relationships impact digital transactions?

Vendor relationships significantly impact the efficiency and reliability of digital transactions. Collaborative efforts among vendors streamline processes, enhance technology, and improve the overall user experience. Strong relationships ensure seamless transactions, benefiting both merchants and customers.

What role do government regulations play in the industry

Government regulations play a crucial role in shaping the payment gateway industry. These regulations define standards for security, data privacy, and financial transparency. Compliance with these regulations is essential for vendors to operate legally and maintain trust among stakeholders.

Which companies are leading the payment gateway sector in India?

Several companies have established themselves as leaders in the Indian payment gateway sector. Entities like Paytm, Razorpay, and Instamojo have gained prominence due to their innovative solutions, widespread adoption, and customer centric approaches.

What are the upcoming trends in payment gateway vendor relationships?

The future of payment gateway vendor relationships is poised for innovation. Advancements in technologies such as blockchain, artificial intelligence, and biometrics are expected to revolutionize security measures, streamline transactions, and provide more personalized experiences for users.

Conclusion

Payment gateway vendor relationships in India are at the heart of a burgeoning digital economy. The industry’s future hinges on collaborative efforts, technological advancements, and a customer-centric approach, shaping a robust and secure financial landscape.

FAQs

- Are payment gateways in India safe?

- How do vendor relationships impact digital transactions?

- What role do government regulations play in the industry?

- Which companies are leading the payment gateway sector in India?

- What are the upcoming trends in payment gateway vendor relationships?