AUTHOR : ISTELLA ISSO

DATE : 27/02/24

Introduction

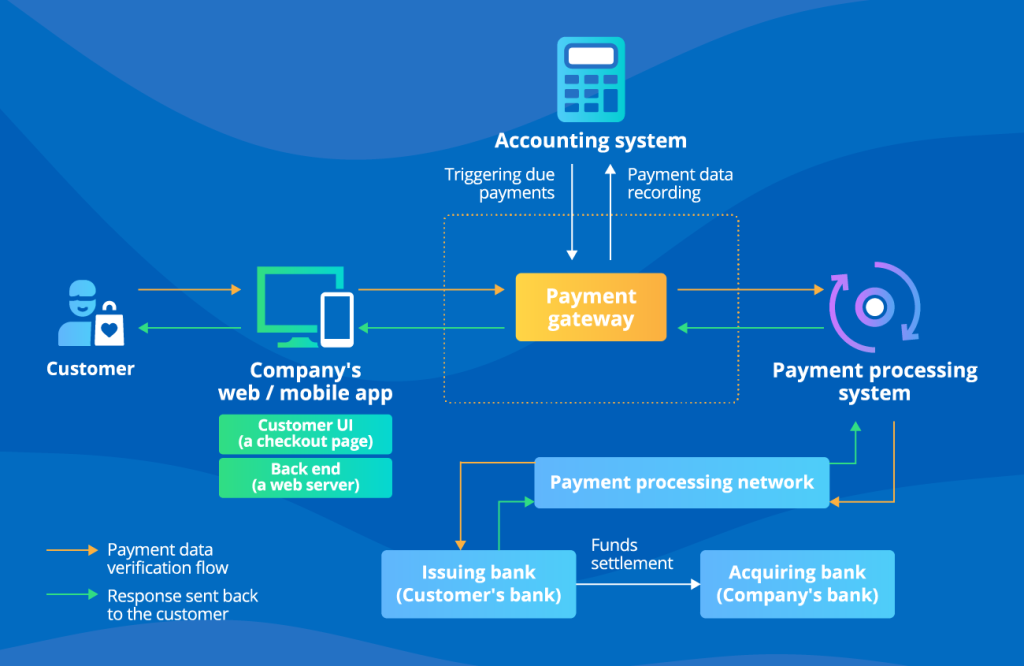

In the fast-paced world of online transactions, a seamless payment process is crucial. This is the juncture where payment gateways come into operation. They serve as the virtual bridge between a customer and a business, ensuring secure and swift transactions. As the e-commerce landscape in India continues to evolve, understanding the dynamics of web-based payment gateways becomes paramount for businesses aiming to thrive in the digital realm.

Evolution of Payment Gateways in India

In the early days of online transactions in India, businesses faced significant challenges in facilitating secure payments. However, with the rapid growth of the e-commerce sector, the need for efficient payment gateways became more evident. The evolution of these gateways has been marked by technological advancements and a heightened focus on user experience.

Key Features of Web-Based Payment Gateways

Web-based payment gateways boast a range of features designed to enhance security and user convenience. From robust encryption measures to seamless integration options, these gateways have become indispensable for online businesses. The user-friendly interfaces of these gateways contribute to a positive customer experience, fostering trust and also encouraging repeat transactions.

Top Web-Based Payment Gateways in India

In a market flooded with options, it’s essential to compare and contrast the top web-based payment gateways. Each gateway comes with its own unique set of features, catering to diverse business needs. Whether it’s about transaction fees, international accessibility, or customizable interfaces, businesses can choose a gateway that aligns with their specific requirements.

Advantages of Using Web-Based Payment Gateways

The advantages of adopting web-based payment gateways are manifold. From transactions to increasing customer trust through secure processes, these gateways provide businesses with a competitive edge. The accessibility and convenience they offer further contribute to a positive customer journey, making it easier for businesses to thrive in the online marketplace[1].

Challenges and Solutions in the Indian Context

While web-based payment gateways offer numerous benefits, there are challenges unique to the Indian context. Issues like currency, security concerns, and regulatory compliance need careful consideration. However, various solutions and best practices can help businesses[2] navigate these challenges successfully.

How to Choose the Right Payment Gateway for Your Business

Selecting the right payment gateway involves understanding your business needs, evaluating fees, and considering user reviews. A comprehensive approach to choosing a gateway ensures a smooth integration process and sets the stage for a reliable and efficient payment system[3].

Steps to Integrate a Payment Gateway

The technical aspect of integrating a payment gateway might seem daunting, but a step-by-step guide can simplify the process. From obtaining necessary credentials to implementing the gateway into your website, a well-thought-out integration plan ensures a seamless payment experience for your customers[4].

Success Stories: Businesses Thriving with Web-Based Payment Gateways

Real-life examples of businesses flourishing with web-based payment gateways showcase the tangible impact on revenue and customer satisfaction. These success stories serve as inspiration for other businesses looking to enhance their online transactions. Payment Gateway Web Based Software in India.

Future Trends in Payment Gateways

As technology continues to advance, so do payment gateways. Emerging trends such as contactless payments, blockchain integration, and artificial intelligence-driven security measures are shaping the future of online transactions. Staying informed about these trends is crucial for businesses aiming to stay ahead in the digital landscape[5].

Common Misconceptions About Payment Gateways

Addressing misconceptions and clarifying doubts is essential in fostering trust. From concerns about transaction security to misconceptions about fees and charges, dispelling myths ensures that businesses and customers alike can make informed decisions regarding payment gateways.

Customer Support in Web-Based Payment Gateways

Responsive customer support is a hallmark of reliable payment gateways. Businesses should prioritize gateways that offer excellent customer service, providing assistance when needed, and resolving issues promptly. Examples of exceptional customer support in payment gateways can guide businesses in making the right choices. Payment Gateway Web Based Software in India.

Security Measures in Payment Gateway Transactions

Ensuring the security of online transactions is paramount. Payment gateways employ robust security measures such as SSL encryption and two-factor authentication to safeguard customer data. Understanding these security measures instills confidence in both businesses and customers.

The Role of Payment Gateways in a Cashless Economy

The increasing emphasis on a cashless economy underscores the pivotal role of payment gateways. From driving digital transactions to aligning with government initiatives, payment gateways contribute significantly to the overall economic landscape.

Conclusion

In conclusion, web-based payment gateways have become indispensable for businesses navigating the complexities of online transactions. From enhancing security to streamlining processes, these gateways are the backbone of the digital economy. Businesses that embrace and integrate these technologies are better positioned for success in the ever-evolving landscape of online commerce.

FAQs

- Are web-based payment gateways secure?

- Yes, web-based payment gateways employ robust security measures such as SSL encryption and two-factor authentication to ensure secure transactions.

- How can I select the appropriate payment gateway for my business?

- What are the emerging trends in payment gateways?

- Do payment gateways work internationally?

- Many web-based payment gateways offer international accessibility, but it’s essential to check each gateway’s features and limitations.

- How do payment gateways contribute to a cashless economy?

- Payment gateways play a crucial role in driving digital transactions and aligning with government initiatives, contributing to the transition to a cashless economy.

- Emerging trends include contactless payments, blockchain integration, and artificial intelligence-driven security measures.