AUTHOR:AYAKA SHAIKH

DATE:20/12/2023

Introduction

Hey there! Ever wondered how businesses in India thrive amidst the bustling economy? One crucial element fueling this growth is payment processing. Dive in with me as we explore its significance, challenges, and the exciting future it holds!In a country where smartphones are ubiquitous, mobile payments are more than just a trend;

Understanding Payment Processing

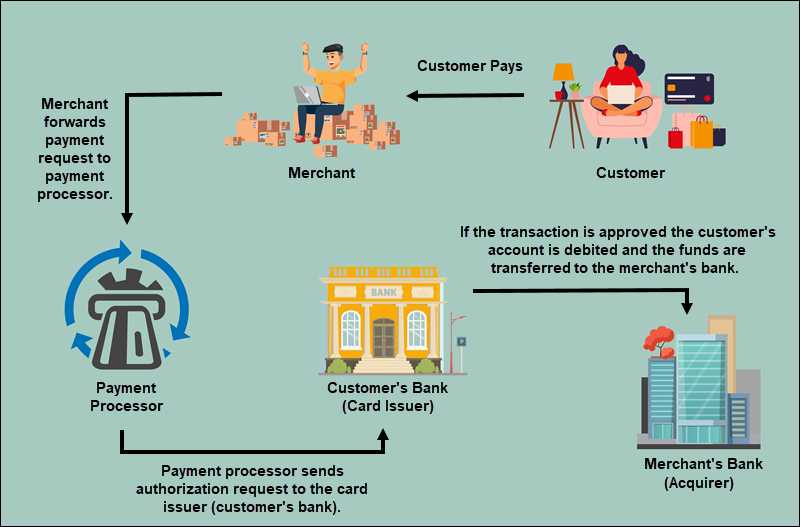

What is payment processing?

Simply put, payment processing involves the intricate system that allows businesses to receive payments from customers. Processing For Business From swiping a card to online transactions, it’s the heart of any sales process.

Importance in Business Development

Imagine embarking on a cross-country journey with a stone in your boot. Uncomfortable right? Similarly, efficient payment processing Business Development in India is the smooth pathway businesses need to grow, ensuring seamless transactions and happy customers.

Payment Processing in India

India, Payment for Business with its vast population and evolving market dynamics, has witnessed a transformative shift in payment methodologies. Development in India The digital revolution has paved the way for innovative solutions, making transactions more accessible than ever.

Key Players in the Indian Market

Big names like Paytm, PhonePe, and Razorpay dominate the scene, providing robust platforms that cater to diverse business needs. Their innovative approaches have revolutionized how Indians perceive and execute transactions They are regular payments made by a customer to a business for a service or product, charged on a recurring basis.

Challenges in Payment Processing

Regulatory Issues

Navigating the regulatory maze in India can be daunting. Businesses often grapple with compliance requirements, making it crucial to stay updated and agile. B2B Payment System[1] development in India.

Infrastructure Limitations

Despite rapid advancements, infrastructure bottlenecks persist. Ensuring a seamless payment[2] experience demands addressing these challenges head-on. If your business follows a B2B sales model, you’ll need to set up a payments system catering specifically to a business-oriented clientele.

Benefits of Efficient Payment Processing

Efficiency isn’t just a buzzword; it’s the lifeline businesses need. If your business follows a B2B sales model, you’ll need to set up a Recurring payment processing[3] catering specifically to a business-oriented clientele. Faster transactions, reduced errors, and enhanced customer satisfaction are just a few perks businesses enjoy with efficient payment processing.

Trends Shaping Payment Processing in India

From UPI-driven solutions to AI-powered fraud detection, India’s payment landscape is evolving. Embracing these trends is pivotal for businesses aiming to stay ahead of the curve. Payment Aggregators[4] processing for business development in India.

Case Studies

They are regular payments made by a customer to a business for a service or product, charged on a recurring basis. Have you ever heard of a local vendor going global? Thanks to efficient payment processing, countless businesses[5] have scaled new heights, underscoring its transformative impact.

Security Concerns and Solutions

With great power comes great responsibility. Ensuring secure transactions remains paramount, with businesses adopting cutting-edge solutions to safeguard customer data.

Integration with Digital India Initiatives

The government’s Digital India push has synergized with payment processing, fostering a conducive environment for businesses to thrive. Seamless integration with these initiatives unlocks untapped potential, driving growth and innovation.

Future Prospects and Innovations

Hold onto your seats! The future looks promising, with AI, blockchain, and IoT poised to redefine payment processing in India. Buckle up for an exhilarating ride Recurring payment processing refers to the methods and systems businesses use to automatically collect recurring payments from customers.

Navigating the Waters Ahead

As we sail into uncharted waters, the essence of payment processing becomes even more pronounced. The evolving landscape demands agility, innovation, and a customer-centric approach. Let’s delve deeper, shall we? Recurring payment processing refers to the methods and systems businesses use to automatically collect recurring payments from customers.

Empowering Small Businesses

While giants like Amazon and Flipkart dominate headlines, it’s the small and medium-sized enterprises (SMEs) that form the backbone of India’s economy. Efficient payment processing levels the playing field, enabling these businesses to compete on a global scale. Imagine a local artisan showcasing products to a global audience, all thanks to seamless payment solutions!

The Rise of Mobile Payments

In a country where smartphones are ubiquitous, mobile payments are more than just a trend; they’re a way of life. From bustling cities to remote villages, mobile payment solutions like UPI have revolutionized daily transactions. The convenience, speed, and security they offer are unparalleled, transforming how Indians perceive and engage with financial services.

Collaborations and Partnerships

The adage “Unity is strength” rings true in the payment processing realm. Collaborations between fintech startups, traditional banks, and regulatory bodies are fostering an ecosystem ripe for innovation. These synergies are driving technological advancements, enhancing user experiences, and unlocking new avenues for growth.

Education and Awareness

In a rapidly evolving landscape, knowledge is power. Educating businesses and consumers about the intricacies of payment processing is crucial. From understanding transaction fees to ensuring data security, awareness campaigns play a pivotal role in fostering trust and transparency.

The Green Revolution: Sustainable Payment Solutions

As sustainability takes center stage, payment processing isn’t far behind. Eco-friendly solutions, reduced carbon footprints, and ethical practices are gaining traction. Businesses are increasingly adopting sustainable payment solutions, aligning profitability with planet-friendly practices

Conclusion

Payment processing isn’t just a backend operation; it’s the lifeblood powering India’s vibrant business landscape. Embracing innovation, addressing challenges, and staying customer-centric are pivotal for sustained growth. Here’s to the exciting journey ahead!

FAQs

- Why is payment processing crucial for businesses in India?

- Payment processing ensures seamless transactions, fostering growth and customer satisfaction.

- Which are the leading payment processing platforms in India?

- Platforms like Paytm, PhonePe, and Razorpay dominate the Indian market.

- How are regulatory challenges impacting payment processing in India?

- Navigating regulatory hurdles requires businesses to stay agile and compliant.

- What security measures are in place for payment processing?

- Businesses employ cutting-edge solutions like encryption and fraud detection to safeguard transactions.

- How is technology shaping the future of payment processing in India?

- Emerging technologies like AI, blockchain, and IoT are poised to revolutionize payment processing, unlocking new possibilities,