AUTHOR : KHOKHO

DATE : 21/12/2023

Introduction to B2B Payment Processing

The world of business is rapidly evolving, and with it, the methods of conducting transactions are also undergoing a transformation. In India, the realm of Business-to-Business (B2B) trade is no exception. Payment Processing For Business-To-Business[1] Trade In India In this article, we will delve into the nuances of payment processing for B2B transactions in India, exploring the current landscape, challenges, and the imperative need for efficient payment methods

In the intricate web of B2B transactions, payment processing plays a pivotal role. Payment Processing For Business-To-Business Trade In India Unlike Business-to-Consumer (B2C) transactions, B2B dealings involve larger sums of money and more complex payment structures. Efficient payment processing is not merely a convenience but a necessity for the smooth functioning of businesses engaged in B2B trade.

Current Landscape of B2B Trade in India

To comprehend the significance of payment processing[2] in B2B transactions, let’s first glance at the current state of B2B trade in India. Recent statistics reveal a substantial surge in B2B transactions, indicating a thriving business ecosystem. However, this growth comes with its own set of challenges, especially in the realm of payment processing.

Challenges in Traditional Payment Methods

Traditional payment methods, such as cheques and wire transfers, have been the backbone of B2B transactions for years. However, these methods are plagued with delays, inefficiencies, and a lack of transparency. Businesses[3] often find themselves caught in the web of bureaucratic processes, hindering the fluidity of trade.

The Need for Efficient Payment Processing

In the fast-paced world of business, time is money. The need for efficient payment processing For Business has never been more crucial. Businesses are seeking solutions that can streamline their payment processes, ensuring timely transactions and reducing the burden of administrative tasks associated with traditional payment methods.

Overview of Payment Processing Technologies

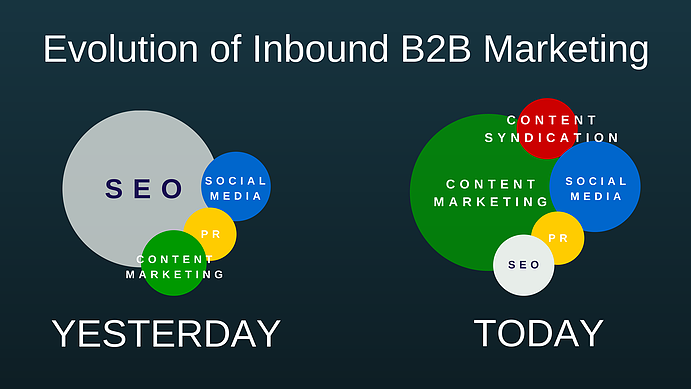

The evolution of technology has given rise to a myriad of payment processing[4] options. From digital wallets to UPI (Unified Payments Interface) and mobile banking, businesses now have an array of choices to facilitate their transactions. These technologies offer speed, convenience, and a level of automation that was unimaginable a few years ago.

Benefits of Online Payment Systems

The adoption of online payment systems in B2B trade brings forth a plethora of benefits. Faster transactions, reduced paperwork, and enhanced accuracy are just a few advantages that businesses can reap. The ease of tracking payments[5] and real-time updates further contribute to the appeal of digital payment methods.

Security Measures in B2B Payment Processing

With the convenience of online payments comes the paramount concern for security. Businesses engaging in B2B transactions must prioritize secure payment gateways, Payment Processing For Business-To-Business Trade In India encryption, and robust authentication processes to safeguard sensitive financial information.

Popular Payment Gateways in India

In the Indian business landscape, several payment gateways have gained prominence. From industry giants to startups, these gateways offer diverse features catering specifically to the needs of B2B transactions. Names like Paytm, Razorpay, and Instamojo have become synonymous with secure and efficient payment processing.

Integration of Invoicing Systems

The integration of invoicing systems with payment processing further enhances the efficiency of B2B transactions. Automated invoicing not only reduces manual errors but also ensures that payments are linked to specific transactions, providing a transparent and accountable system.

Government Initiatives Promoting Digital Payments

Recognizing the importance of digital transactions, the Indian government has launched initiatives to promote cashless payments. With campaigns like ‘Digital India’ and the introduction of the Goods and Services Tax (GST), businesses are incentivized to embrace digital payment methods.

Case Studies: Successful Implementation

Numerous businesses in India have successfully implemented modern payment processing methods showcasing the tangible benefits of this transition. Case studies reveal improved cash flow, reduced payment cycles, and increased overall efficiency in business operations.

Adopting a Customer-Centric Approach

In the realm of B2B transactions, customer satisfaction is paramount. Businesses must adopt a customer-centric approach in their payment processing strategies, ensuring that the chosen methods align with the preferences and needs of their clients.

Future Trends in B2B Payment Processing

The landscape of payment processing is ever-evolving, with continuous advancements in technology. The future of B2B payments holds exciting possibilities, including blockchain technology, artificial intelligence, and further simplification of payment processes through innovative solutions.

Tips for Businesses in India to Improve Payment Processes

For businesses looking to enhance their payment processes, a few actionable tips can make a significant difference. Embracing automation, staying updated on emerging technologies, and fostering partnerships with reliable payment gateways are key steps in ensuring a seamless payment experience.

Conclusion

In conclusion, the evolution of payment processing for B2B trade in India signifies a paradigm shift in the way businesses conduct transactions. The move towards digital payment methods not only addresses the challenges of traditional methods but also propels businesses into a future where efficiency, security, and customer satisfaction take center stage.

Frequently Asked Questions (FAQs)

- How does blockchain technology benefit B2B transactions?

- Blockchain technology enhances transparency and security, reducing the risk of fraud in B2B transactions.

- What role does artificial intelligence play in B2B payment processing?

- AI automates tasks, analyses data for patterns, and improves fraud detection in B2B transactions, making processes smarter and more efficient.

- Are contactless payments secure for B2B trade?

- Yes, contactless payments use secure encryption and are a safe option for B2B transactions, providing convenience and safety.

- How does embedded finance simplify B2B payments?

- Embedded finance integrates financial services directly into non-financial business platforms, streamlining B2B payment processes and reducing complexity.

- What are the advantages of subscription-based payment models in B2B trade?

- Subscription-based payment models provide businesses with predictable revenue streams and offer customers flexible payment options, contributing to long-term relationships.