AUTHOR : SELENA GIL

DATE : 22/12/2023

Introduction

Payment processing forms a crucial part of corporate acquisitions in India. Whether it’s acquiring a company for its talent, technology, or market presence, understanding the intricacies of payment methods is essential for successful transactions Acquisitions in India.

Payment Methods in Corporate Acquisitions

Cash Transactions

In many instances, cash transactions remain a prevalent method of Processing for Corporate acquisitions. The simplicity and immediacy of cash deals make them attractive, facilitating swift ownership transfers this involves substantial sums of money changing hands to facilitate the purchase of shares or assets.

Stock Transactions

Utilizing stocks as a form of payment Corporate Acquisitions involves exchanging the acquiring company’s shares for the target company’s stocks. This method is often employed to maintain the value of the acquisition while minimizing cash usage.

Debt Assumption

Assuming the target company’s debts can also be a part of the acquisition strategy. This method can provide tax benefits and leverage existing debt structures efficiently Acquisitions in India on Payment .payment gateway and payment processing service providers. They make sure that transactions are carried out seamlessly to enhance customer experience and improve business reputation

Regulatory Framework for Payment Processing in India

Navigating India’s regulatory landscape is pivotal in ensuring compliance during payment processing in corporate acquisitions. Payment Processing Services[1] Understanding legal considerations and compliance requirements is crucial to executing acquisitions seamlessly.

Challenges in Payment Processing for Corporate Acquisitions

Currency Fluctuations

E-commerce payment system[2] Fluctuating currency values can significantly impact the financial aspects of acquisitions, leading to potential risks and uncertainties Behind every business, whether it is in-store or online, is a payment gateway and payment processing service providers. They make sure that transactions are carried out seamlessly to enhance customer experience and improve business reputation Transaction Processing System[3] .

Tax Implications

Tax considerations play a pivotal role in payment processing, Payment processing security[4] influencing the structure and execution of acquisitions Businesses that provide payment options through credit or debit cards to their customers need a payment processing service provider who would help them in crediting the money into their bank accounts. .

Due Diligence Requirements

Meeting due diligence requirements is essential to ascertain the financial health and legal compliance of the target company. They collaborate between all parties involved to make the payment process efficient and seamless for the merchants and customers

Best Practices for Efficient Payment Processing

Enterprise Payment Processing[5] are the ones who fulfil a number of steps required from authenticating to settling a transaction. Implementing robust risk mitigation strategies and thorough financial planning aids in streamlining the payment process, reducing potential obstacles.

Role of Technology in Payment Processing

Innovations in financial technology have revolutionized payment processing, offering digital solutions that enhance efficiency and security. They are entities which synchronize non-cash transactions by validating all information and also distribute funds to the merchant, once a sale is completed

Case Studies on Successful Payment Processing in Corporate Acquisitions

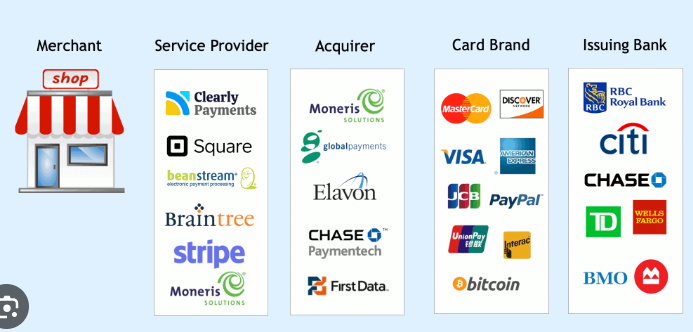

As a payment processor, not only to the merchant, but also making sure even the issuing bank receives its funds. The network payment processors own lets them accommodate a flow of data between all parties. Exploring successful acquisitions in India sheds light on the strategies employed and the lessons learned from these transactions.

Future Trends in Payment Processing for Corporate Acquisitions

Emerging Technologies

Advancements in technologies like blockchain and AI are expected to reshape payment processing methodologies. Mergers typically involve the exchange of shares, whereas takeovers might include a mix of cash, stock, or other financial instruments

Changing Regulatory Landscape

Anticipating and adapting to regulatory changes is crucial for future-proofing payment processing in corporate acquisitions. Payment processing encompasses the mechanisms involved in transferring funds from one entity to another. In the landscape of corporate acquisitions, this involves substantial sums of money changing hands to facilitate the purchase of shares or assets

Understanding Payment Processing

Payment processing encompasses the mechanisms involved in transferring funds from one entity to another. In the landscape of corporate acquisitions, this involves substantial sums of money changing hands to facilitate the purchase of shares or assets. The payment process often follows distinct phases, including negotiation, due diligence, agreement, and ultimately, the transfer of funds.

Types and Process of Corporate Acquisitions in India

Corporate acquisitions in India can take various forms, such as mergers, takeovers, or asset acquisitions. Each type involves its unique payment processing procedures. Mergers typically involve the exchange of shares, whereas takeovers might include a mix of cash, stock, or other financial instruments. Asset acquisitions focus on purchasing specific assets, often involving direct payment mechanisms.

Importance of Efficient Payment Processing

Efficient payment processing is crucial for the success and smooth execution of corporate acquisitions. Timely and secure transactions are essential to ensure trust between involved parties and maintain the integrity of the deal. Delays or complications in payments can jeopardize the entire acquisition process, leading to legal and financial implications.

Regulatory Challenges

Navigating the regulatory landscape in India poses significant challenges in payment processing for corporate acquisitions. Compliance with laws and regulations, including those related to foreign investments, taxation, and company laws, adds complexity to the payment process. Ensuring adherence to these regulations is critical to avoiding legal hurdles.

Solutions for Streamlining Payment Processes

To overcome challenges, companies often employ technology-driven solutions. Utilizing secure payment platforms, implementing robust compliance measures, and leveraging financial technologies play a pivotal role in streamlining payment processes. These solutions not only enhance efficiency but also ensure transparency and security in transactions.

Key Players and Future Trends

Several entities, including financial institutions, legal advisors, and fintech companies, play vital roles in facilitating payment processing for corporate acquisitions in India. Additionally, the future of payment processing in acquisitions is expected to witness advancements in financial technology, automation, and further regulatory adaptations.

Conclusion

Efficient payment processing is integral to successful corporate acquisitions in India. Navigating payment methods, regulatory frameworks, and emerging trends is essential for a seamless transaction. these solutions not only enhance efficiency but also ensure transparency and security in transactions.

FAQs

- Are cash transactions the most common method in corporate acquisitions in India?Cash transactions are prevalent but not always the most common. Stock transactions and debt assumption are also widely used depending on various factors.

- How do currency fluctuations impact payment processing in acquisitions?Currency fluctuations can significantly affect the final cost of acquisitions, leading to financial uncertainties.

- What role does due diligence play in payment processing for acquisitions?Due diligence ensures that the acquiring company thoroughly assesses the target company’s financial health and compliance status.

- Are there specific technologies revolutionizing payment processing in India?Yes, technologies like fintech solutions, blockchain, and AI are transforming payment processing methodologies.

- How can companies prepare for changes in the regulatory landscape affecting payment processing?Staying updated with regulatory changes and having adaptable strategies in place is crucial for companies navigating the changing regulatory environment.