AUTHOR : SELENA GIL

DATE : 21/12/2023

Introduction

Payment processing stands at the core of financial transactions, facilitating the transfer of funds between businesses and customers. In the context of venture in India, this process has evolved significantly over the years. The proliferation of digital transactions and the need for robust financial systems have fueled the demand for sophisticated payment solutions[1].

Key Features of Enterprise-Level Payment Processing

Scalability and Customization

One of the paramount features of payment processing for venture in India is its scalability. These services are tailored to accommodate the diverse needs and Payment Processing for Enterprise-level Services in India volume requirements of large-scale businesses. Customization options enable seamless integration with existing systems.

Security Protocols and Compliance

Security is a top priority in enterprise payment processing. Stringent security protocols and compliance measures ensure the safety of sensitive financial data, Services in India adhering to regulatory standards and mitigating potential risks.

Integration Capabilities

The adaptability and integration prowess of payment processors allow venture to synchronize their payment systems with various platforms, enhancing operational efficiency and customer convenience Enterprise-level Services in India. Smartphones and tablets enable us to manage our day-to-day tasks and business operations easily on the go.

Challenges Faced in Enterprise Payment Processing

Despite the advancements, Mobile Payment Solutions[2] the sector encounters several challenges. Regulatory hurdles, technological adaptation, and managing high transaction volumes pose significant obstacles for venture seeking streamlined payment processes.

Leading Payment Processors for Enterprises in India

Several companies specialize in catering to the payment needs of venture in India. Each company offers unique features and services tailored to specific business requirements. Company A, known for its robust security measures, competes with Company B, which emphasizes seamless integration. Company C stands out for its Electronic Payment System[3].

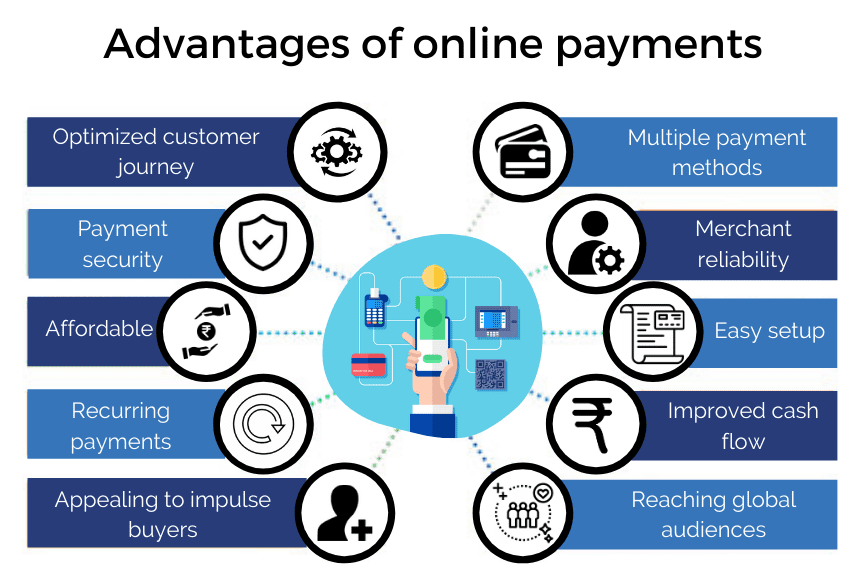

Advantages of Opting for Enterprise Payment Services in India

Streamlined Financial Operations

Implementing -level payment services streamlines financial operations, reducing complexities and enhancing accuracy in transactions and record-keeping. In today’s digital economy, the landscape of financial transactions is rapidly evolving, with electronic payment systems leading the charge.

Enhanced Customer Experience

A seamless payment system[4] contributes significantly to an enhanced customer experience, fostering trust and loyalty among clientele. These systems have revolutionized how we handle money, from facilitating online shopping to enabling contactless payments[5]. is a touch-free payment method that allows customers to purchase

Competitive Edge and Growth Opportunities

Businesses gain a competitive edge by adopting advanced payment solutions, unlocking new growth opportunities and expanding their market presence. This article explores how electronic payment systems work, the benefits of adopting them, and the macroeconomic trends influencing their growth today.

Case Studies: Successful Implementation in Enterprises

Real-life case studies highlight the tangible benefits of efficient payment processing. In Case 1, a company witnessed efficiency improvement and cost savings Payment payment processing for Enterprise-level Services in India. Case 2 emphasizes the boost in security and compliance, while Case 3 outlines market expansion and revenue growth due to advanced payment solutions.

Future Trends and Innovations

The landscape of payment processing continues to evolve. Emerging technologies, shifting market dynamics, and changing consumer expectations are poised to transform enterprise payment processing in India. Anticipated trends include the integration of AI, blockchain, and seamless cross-border transactions.

Adaptation Challenges and Solutions

Regulatory Hurdles

Navigating the convoluted web of regulations poses a significant challenge. However, payment processors specializing in enterprise services often provide comprehensive compliance solutions. These solutions streamline adherence to diverse regulatory frameworks, ensuring businesses remain critical while focusing on growth.

Technological Adaptation

The rapidly advanced technological landscape demands continuous adaptation. Payment processors offer robust support through seamless integration and constant updates. They provide user-friendly interfaces and tech-savvy solutions, making the transition smoother for venture

Transaction Volume Management

Managing high transaction volumes efficiently is vital for ventures. Payment processors equipped with scalable infrastructure and advanced analytics cater to this need. They optimize transaction flow, ensuring seamless processing even during peak periods.

Leading Payment Processors in India

Company A: Security-Centric Solutions

Company A is renowned for its stringent security measures. They employ cutting-edge encryption and authentication protocols, ensuring the utmost safety for transactions, a vital aspect for enterprises dealing with sensitive financial data.

Company B: Integration Expertise

Company B specializes in seamless integration. Their systems effortlessly sync with various enterprise platforms, facilitating a cohesive payment ecosystem. This integration enhances operational efficiency and customer convenience.

Innovators in Payment Solutions

Company C stands out for its innovative payment solutions. They continuously push the boundaries with evolutions such as mobile payment integration, AI-driven fraud detection, and personalized transaction experiences.

Advantages of Enterprise Payment Services

Implementing robust payment services streamlines financial operations. Automation reduces human errors and manual intervention, leading to smoother processes and enhanced productivity. The landscape of payment processing continues to evolve. Emerging technologies, shifting market dynamics

Conclusion

In conclusion, the significance of robust payment processing for ventures in India cannot be understated. Embracing these evolving solutions offers streamlined operations, enhanced customer experiences, and a competitive advantage in the market.