Name: Buddy Kim

Date: 21/12/23

Introduction

Payment For Industrial In a rapidly evolving industrial landscape, partnerships play a pivotal role in driving growth and innovation. The efficient functioning of these collaborations hinges on a robust payment processing system. This article delves into the intricacies of payment processing for industrial partnerships in India, exploring challenges, trends, and best practices to foster seamless transactions.

Payment processing forms the backbone of any industrial partnership. Whether it’s manufacturing, supply chain management, or joint ventures, a reliable payment system ensures the smooth flow of financial transactions. In India, where industrial collaborations are on the rise, addressing the unique challenges associated with payment processing becomes imperative.

The Landscape of Industrial Partnerships in India

India’s industrial sector is diverse, encompassing various domains such as manufacturing, Processing For Industrial technology, and energy. Partnerships between companies contribute significantly to the economic growth of the nation. These collaborations range from joint ventures to strategic alliances, creating a complex web of financial transactions.

Challenges in Payment Processing for Industrial Partnerships

Navigating the payment landscape in India comes with its set of challenges. Currency complexities, regulatory hurdles, the Payment ecosystem[1] and security concerns often pose obstacles to seamless transactions. Understanding and addressing these challenges is crucial for the success of industrial partnerships.

Emerging Trends in Payment Processing

The industrial sector in India is witnessing a paradigm shift in payment The adoption of digital payments, integration of blockchain and smart contracts, and the infusion of artificial intelligence are transforming the way financial transactions are conducted Solutions designed for industry[2].

Benefits of Streamlined Payment Processes

Efficient payment modernization brings numerous benefits to industrial partnerships. They not only save time and costs but also reduce errors and disputes. Improved financial management[3] becomes a reality, fostering a conducive environment for collaboration.

Popular Payment Methods in Industrial Partnerships

Choosing the right payment method is vital for account payment solutions for industrial partnerships. Online bank transfers[4], mobile payment solutions, and electronic wallets are gaining popularity due to their convenience and accessibility.

Government Initiatives and Policies

The Indian government has introduced several initiatives to promote digital payments and streamline financial transactions. Understanding these policies is essential for industrial partners to align their payment processes with the regulatory framework.

Case Studies: Successful Payment Models in Industrial Partnerships

Examining successful payment models provides valuable insights. Real-life examples showcase the effectiveness of streamlined payment processes, The efficient functioning of these collaborations hinges on a robust payment processing system. This article delves into the intricacies of payment processing offering lessons that can be applied to diverse industrial partnerships.

Navigating Cross-Border Payment Challenges

As industrial partnerships expand globally, navigating cross-border payment[5] challenges becomes crucial. Understanding international transactions and implementing risk mitigation strategies are essential for seamless cross-border payments.

The Role of Fintech Companies in Industrial Payments

Fintech companies are playing a pivotal role in revolutionizing payment processing for industrial collaborations. Their innovative solutions, collaborations, and customizable offerings cater to the specific needs of industrial partners.

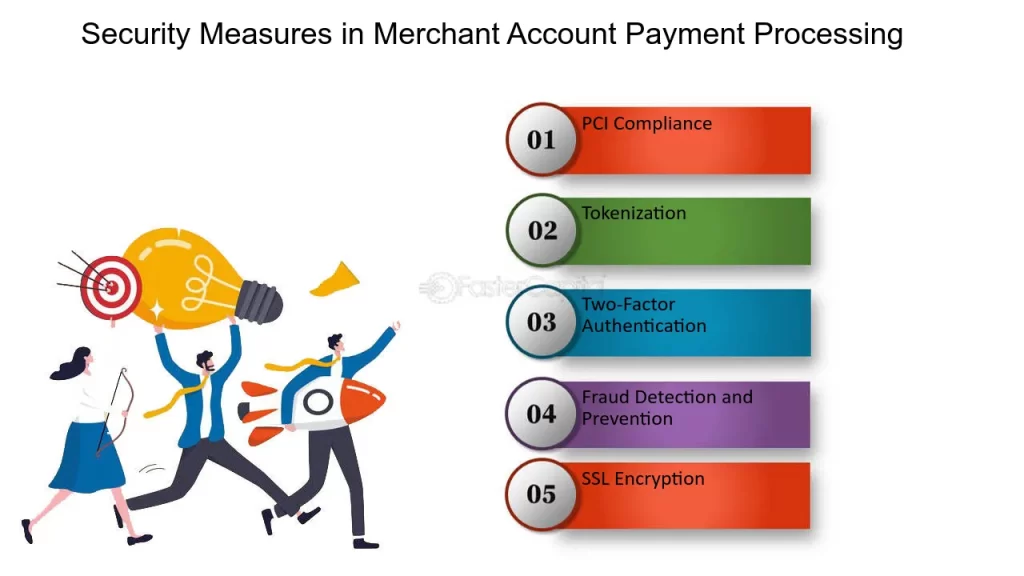

Security Measures in Payment Processing

Security is paramount in payment processing. Implementing secure payment gateways and adhering to best practices for data protection safeguard industrial partnerships against potential threats and breaches.

Tips for Choosing the Right Payment Processing Solution

Factors such as the nature of the partnership, scalability, and customization options should be weighed to ensure a tailored and efficient payment system The efficient functioning of these collaborations hinges on a robust payment processing system. This article delves into the intricacies of payment processing

Future Outlook of Payment Processing in Indian Industrial Sectors

The future of payment processing in Indian industrial sectors holds exciting prospects. Anticipated advancements, coupled with potential regulatory changes, will further enhance the efficiency and effectiveness of financial transactions in industrial partnerships.

Conclusion

In conclusion, payment processing is a critical aspect of industrial partnerships in India. Streamlining financial transactions, embracing emerging trends, and adhering to best practices contribute to the success of collaborations. As the industrial landscape evolves, efficient payment systems will continue to be a driving force behind sustainable growth.

FAQs

- Q: Are digital payments widely accepted in Indian industrial partnerships?

- A: Yes, digital payments have gained significant traction, offering convenience and efficiency.

- Q: How can industrial partners ensure the security of their payment transactions?

- A: Implementing secure payment gateways and following data protection best practices is essential.

- Q: What role do government initiatives play in shaping payment processing in India?

- A: Government initiatives set the regulatory framework and promote the adoption of digital payments.

- Q: How can Fintech companies contribute to the efficiency of payment processing in industrial collaborations?

- A: Fintech companies offer innovative solutions and customizable offerings tailored to industrial partners’ needs.

- Q: What factors should industrial partners consider when choosing a payment processing solution?

- A: Consideration factors include the nature of the partnership, scalability, and customization options.