AUTHOR NAME : JASMINE

DATE : 21/12/2023

Introduction

In the dynamic landscape of Procurement in india , the seamless operation of payment processing plays a pivotal role in see to it a smooth and efficient supply chain. Let’s delve into the intricacies of payment processing for procurement strategies and explore how businesses can optimize this crucial aspect payment processing for Procurement strategies in India.

Definition of Payment Processing

Payment processing refers to the entire lifecycle of a financial transaction, from the initiation of a purchase to the settlement of funds. strategies in India In the context of procurement, it involves the payment of funds to suppliers and service providers in exchange for goods or services.

Importance of Payment Processing in Procurement Strategies

Efficient payment processing is the backbone of successful ownership strategies. Procurement strategies It payment processing for Procurement not only ensures timely payments but also contributes to the overall effectiveness of the ownership workflow, fostering positive relationships with suppliers.

Key Components of Payment Processing

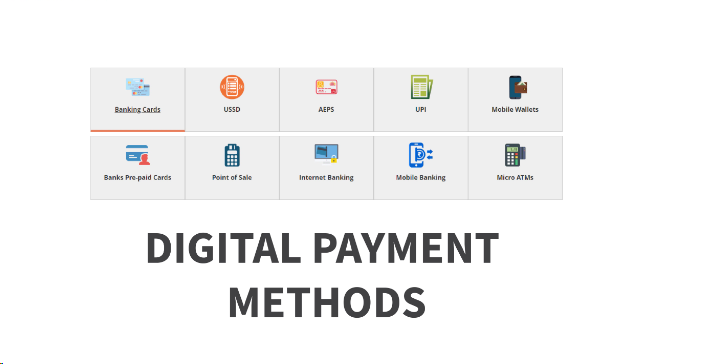

Digital Payment Methods

In the digital era, businesses are increasingly adopting electronic payment methods such as credit cards, online transfers, and digital wallets. The speed and convenience offered by these methods contribute to a more agile ownership process.

Traditional Payment Methods

While digital methods are on the rise, traditional payment methods like checks and wire transfers still play a crucial role in ownership, especially for larger transactions. Striking the right balance between digital and traditional methods is essential for a comprehensive payment strategy.

Integration with Procurement Systems

Seamless integration between payment processing Procurement systems[1] and ownership software is imperative for efficiency. Automated processes reduce manual errors and enhance the overall accuracy of financial transactions.

Challenges in Payment Processing for Procurement

Security Concerns

One of the primary challenges in payment processing is the need for robust security measures. With the increasing currency of cyber threats, procurement management[2] businesses must implement code and proof protocols to guard sensitive financial information.

Regulatory Compliance

Procurement processes are subject to various regulations, and compliance to these compliance standards is critical for businesses. Payment processing systems[3] must align with legal requirements to avoid penalties and ensure ethical business practices payment processing for Procurement strategies in India.

Delayed payments can strain supplier relationships and disrupt the Procurement Process in Supply Chain[4]. Implementing efficient payment processing strategies minimizes delays, fostering a collaborative and mutually beneficial partnership with suppliers.

Advantages of Streamlined Payment Processes

Cost Efficiency

Streamlining payment[5] processes reduces administrative costs associated with manual handling of transactions. Automated invoicing and payment systems contribute to significant cost savings for businesses.

Improved Supplier Relationships

Timely and transparent payments build trust and strengthen relationships with suppliers. This, in turn, leads to better negotiation terms, discounts, and improved overall collaboration.

Enhanced Procurement Workflow

Efficient payment processes contribute to the overall optimization of the procurement workflow. Businesses experience smoother operations, from order placement to payment settlement, resulting in increased productivity.

Emerging Trends in Payment Processing for Procurement

Blockchain Technology

Blockchain technology provides a decentralized and secure platform for financial transactions. Its transparency and traceability make it an ideal solution for enhancing trust in payment processing within procurement.

Artificial Intelligence Integration

Artificial intelligence (AI) is revolutionizing payment processing by automating routine tasks, detecting anomalies, and providing valuable insights. AI-driven systems contribute to increased efficiency and accuracy in financial transactions.

Mobile Payment Solutions

The widespread use of smartphones has given rise to mobile payment solutions. Integrating mobile payment options in procurement processes adds flexibility and convenience for businesses and suppliers.

Best Practices for Effective Payment Processing

Transparent Communication

Open communication between buyers and suppliers is crucial for effective payment processing. Clear expectations, invoicing details, and payment terms should be communicated transparently to avoid misunderstandings.

Automated Invoicing

Automation of invoicing processes reduces manual errors and accelerates the payment cycle. Implementing systems that generate and track invoices automatically streamlines the entire payment process.

Regular Audits and Reviews

Periodic audits of payment processes help identify inefficiencies, errors, or potential areas of improvement. Regular reviews ensure that the payment system remains aligned with the evolving needs of the business.

Successful Payment Processing in Indian Procurement

Company A’s Efficient Payment System

Company A, a leading player in the Indian procurement market, implemented a fully automated payment processing system. This resulted in a 30% reduction in processing time and enhanced relationships with suppliers due to timely payments.

Implementing Digital Wallets in Procurement

A forward-thinking business introduced digital wallets for procurement transactions. This not only improved the speed of payments but also attracted tech-savvy suppliers, contributing to a more diversified supplier base.

Future Outlook and Innovations

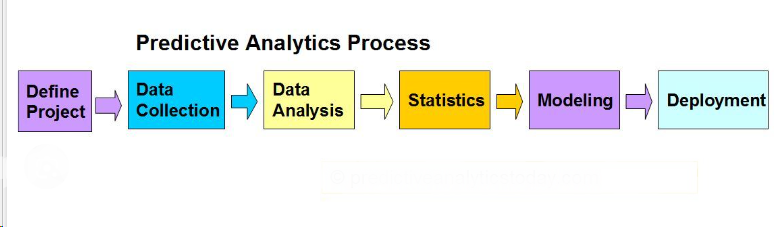

Predictive Analytics in Payment Processing

The integration of predictive analytics enables businesses to forecast payment trends, reducing the risk of delayed payments and optimizing cash flow management.

Collaboration between Financial Institutions and Procurement

Collaboration between financial institutions and procurement entities is set to increase. This synergy an lead to innovative financial solutions tailored to the specific needs of businesses involved in procurement.

Conclusion

In conclusion, effective payment processing is a cornerstone of successful procurement strategies in India. Businesses must embrace technological advancements, streamline processes, and prioritize transparent communication to ensure a robust payment ecosystem. By doing so, they can not only reduce challenges but also pave the way for a more efficient and collaborative procurement landscape payment processing for Procurement strategies in india.

FAQs

- How can businesses address security concerns in payment processing for procurement?

- Implementing encryption protocols and regular security audits can help businesses defence sensitive financial information.

- What role does artificial intelligence play in streamlining payment processes?

- Artificial intelligence automates routine tasks, detects anomalies, and provides valuable insights, contributing to increased efficiency and accuracy in financial transactions.

- Why is transparent communication crucial in payment processing for procurement?

- Transparent communication ensures that both buyers and suppliers have clear expectations, reducing the likelihood of misunderstandings and disputes.

- How do mobile payment solutions benefit procurement processes?

- Mobile payment solutions add flexibility and convenience to procurement processes, catering to the evolving needs of businesses and suppliers.

- What are the advantages of collaboration between financial institutions and procurement entities?

- Collaboration can lead to innovative financial solutions tailored to the specific needs of businesses involved in procurement, enhancing overall efficiency.