AUTHOR: NORA

DATE: 17-12-2023

Introduction

In the ever-evolving landscape of business, the significance of payment processing cannot be overstated. Particularly in the dynamic market of spark plugs in India, where traditional and digital channels coexist, understanding and implementing efficient payment solutions are paramount.

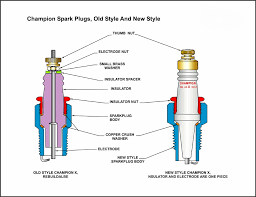

Overview of the Spark Plugs Market

has witnessed substantial growth in recent years. With a surge in automotive sales and increasing demand for fuel-efficient vehicles[1], the need for spark plugs has intensified.

Growth Trends in the Industry

The market’s upward trajectory is fueled [2]by technological advancements, stringent emission norms, and a burgeoning automotive sector. Key players are capitalizing on these trends to expand[3] their market share.

Key Players and Market Dynamics

Major players in the spark plug industry include [List of Key Players]. The market dynamics are influenced by [4] strategies and technological innovations.

Payment Challenges in the Spark Plugs Business

Cash Transactions vs. Digital Payments

In a market where cash transactions have been prevalent, transitioning to digital payments poses challenges. However, the shift is crucial for efficiency and transparency[5]

Risks Associated with Traditional Payment Methods

Traditional payment methods come with inherent risks, including delayed transactions, accounting discrepancies, and susceptibility to fraud

Need for Secure and Efficient Payment Solutions

To overcome challenges, spark plugPayment Processing For Spark Plugs In India, businesses must adopt secure and efficient payment solutions that align with the modern consumer’s expectations.

Emerging Trends in Payment Processing

Digital Wallets and Mobile Payments

The rise of digital wallets and mobile payments Payment processing for spark plugs in India has transformed how consumers make purchases. Spark plug businesses can leverage these trends to offer convenient payment options.

UPI and Contactless Payments

The popularity of UPI (Unified Payments Interface) and contactless payments has soared, providing faster and safer transactions for both businesses and consumers.

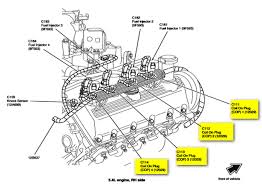

Integration of Technology in Spark Plug Sales

Integrating payment technology into the spark plug sales processPayment processing at Spark Plugs in India enhances the overall customer experience and streamlines transactions.

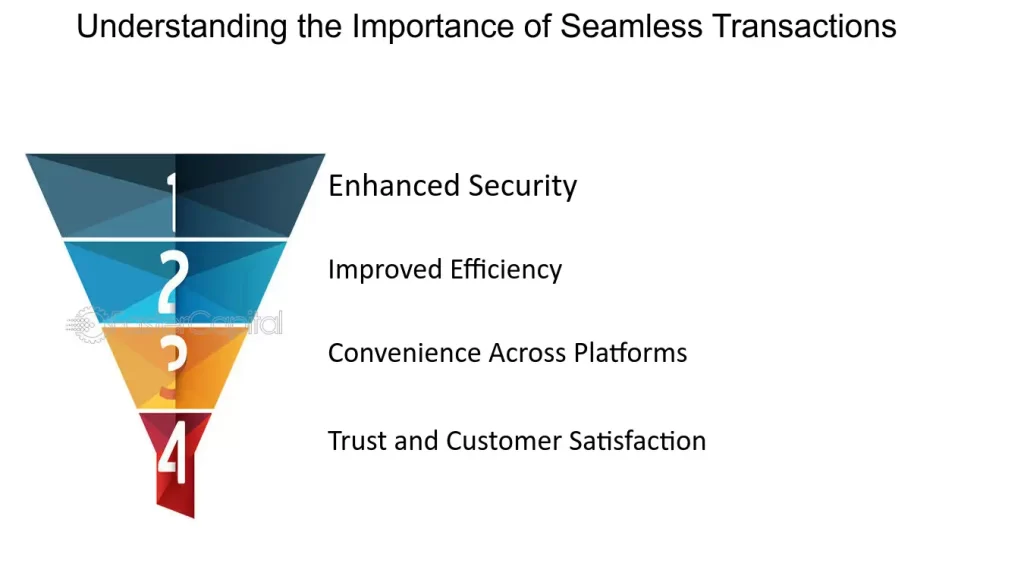

Importance of Seamless Transactions

Customer Experience and Satisfaction

Seamless transactions contribute to a positive customer experience, fostering satisfaction and loyalty. In a competitive market, customer-centric payment solutions set businesses apart.

Building Trust with Reliable Payment Systems

Reliability in payment processing builds trust among consumers, encouraging repeat business and positive word-of-mouth recommendations.

Enhancing Business Credibility

Businesses that prioritize seamless transactions and embrace modern payment methods enhance their overall credibility in the eyes of consumers and industry partners.

Benefits of Online Payment Processing

Streamlining Transactions

Online payment processing streamlines transactions, reducing manual errors and operational bottlenecks associated with traditional methods.

Improving Cash Flow

Efficient payment systems contribute to improved cash flow, enabling businesses to reinvest in operations, innovation, and customer service.

Reducing Operational Costs

Automating payment processes reduces operational costs, allowing businesses to allocate resources more strategically.

Security Measures in Payment Processing

Encryption and Data Protection

Implementing robust encryption and data protection measures is essential to safeguarding customer information and preventing unauthorized access.

Compliance with Payment Standards

Adhering to industry standards and regulations ensures compliance and instills confidence in customers regarding the security of their transactions.

Fraud Prevention Strategies

Proactive fraud prevention strategies, such as real-time monitoring and authentication protocols, are crucial to mitigating the risks associated with online transactions.

Choosing the Right Payment Gateway

Factors to Consider

Selecting the right payment gateway involves considering factors such as transaction fees, user experience, integration capabilities, and customer support.

Comparison of Popular Payment Gateways

A comparative analysis of popular payment gateways can assist Spark Plug businesses in making informed decisions that align with their specific needs.

Customized Solutions for Spark Plug Businesses

Tailoring payment solutions to the unique requirements of the spark plug industry ensures seamless and effective integration into existing business processes.

Case Studies: Successful Payment Processing in Spark Plug Industry

Examples of Businesses Implementing Efficient Payment Systems

Several businesses in the spark plug industry have successfully implemented efficient payment systems, setting benchmarks for others to follow.

Positive Outcomes and Impact on Sales

The positive outcomes of embracing modern payment methods are reflected not only in streamlined operations but also in increased sales and customer satisfaction.

Future Outlook for Payment Processing in Spark Plug Sales

Anticipated Technological Advancements

As technology continues to evolve, the spark plug industry can expect further advancements in payment processing, enhancing convenience for both businesses and consumers.

Changing Consumer Preferences

Consumer preferences will play a pivotal role in shaping the future of payment processing. Adapting to these preferences is essential for sustained success.

Market Adaptation Strategies

Businesses must remain agile and adapt their payment processing strategies to stay ahead in a dynamic market, embracing innovation and consumer-centric solutions.

Conclusion

In conclusion, the integration of efficient payment processing solutions is not just a necessity but a strategic advantage for Spark Plug businesses in India. By staying ahead of industry trends, adopting secure technologies, and prioritizing customer experience, businesses can navigate the evolving landscape successfully.

FAQs

- Q: What are the common challenges in payment processing for spark plug businesses? Common challenges include transitioning from cash to digital payments, managing risks associated with traditional methods, and the need for secure and efficient payment solutions.

- Q: How can businesses benefit from online payment processing? Online payment processing streamlines transactions, improves cash flow, and reduces operational costs, providing businesses with numerous advantages.

- Q: What security measures are crucial in payment processing for spark plug sales? Encryption, compliance with payment standards, and effective fraud prevention strategies are crucial security measures in payment processing.

- Q: How can businesses choose the right payment gateway for spark plug sales? Factors to consider include transaction fees, user experience, integration capabilities, and the ability to provide customized solutions tailored to the spark plug industry.

- Q: What is the future outlook for payment processing in the spark plug industry? A: The future holds anticipated technological advancements, changing consumer preferences, and the need for businesses to adapt their payment processing strategies to stay competitive.