AUTHOR : JAYOKI

DATE : 20/12/2023

Introduction

Processing For Supplier is a crucial aspect of business operations, especially when it comes to maintaining strong connections with suppliers. In India, the landscape of payment systems has undergone significant changes over the years, evolving from traditional methods to embracing cutting-edge digital solutions.

Evolution of Payment Processing in India

India has witnessed a remarkable transformation in payment processing, from relying on cash and checks to the widespread use of digital methods. Connections In India The advent of technology has played a pivotal role in streamlining financial transactions, making them faster, more secure, and efficient.

Challenges in Traditional Supplier Payment Methods

While traditional payment methods served their purpose, manual processes at Supplier Connections presented various challenges. Delays, errors, and the risk of fraud were inherent in these systems, prompting businesses to explore alternative solutions for making supplier Connections For payments.

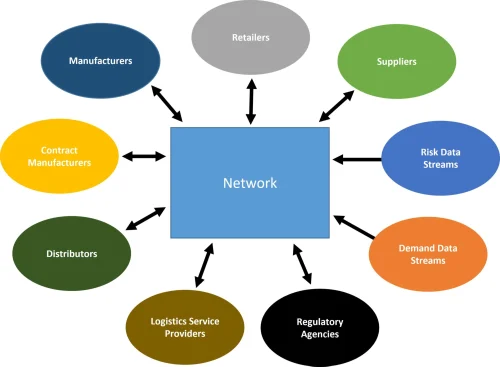

The Rise of Digital Payment Solutions

In recent years, digital payment options have gained immense popularity. Payment Processing For Supplier Connections In India supply chain management[1] Businesses are increasingly adopting digital wallets, online banking, and other electronic payment methods to facilitate seamless transactions with suppliers. The advantages include speed, convenience, and enhanced record-keeping.

Popular Payment Gateways in India

Several payment gateways have emerged as leaders in the Indian market. Analyzing their features, transaction fees, and user experiences can help businesses choose the most suitable platform for their Supplier Invoice[2] connections. From Paytm to Razorpay, the options are diverse, each catering to specific business needs.

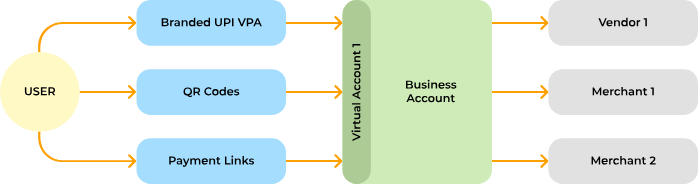

Integration of UPI in Supplier Payments

Unified Payments Interface (UPI) has revolutionized the way payments are made in India. Its integration into supplier transactions ensures quick and secure payments. Supplier relationship management[3]

Businesses benefit from the simplicity and accessibility that UPI brings to the payment process.

Security Measures in Payment Processing

Security is paramount in financial transactions. Businesses must implement robust security measures to protect sensitive information during supplier payments. Payment Systems Management[4]

For Supplier Connections In India Encryption, multi-factor authentication, and regular security audits are essential components of a secure payment environment.

Impact of GST on Supplier Payments

The introduction of the Goods and Services Tax (GST) has had a significant impact on payment processing for suppliers. Multi-Tier Supply Chain Analytics[5] It has streamlined tax procedures, making it imperative for businesses to align their payment processes with GST regulations.

Streamlining International Supplier Payments

International transactions come with their own set of challenges. Businesses need reliable platforms and solutions to navigate the complexities of cross-border payments. Streamlining international supplier payments is crucial for global enterprises.

The Role of Fintech Companies

Fintech companies are playing a pivotal role in shaping the future of payment processing. Through innovation and collaboration, fintech is providing businesses with cutting-edge solutions to enhance their supplier connections.

Adopting Automation for Efficiency

Automation is key to optimizing supplier payment processes. Businesses can leverage technology to automate routine tasks, reducing errors and processing times. This not only enhances efficiency but also allows staff to focus on more strategic aspects of supplier relationships.

Ensuring Compliance in Supplier Payments

Regulatory compliance is a crucial consideration in supplier payments. Businesses must stay informed about the legal requirements associated with financial transactions to avoid penalties and maintain ethical business practices.

Success Stories in Supplier Payments

Examining real-world examples of companies that have successfully transformed their supplier payment processes provides valuable insights. Case studies showcase the positive impact of adopting modern payment solutions on efficiency and overall business performance.

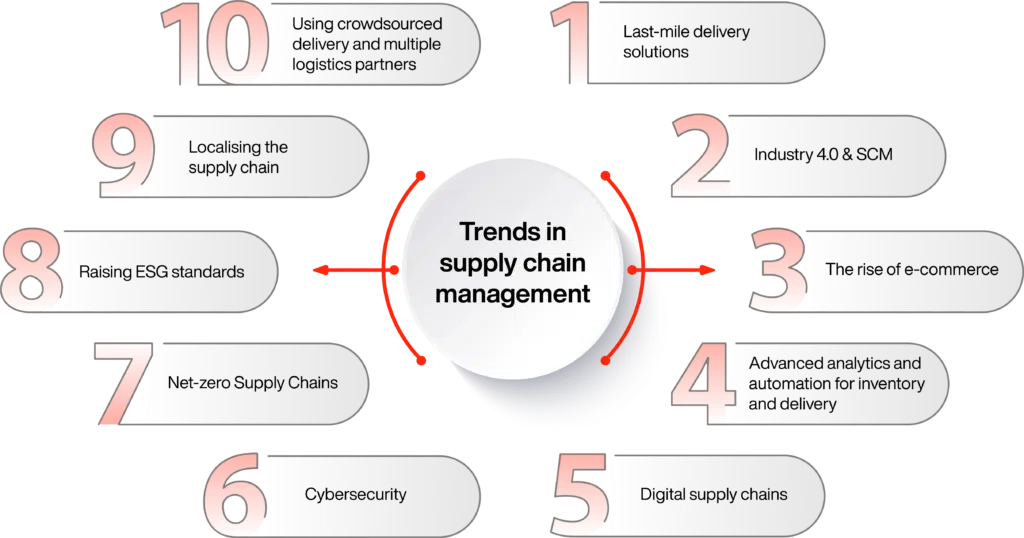

Future Trends in Payment Processing for Suppliers

The future holds exciting possibilities for payment processing. Emerging technologies such as blockchain, artificial intelligence, and machine learning are likely to shape the landscape. Businesses that stay abreast of these trends can position themselves for sustained success.

Conclusion

Efficient payment processing is the lifeline of strong supplier connections. From the evolution of payment methods to the rise of digital solutions, businesses in India have a plethora of options to enhance their supplier payment processes. Embracing innovation, ensuring security, and staying compliant are the cornerstones of a robust payment strategy.

FAQs

- Q: How can businesses choose the right payment gateway for supplier transactions?

- A: Evaluating features, transaction fees, and user experiences is crucial in selecting the most suitable payment gateway.

- Q: What security measures should businesses implement for secure supplier payments?

- A: Encryption, multi-factor authentication, and regular security audits are essential for ensuring the security of financial transactions.

- Q: How has the Goods and Services Tax (GST) impacted supplier payments in India?

- A: GST has streamlined tax procedures, requiring businesses to align their payment processes with GST regulations.

- Q: Why is automation important in supplier payment processes?

- A: Automation optimizes efficiency by reducing errors and processing times, allowing businesses to focus on strategic aspects of supplier relationships.

- Q: What are the future trends in payment processing for suppliers?

- A: Emerging technologies such as blockchain, artificial intelligence, and machine learning are likely to shape the future of payment processing for suppliers.