AUTHOR:HAZEL DSOUZA

DATE:20/12/2023

Trade agreements play a crucial role in fostering economic relationships between nations, and one often overlooked aspect is payment processing. In this article, we’ll delve into the intricacies[1] of payment processing for trade agreements[2] in India, exploring traditional[3] and digital methods, challenges faced, government initiatives, and future trends.

Introduction

Trade agreements[4] facilitate the exchange of goods and services between countries, requiring[5] a robust payment infrastructure to ensure smooth transactions.

Importance of Efficient Payment Processing

Efficient payment processing is the lifeblood of international trade, impacting the speed, accuracy, and security of transactions.

Traditional Payment Methods in Trade

Cash Transactions

Cash transactions have been a historical norm in trade, but their limitations are increasingly evident.

Cheque Payments

Cheque payments offer a paper trail but are often slow and cumbersome.

Evolution of Digital Payments

NEFT and RTGS

National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) have streamlined domestic[1] trade payments.

UPI Transactions

The rise of Unified Payments Interface (UPI) transactions has revolutionized peer-to-peer and business transactions.

Challenges in Payment Processing

Currency Exchange Concerns

International trade involves diverse currencies, creating complexities[2] in conversion and exchange rates.

Regulatory Compliance

Stringent regulations can hinder seamless payment processing, necessitating careful adherence to compliance measures.

Cybersecurity Risks

The digital landscape introduces cybersecurity risks, demanding robust measures to protect financial transactions.

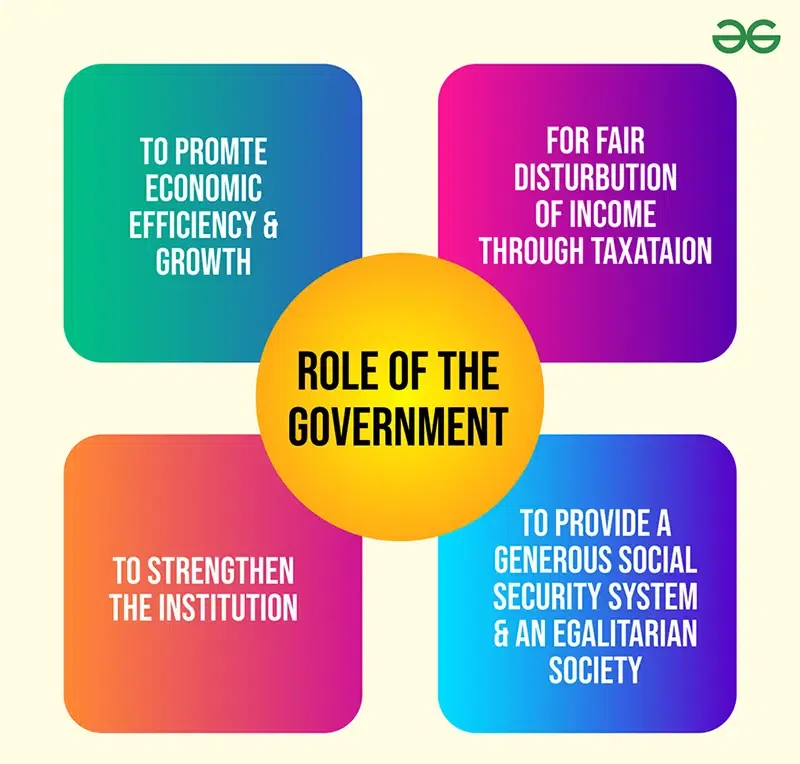

Role of Government Initiatives

Digital India Campaign

The Digital India campaign promotes technological[3] advancements, impacting payment processing positively.

Make in India Initiative

The Make in India initiative fosters domestic production, influencing payment processes within the country.

Impact on Small and Medium Enterprises (SMEs)

Access to Global Markets

Efficient payment processing enables SMEs to access global markets, fostering growth and expansion.

Financial Inclusion

Streamlined digital payment methods contribute to the financial inclusion of SMEs, leveling the playing field.

Future Trends in Payment Processing

Blockchain Technology

Blockchain technology holds the potential to revolutionize[4] secure and transparent cross-border transactions.

Central Bank Digital Currencies (CBDCs)

CBDCs are emerging as a future frontier, offering central bank-issued digital currencies for international trade.

Case Studies

Successful Payment Processing in Indian Trade

Examining successful cases provides insights into effective payment processing strategies.

Lessons Learned from Failures

Analyzing failures allows us to learn from past mistakes and strengthen the payment infrastructure.

Recommendations for Improving Payment Processing

Collaboration between Financial Institutions

Collaboration between financial institutions is key to developing a cohesive and efficient payment ecosystem.

Education and Awareness Programs

Educational initiatives and awareness programs can enhance understanding and adoption of modern payment methods.

The Role of FinTech Companies

Innovation in Payment Solutions

FinTech companies play a pivotal role in innovating and providing cutting-edge[5] payment solutions.

Streamlining Cross-Border Transactions

FinTech solutions streamline cross-border transactions, reducing friction and costs.

Global Comparisons

India vs. Developed Economies

Comparing India’s payment processing with developed economies highlights areas for improvement.

Learning from Emerging Markets

Learning from emerging markets provides valuable insights into adapting to dynamic global trade landscapes.

The Future Landscape of Trade Payments

Adaptation to Technological Advances

Adapting to technological advances is crucial for staying competitive in the evolving trade scenario.

Sustainable Practices

Implementing sustainable payment practices aligns with global efforts towards environmental responsibility.

Conclusion

the landscape of payment processing for trade agreements in India is evolving rapidly. Embracing digital advancements, overcoming challenges, and fostering collaboration will pave the way for a robust and efficient payment ecosystem.

FAQs

- Q: How do digital payment methods impact the security of trade transactions?

- A: Digital payment methods, when properly implemented, enhance security through encryption and authentication protocols.

- Q: Can small businesses benefit from the Make in India initiative in terms of payment processing?

- A: Yes, the Make in India initiative promotes domestic production, offering small businesses opportunities for seamless payment transactions.

- Q: What role does blockchain technology play in cross-border trade payments?

- A: Blockchain technology ensures secure, transparent, and tamper-resistant cross-border transactions.

- Q: How can regulatory compliance be streamlined to facilitate smoother payment processing in international trade?

- A: Streamlining regulatory processes and promoting international standards can simplify compliance, ensuring smoother payment processing.

- Q: Are there any specific challenges faced by FinTech companies in the payment processing landscape?

- A: FinTech companies may encounter challenges related to regulatory frameworks, but their innovations contribute significantly to improving payment processes.