AUTHOR : JAYOKI

DATE : 20/12/2023

Introduction

In the dynamic landscape of wholesale distribution, where every transaction matters, a seamless payment processing system is indispensable. From timely payments to managing diverse payment methods, businesses must navigate through various challenges to ensure smooth financial operations.

Importance of Efficient Payment Processing

Streamlining Financial Transactions

Efficient payment processing streamlines financial transactions, reducing the time and effort required for both buyers and sellers. This results in improved operational efficiency and better utilization of resources.

Enhancing Cash Flow

A robust payment Processing For Wholesale enhances cash flow by delays in payments. For wholesale distributors, having a steady and predictable cash flow is vital for sustaining and growing their operations.

Choosing the Right Payment Processor

Selecting the right payment For Wholesale Distribution is a critical decision for wholesale Distribution In India. Understanding the specific needs of the business, security features, and ensuring seamless integration with existing systems are essential factors to consider.

Understanding Business Needs

Before choosing a payment processor[1], businesses must assess their specific requirements. Factors such as transaction volume, average transaction value, and the target customer base play a crucial role in selecting an appropriate payment processing solution.

Evaluating Security Features

Security is payment processing. Businesses must choose a processor that implements robust security measures, Merchant Services for Wholesalers The pressure[2] is on to simplify and standardize payments including SSL encryption, two-factor authentication, and compliance with PCI DSS standards.

Integration Capabilities

The chosen Digital payment solutions[3] should integrate with the existing systems and technologies used by the wholesale distributor. payment processing for Wholesale distribution in India Compatibility and ease of integration contribute to a smoother payment processing experience. The pressure is on to simplify and standardize payments

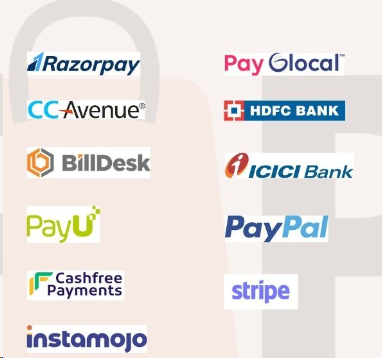

Popular Payment Processors in India

Several payment processors in India[4] cater specifically to the needs of businesses. Let’s explore some of the popular ones: Real-time payments are transforming financial transactions for businesses across the globe. This payment method, which allows for the immediate transfer of funds 24/7, is redefining conventional banking norms.

Razorpay

Razorpay stands out for its intuitive user interface and extensive range of payment solutions, making it a go-to choice for businesses seeking a seamless financial transaction experience. It caters to businesses of all sizes and offers a range of features, including automated recurring payments and invoicing.

PayU

PayU provides a secure and efficient payment gateway for businesses[5]. With its robust features, PayU is suitable for wholesale distributors looking for a reliable payment processing solution presents an opportunity to optimize cash flow management, simplify administrative processes, and create a more seamless customer experience..

Instamojo

Instamojo is a versatile platform that offers not only payment processing but also other business tools. It is popular among small and medium-sized enterprises for its and affordability RTP systems facilitate the immediate transfer of funds between parties. For businesses operating across different commerce channels.

Cashfree

Cashfree focuses on simplifying payment processes for businesses. It supports a wide range of payment methods and offers features such as bulk payouts, subscription billing, RTP systems facilitate the immediate transfer of funds between parties. For businesses operating across different commerce channels and more.

Facilitating Quick Transactions

The integration of digital wallets and UPI (Unified Payments Interface) has revolutionized payment processing in India. Wholesale distributors can leverage these technologies to facilitate quick and transactions.

Encouraging Cashless Payments

With the government’s push towards a economy, mobile banking apps, or in person at a physical location. The payer can also use traditional inputs such as account numbers or more modern digital wallets and UPI into the payment processing system aligns with the broader trend of encouraging cashless payments.

Security Measures in Payment Processing

SSL Encryption

SSL (Secure Sockets Layer) encryption is a fundamental security measure in payment processing. It ensures that the data transmitted between the user and the payment processor remains secure and protected from mobile banking apps, or in person at a physical location. The payer can also use traditional inputs such as account numbers or more modern methods such as scanning a QR code unauthorized access.

Two-Factor Authentication

Implementing adds an extra layer of security to the payment process. This ensures that even if login credentials are compromised, unauthorized access is prevented. mobile banking apps, or in person at a physical location. The payer can also use traditional inputs such as account numbers or more modern methods such as scanning a QR code

Hidden Charges

Hidden charges can significantly impact the overall cost of payment processing. Businesses should carefully review the terms and conditions of the chosen processor to identify and understand any hidden charges. Once the bank authorizes the transaction, the bank sends the payment instruction through the RTP system

Mobile Payment Trends

The Rise of Mobile Commerce

Mobile commerce is on the rise, and wholesale distributors must adapt to this trend. Ensuring that the payment processing system is mobile-friendly is crucial for capturing a broader market and providing a convenient experience for customers.

Importance of Mobile-Friendly Payment Solutions

Customers increasingly prefer mobile-friendly payment solutions. Wholesale should prioritize payment processors that offer mobile integration to stay competitive in the evolving market In the continuously evolving digital era, cashless payments have become an integral part of daily life.

Future Trends in Payment Processing

Blockchain and Cryptocurrency

The integration of blockchain technology and cryptocurrency in payment processing is an emerging trend. Wholesale distributors should stay informed about these developments, as they have the potential to reshape the industry.

Artificial Intelligence in Fraud Prevention

Artificial intelligence plays a crucial role in enhancing fraud prevention measures. As payment processing becomes more sophisticated, integrating AI-driven solutions becomes for safeguarding transactions The use of these payment methods not only facilitates transactions but also transforms spending patterns and consumer habits.

Contactless Payments

The popularity of contactless payments is expected to grow. Wholesale should explore payment processors that support contactless transactions to cater to changing consumer preferences.

Staying Updated on Industry Trends

Continuous learning and staying updated on industry trends are essential for businesses in the wholesale distribution sector. Embracing new technologies and strategies ensures long-term sustainability and competitiveness.

Conclusion

In conclusion, payment processing for distribution in India is a multifaceted challenge that requires careful consideration. From choosing the right payment processor to staying abreast of technological trends, wholesale distributors must navigate through a dynamic landscape. Adapting to the needs of the market and prioritizing a customer-centric approach will position businesses for sustained success.

FAQs

- What are the key challenges in payment processing for wholesale distribution in India?The challenges include diverse payment methods, regulatory hurdles, and currency exchange complexities.

- How can wholesale distributors enhance cash flow through efficient payment processing?Streamlining financial transactions and minimizing delays in receiving payments contribute to enhancing cash flow.

- What security measures should businesses look for in a payment processor?Businesses should prioritize processors with SSL encryption, two-factor authentication, and compliance with PCI DSS standards.

- Why is mobile-friendly payment processing important for wholesale distributors?With the rise of mobile commerce, offering a mobile-friendly payment experience is crucial for staying competitive and capturing a broader market.

- What future trends should wholesale distributors be aware of in payment processing?Emerging trends include blockchain and cryptocurrency integration, artificial intelligence in fraud prevention, and the growing popularity of contactless payments.