AUTHOR : RUBBY PATEL

DATE : 14/12/23

Introduction

In a world where technological advancements are reshaping our daily lives, the way we handle transactions is no exception. Cashless payment options have become increasingly prevalent in India, transforming the traditional financial landscape. Let’s delve into the nuances of payment processors and the array of cashless payment choices available in the Indian market .

Benefits of Cashless Payment Options

Embracing cashless payments brings forth a myriad of advantages. The unparalleled convenience and efficiency provided by these systems set them apart in a league of their own. Users experience heightened security, with robust measures in place to prevent fraud. Additionally, cashless transactions contribute to financial inclusion, bringing more individuals into the formal financial sector.

Popular Payment Processors in India

The Indian payment ecosystem boasts various options, each catering to different preferences. Payment Options In India The Unified Payments Interface (UPI) has emerged as a frontrunner, simplifying peer-to-peer transactions. Mobile wallets, loaded with features, and traditional debit and credit cards continue to be widely used.

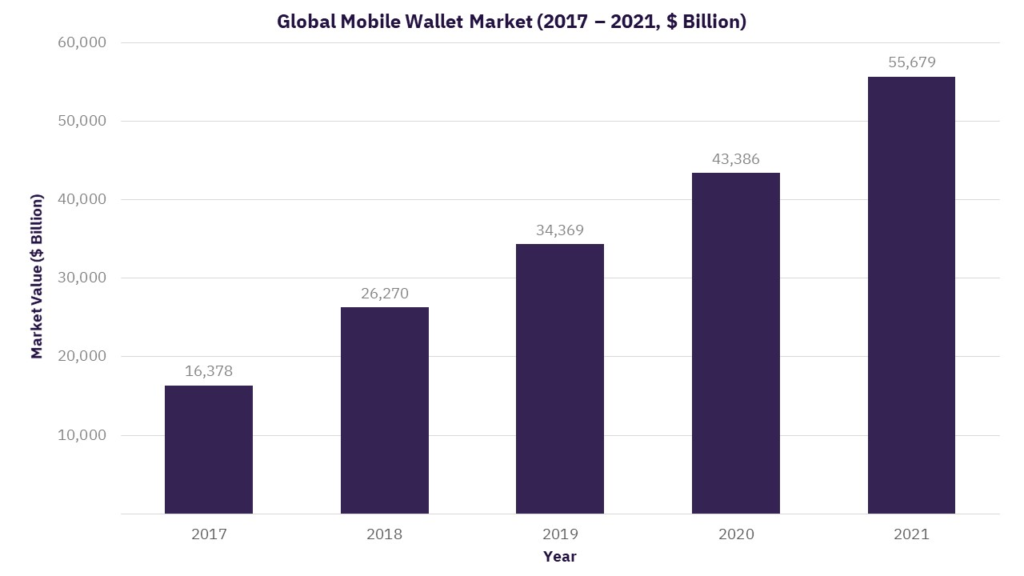

The Rise of Digital Wallets

Digital wallets, a subset of mobile payment solutions[1], have gained immense popularity. Offering features like contactless payments and in-app purchases, these wallets have become an integral part of the cashless revolution. User adoption is on the rise, with trends indicating a shift towards these convenient and secure options.

Challenges and Concerns

While the benefits are evident, challenges persist. Cybersecurity issues pose a threat to the integrity of cashless transactions. Technological barriers and consumer resistance also need addressing to ensure a seamless transition to a cashless economy[2].

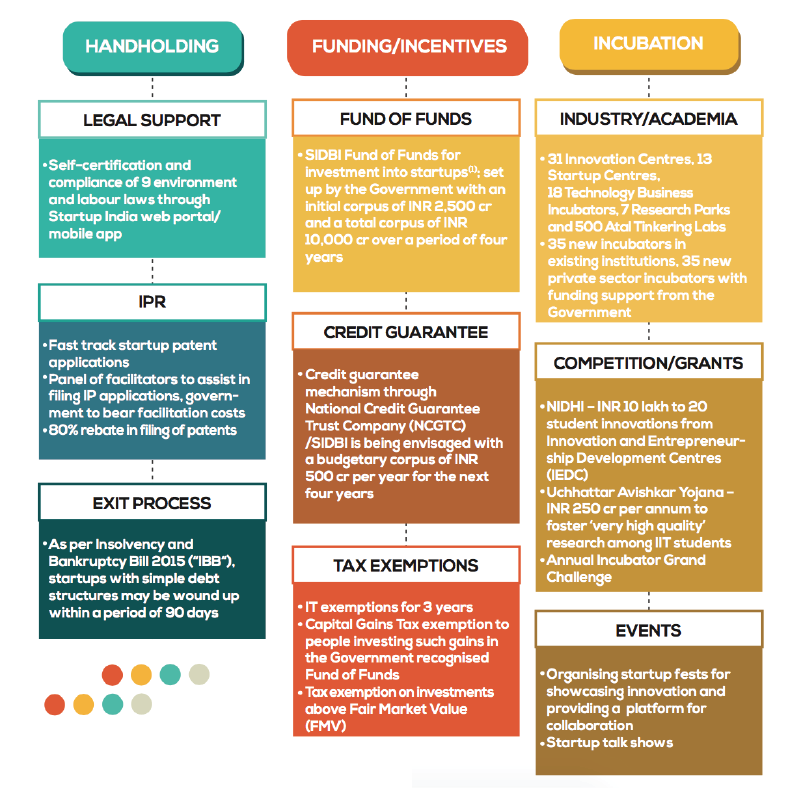

Government Initiatives

The Indian government plays a pivotal role in promoting digital transactions. Payment Processor[3] Initiatives aimed at creating a robust regulatory framework and encouraging citizens to embrace cashless modes of payment have been pivotal in shaping the current landscape.

Future Outlook

The future of cashless payments[4] in India looks promising. Technological innovations, including advancements in artificial intelligence and blockchain, are set to further enhance the user experience. Integration of emerging technologies will define the next phase of cashless transactions.

How Businesses Can Benefit

Businesses stand to gain significantly from the adoption of cashless payment Methods[5]. Enhanced customer experiences, streamlined financial processes, and increased revenue opportunities are among the many advantages awaiting businesses that make the transition.

Case Studies

Real-world examples of businesses successfully embracing cashless payments provide insights into the positive impact on operations and customer relations. These case studies serve as inspiration for others considering a similar shift.

Tips for Consumers

Consumers can maximize the benefits of cashless payments by adopting safe usage practices. Additionally, understanding the rewards and benefits associated with different payment options ensures users make the most of available features.

Comparison of Cashless Payment Options

A comparative analysis of UPI, mobile wallets, and traditional cards sheds light on the pros and cons of each. This information aids users in making informed choices based on their preferences and requirements.

The Role of Banks

Banks play a crucial role in the cashless payment ecosystem. Collaborations with payment processors and initiatives aimed at driving financial inclusion highlight the symbiotic relationship between traditional banking institutions and modern payment solutions.

Social Impact

The shift towards cashless payments also has social implications. Reducing the digital divide and empowering small businesses are key aspects of the broader societal impact of cashless transactions.

Global Perspectives on Cashless Payments

Examining global perspectives provides valuable insights. Learning from successful implementations in other countries and understanding international best practices can further inform the evolution of cashless payments in India.

Conclusion

In conclusion, the landscape of and cashless payment options in India is dynamic and evolving. The benefits are clear, and as technology continues to advance, the way we transact will only become more sophisticated and secure.

FAQs

- Is it safe to use cashless payment options in India?

- Yes, with robust security measures in place, cashless payments in India are generally safe and secure.

- What are the advantages of digital wallets over traditional cards?

- Digital wallets offer added features such as contactless payments and in-app purchases, making them more versatile for modern users.

- How can businesses transition to cashless payments successfully?

- Businesses can transition successfully by understanding customer needs, adopting user-friendly systems, and promoting the benefits of cashless transactions.

- Are there any government incentives for promoting cashless transactions?

- Yes, the government has introduced various incentives and initiatives to promote and reward the use of cashless payment options.

- What role do banks play in the cashless payment ecosystem?

- Banks collaborate with payment processors and drive financial inclusion, acting as key players in the cashless payment landscape.