AUTHOR : RIVA BLACKLEY

DATE : 11/12/2023

Introduction

In the dynamic landscape of business finances, payment processors[1] play a pivotal role in facilitating transactions. However, the accumulation of debt through these processors can pose significant challenges for businesses. In India, where the market is burgeoning with opportunities, understanding and managing payment processor debt becomes crucial for sustained success.

The Need for Debt Consolidation

Many businesses find themselves entangled in financial complexities, with payment processor debts contributing to the overall burden. This section explores the common challenges faced by businesses and the impact these challenges can have on their financial stability[2].

Understanding Payment Processor Debt

To effectively tackle payment processor debt, it’s essential to comprehend how it accrues and the mechanisms behind it. This section breaks down the nuances of payment processor debt, shedding light on why businesses may find themselves in such situations. Payment Processor Debt Consolidation in India

Benefits of Debt Consolidation

Debt consolidation isn’t just a financial maneuver; it’s a strategic decision that can streamline payments, reduce interest rates, and even improve credit scores. In this section, we discuss the multifaceted benefits that businesses can reap through debt consolidation[3].

Choosing the Right Payment Processor

Selecting an appropriate payment processor is a critical step in avoiding debt accumulation. We provide insights into the factors businesses should consider and compare popular processors in the Indian market.

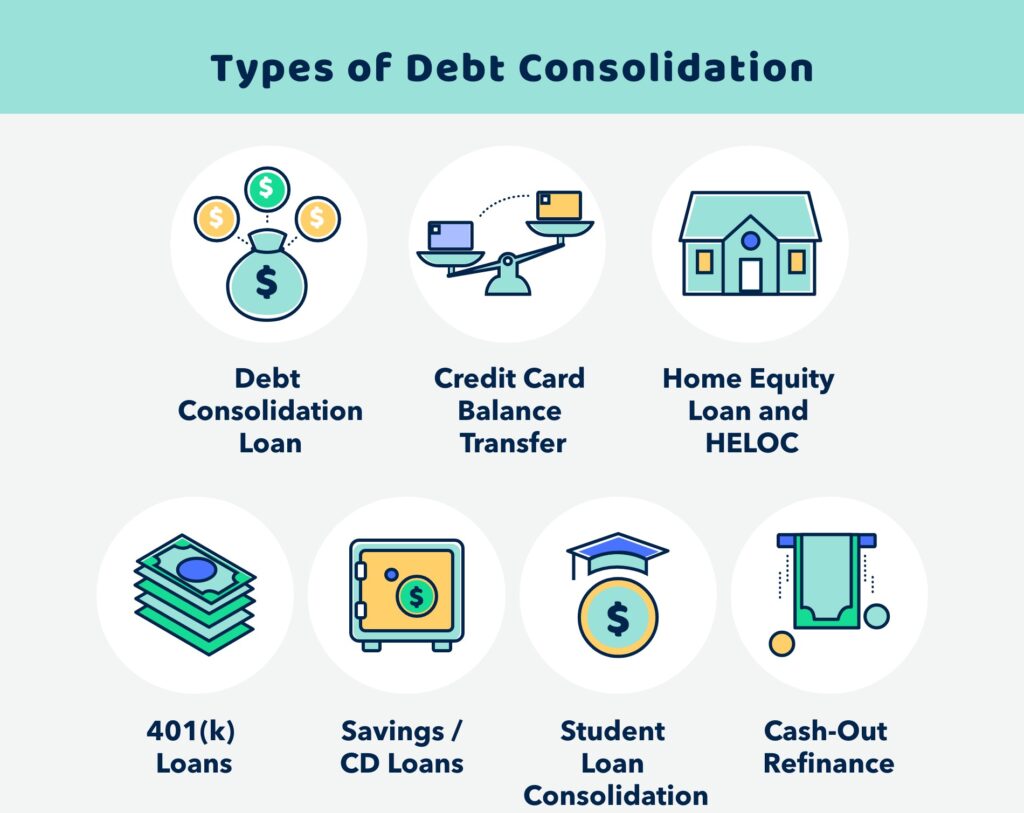

Debt Consolidation Options in India

India offers various debt consolidation services tailored to businesses’ needs. This section explores the available options and how these services function to alleviate financial burdens.

How Payment Processors Can Assist in Debt Consolidation

Payment processors can be valuable allies in the debt consolidation journey. This section explores collaborative efforts and tailored solutions that payment processors can offer to businesses in need.

Case Studies

Real-world examples add a practical dimension to theoretical concepts. We present case studies of businesses that successfully navigated payment processor debt through consolidation strategies.

Steps to Initiate Debt Consolidation

Understanding the process is key to implementation. This section outlines the steps businesses can take to initiate debt consolidation, from planning to the application process.

Impact on Business Operations

Successfully consolidating debt[4] can have a positive impact on various aspects of business operations. We explore the potential outcomes and challenges businesses might face during this transformative process.

Regulatory Aspects

Navigating the regulatory landscape is crucial for businesses exploring debt consolidation. This section highlights the importance of compliance with Indian financial regulations and other legal considerations.

Success Stories

Inspiration often stems from success stories. We showcase businesses that not only survived payment processor debt but thrived after successful debt consolidation.

Future Trends in Payment Processor Debt Consolidation

The financial landscape is ever-evolving, and businesses must stay ahead of the curve. This section discusses emerging trends[5] in payment processor debt consolidation, from technological advancements to changing market dynamics.

Common Misconceptions

Misconceptions can hinder informed decision-making. We address prevalent myths related to debt consolidation, ensuring businesses have a clear understanding of the process.

Understanding Payment Processor Debt

Payment processors, while essential for facilitating transactions, can inadvertently become sources of financial strain for businesses. Understanding how payment processor debt accumulates is the first step in addressing this issue. Often, it results from delayed payments, high transaction fees, or unforeseen financial downturns. Businesses can find themselves in a web of financial complexity, impacting their overall stability.

The Need for Debt Consolidation

The need for debt consolidation arises from the challenges businesses face in managing multiple debts, especially those incurred through payment processors. Unchecked debts can lead to a downward financial spiral, affecting operations and hindering growth. Debt consolidation becomes a beacon of hope, offering a strategic approach to untangle financial webs.

Conclusion

In conclusion, payment processor debt consolidation in India is not just a financial strategy; it’s a lifeline for businesses navigating complex financial waters. By understanding the intricacies, leveraging payment processors’ assistance, and learning from successful cases, businesses can not only overcome debt challenges but also emerge stronger and more resilient.

FAQS

- Is debt consolidation the right choice for every business?

- Debt consolidation is beneficial for many businesses, but it’s crucial to assess individual circumstances.

- How long does the debt consolidation process take?

- The timeline varies, but businesses can typically expect a few weeks to a few months for the process to complete.

- Can debt consolidation affect credit scores negatively?

- When done correctly, debt consolidation can actually improve credit scores over time.

- Are there risks involved in debt consolidation?

- Like any financial strategy, there are risks, and businesses should carefully consider them before proceeding.

- Are there government programs for debt consolidation in India?

- While there aren’t specific government programs, businesses can explore various financial institutions and services for debt consolidation.