AUTHOR : AYAKA SHAIKH

DATE: 04/03/2024

Introduction to Payment Processors

In today’s digital era, payment processors play a crucial role in facilitating financial[1] transactions, especially in a rapidly growing economy like India. These processors act as intermediaries between merchants[2] and customers, ensuring seamless and secure electronic payments. Payment Processor Electronic Software in India.

Evolution of Electronic Payment Systems

Gone are the days when cash and checks were the primary means of making payments. With the advent of technology, electronic payment[3]systems have revolutionized the way transactions are conducted. From credit and debit cards to mobile wallets, there’s a plethora of options available for consumers[4] and businesses alike. Payment Processor Electronic Software[5] in India.

Role of Payment Processors in India

In India, payment processors[1] are instrumental in driving the adoption of electronic payment methods. They enable businesses to accept payments online, whether it’s through credit/debit cards, net banking, or the UPI (Unified Payments Interface). Moreover, they ensure compliance with regulatory[2]requirements and implement robust security measures to safeguard sensitive financial information.

Major Payment Processors in India

Several payment processors operate in the Indian market, each offering unique features and services. Some of the prominent ones include Paytm, Razorpay, Instamojo, and PayPal. While each platform caters to different segments of the market, they all strive to simplify the payment process for businesses and consumers.

Benefits of Electronic Payment Processors

The adoption of electronic payment processors brings numerous benefits to both merchants and customers. For businesses, it offers convenience by eliminating the need for physical cash handling and streamlining accounting processes. Customers, on the other hand, enjoy faster transaction[3]processing and the flexibility to choose their preferred payment method.

Challenges Faced by Payment Processors in India

Despite the rapid growth of electronic payments, payment processors in India encounter various challenges. Regulatory hurdles, such as compliance with RBI guidelines and taxation policies, often pose obstacles to their operations. Additionally, they face stiff competition from international players entering the Indian market, necessitating[4]continuous innovation and adaptation.

Future Trends in Electronic Payment Processing

Looking ahead, the future of electronic payment processing in India looks promising. The widespread adoption of digital wallets and mobile payment apps is expected to drive further growth in the market. Moreover, the integration of technologies[5] like artificial intelligence and blockchain holds the potential to enhance security, reduce transaction costs, and improve overall efficiency.

Payment Processor Electronic Software in India

In recent years, the landscape of payment processing in India has undergone a significant transformation with the advent of electronic software. This technological advancement has revolutionized the way businesses handle transactions, offering convenience, efficiency, and security like never before. In this article, we delve into the nuances of payment processor electronic software in India, exploring its benefits, challenges, and future prospects.

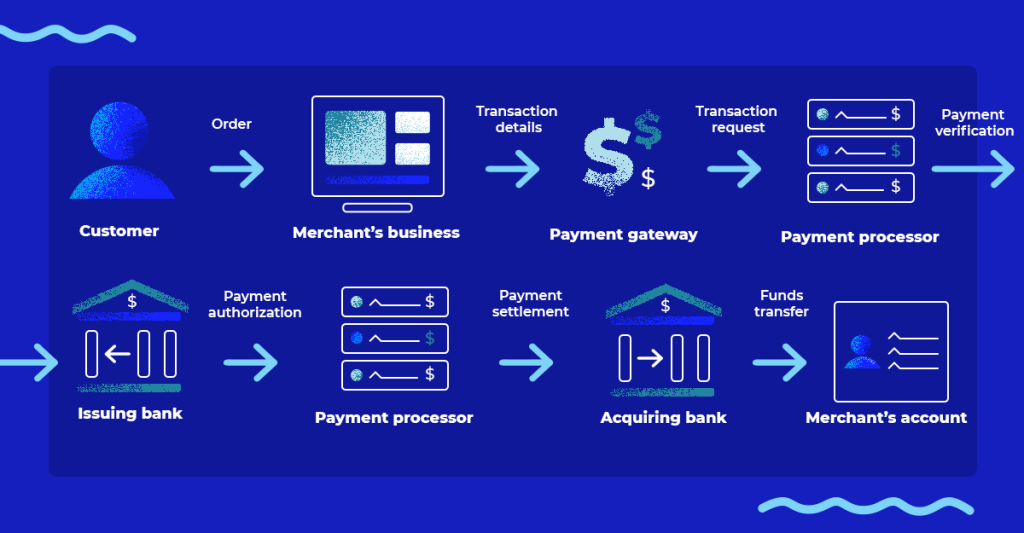

Understanding Payment Processors

What are payment processors?

Payment processors are entities that facilitate the transfer of funds between a payer and a payee. They act as intermediaries, ensuring the smooth and secure execution of transactions. Traditional payment processors typically involve banks and financial institutions, but with the rise of electronic software, new players have emerged in the digital space.

Evolution of Electronic Software in India

Emergence of Digital Payment Solutions

In recent years, India has witnessed a rapid proliferation of digital payment solutions, fueled by government initiatives such as Digital India and demonetization. This has led to a surge in the adoption of electronic software for payment processing across various sectors.

Role of Fintech Companies

Fintech companies have played a pivotal role in driving the adoption of electronic payment solutions in India. These innovative startups leverage technology to offer seamless payment experiences, catering to the evolving needs of businesses and consumers alike.

Advantages of Payment Processor Electronic Software

Enhanced Convenience

Electronic software simplifies the payment process, allowing users to conduct transactions anytime, anywhere, using their preferred devices. Whether it’s online payments, mobile wallets, or contactless payments, electronic software offers unparalleled convenience.

Improved Efficiency

With electronic payment solutions, businesses can streamline their payment processes, reducing manual intervention and administrative overheads. This leads to faster transaction processing, enhanced productivity, and cost savings in the long run.

Enhanced Security

Security is a top priority in electronic payment processing, and modern software solutions incorporate robust encryption techniques and authentication protocols to safeguard sensitive financial data. This instills trust among users and mitigates the risk of fraudulent activities.

Challenges and Considerations

Digital Literacy and Awareness

While electronic payment solutions offer numerous benefits, there is still a segment of the population that lacks digital literacy and awareness. Bridging this gap through education and outreach programs is essential to ensure inclusive access to electronic payment services.

Regulatory Compliance

The regulatory landscape surrounding electronic payment processing is constantly evolving, presenting compliance challenges for businesses and financial institutions. Staying abreast of regulatory changes and adhering to compliance standards is crucial to avoid penalties and legal repercussions.

Conclusion

In conclusion, payment processors play a pivotal role in shaping India’s digital economy by facilitating secure and efficient electronic transactions. As technology continues to evolve, the landscape of electronic payment processing will undergo further transformations, offering new opportunities and challenges for businesses and consumers alike.

FAQs

- Are payment processors safe to use in India?

- Yes, payment processors employ advanced security measures to safeguard transactions and protect user data.

- Can small businesses benefit from using payment processors?

- Absolutely, payment processors offer affordable solutions tailored to the needs of small businesses, enabling them to accept payments online seamlessly.

- How long does it take for transactions to be processed through payment processors?

- Transaction processing times vary depending on the payment method and the processor’s infrastructure. However, most transactions are processed within seconds or minutes.

- Do payment processors charge fees for their services?

- Yes, payment processors typically charge a fee for each transaction processed. The fee may vary based on factors such as transaction volume and the chosen payment method.

- What is the future outlook for electronic payment processing in India? The future looks promising, with continued innovation and market expansion driving the adoption of electronic payment solutions across various sectors.