AUTHOR: HAANA TINE

DATE :26/12/2023

Introduction

In the ever-evolving landscape of the Indian business market, payment processors play a pivotal role in facilitating financial transactions. Understanding the importance of these processors is crucial for businesses aiming to adopt consolidation strategies[1].

Consolidation Strategies

Consolidation strategies involve combining resources to achieve greater efficiency and competitiveness. In the Indian context, businesses are increasingly recognizing the need for consolidation to navigate the diverse and challenging market.

In this section, we’ll explore various consolidation approaches, such as mergers, acquisitions, and alliances. Understanding the distinct advantages each strategy offers will help businesses make informed decisions about the direction they wish to take.

Current Payment Processor Landscape in India

The current scenario presents challenges and opportunities, with a diverse range of payment processors. Identifying trends and overcoming existing challenges are essential for businesses considering consolidation.

This section will delve into the current challenges businesses face when dealing with multiple payment processors, highlighting issues such as compatibility, transaction fees, and security concerns. Payment Processor for Consolidation Strategies in India Additionally, we’ll discuss the evolving landscape, including the rise of fintech and its impact on payment processing in India[2].

Factors Influencing Choice of Payment Processor

Choosing the right payment processor involves evaluating various factors, such as cost, security features, and integration capabilities. Businesses must carefully consider these elements to make informed decisions.

Here, we’ll provide a comprehensive guide on how businesses can assess their specific needs and match them with the features offered by different payment processors. A step-by-step approach will be outlined to simplify the decision-making process.

Key Players in the Indian Market

Reviewing major payment processors in India provides insights into their unique offerings and features. This section will explore the landscape and showcase the diversity of options available.

We’ll conduct a comparative analysis of leading payment processors, discussing their market share, user reviews, and innovative features. Payment Processor for Consolidation Strategies in India This information will empower businesses to make informed choices based on their unique requirements.

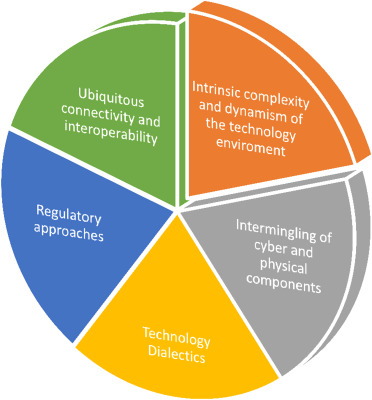

Challenges and Solutions

Overcoming obstacles in payment processing is critical for successful consolidation. This section will delve into innovative solutions that address challenges and contribute to a seamless consolidation process[3].

Common challenges, such as data security concerns and interoperability issues, will be discussed alongside practical solutions. Payment Processor for Consolidation Strategies in India Businesses will gain valuable insights into mitigating the risks associated with payment processing consolidation.

Case Studies

Examining successful consolidation stories in India provides valuable lessons for businesses. Real-world examples will illustrate the benefits and potential pitfalls of various consolidation strategies.

Through detailed case studies, we’ll showcase how businesses in different industries have successfully navigated the challenges of payment processing consolidation. Key takeaways and lessons learned will be highlighted for readers to apply in their own contexts.

Future Trends

Predicting the future of payment processing involves considering technological advancements and emerging trends. Businesses need to stay informed to adapt their consolidation strategies accordingly.

This section will explore upcoming trends in payment processing, such as the adoption of blockchain technology, artificial intelligence, and contactless payments. Understanding these trends will empower businesses to future-proof their payment processing systems[4].

How to Choose the Right Payment Processor

This practical guide will walk businesses through the process of selecting the right payment processor for their consolidation strategy. Clear considerations and steps will be outlined to simplify decision-making.

We’ll provide a detailed checklist for businesses to follow, covering aspects like transaction fees, scalability, customer support, and integration capabilities. This guide will be an invaluable resource for businesses at various stages of the consolidation process.

Customer Feedback and Reviews

User experiences with payment processors offer valuable insights. Testimonials from businesses that have undergone consolidation will provide a realistic view of what to expect.

This section will feature authentic testimonials from businesses that have successfully consolidated their payment processing systems. It will highlight the positive impact on efficiency, cost savings, and overall business operations.

Regulatory Environment

Understanding the regulatory landscape is crucial for businesses navigating the payment processing arena. Compliance requirements will be discussed to ensure a smooth consolidation process.

We’ll provide an overview of the current regulatory environment for payment processors in India[5]. Businesses will gain insights into compliance requirements, licensing, and data protection regulations to make informed decisions.

Expert Insights

Interviews with industry experts will provide additional perspectives on choosing payment processors and implementing consolidation strategies. Recommendations from experts will guide businesses in their decision-making.

In-depth discussions with leading experts in the payment processing industry will offer unique insights into market trends, challenges, and opportunities. Expert opinions will be presented to help businesses make strategic decisions aligned with industry best practices.

Conclusion

In conclusion, this article has explored the intricacies of payment processors and consolidation strategies in the Indian context. Businesses are encouraged to assess their unique needs and explore consolidation for a more efficient and competitive future.

FAQs

- Is consolidation suitable for all types of businesses in India?

- Consolidation strategies can be beneficial for various businesses, but their suitability depends on factors like industry, size, and specific goals.

- How can businesses ensure a smooth transition during consolidation?

- Planning, communication, and selecting the right payment processor are key factors in ensuring a smooth transition during consolidation.

- What role do regulatory considerations play in choosing a payment processor?

- Regulatory considerations are crucial, and businesses must choose a payment processor that complies with the existing regulations in India.

- Are there any specific challenges unique to the Indian market when it comes to payment processing?

- Yes, the diverse market and regulatory landscape in India present unique challenges that businesses need to navigate during payment processing.

- How can businesses stay updated on the latest trends in payment processing?

- Regularly monitoring industry publications, attending conferences, and networking with professionals can help businesses stay updated on the latest trends in payment processing.