AUTHOR :KHOKHO

DATE : 25/12/2023

Introduction

Debt settlement programs in India have become a crucial lifeline for individuals struggling with financial burdens. As these programs gain popularity, the need for a seamless payment processing system becomes paramount.Payment Processor for Debt Settlement Programs in India In this article, we’ll explore the dynamics of payment processors specifically tailored for debt settlement[1] in India, understanding their importance, challenges faced, and the criteria for choosing the right one.

Understanding Debt Settlement Programs

Debt settlement[2] programs offer a strategic approach to help individuals reduce their debt burden by negotiating with creditors. This process[3], though effective, demands a well-organized payment system[4] to ensure timely settlements and smooth operations.

Challenges in the Payment Process

The payment process[5] within debt settlement programs often encounters challenges such as delayed transactions, security concerns, and integration issues. Addressing these challenges is essential for the success and credibility of such programs.

The Need for Specialized Payment Processors

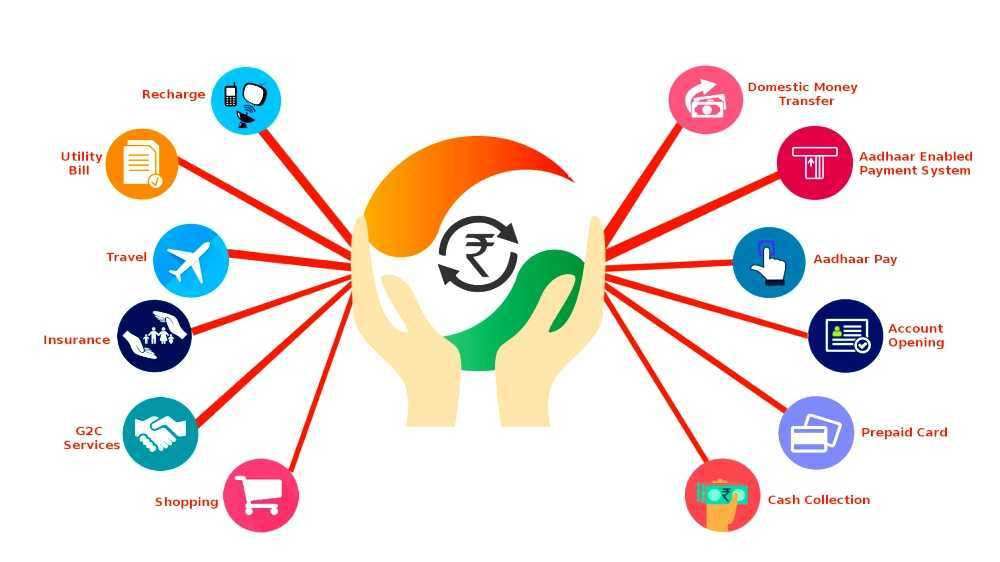

General payment processors may not fully cater to the unique requirements of debt settlement programs. Specialized processors are designed to handle the intricacies of these transactions, providing a tailored solution that ensures efficiency.

Key Features of an Ideal Payment Processor

Security and integration are key features of an ideal payment processor for debt settlement programs. Robust security measures safeguard sensitive financial data, while seamless integration capabilities enhance the overall user experience.

Review of Top Payment Processors in India

In the Indian market, several payment processors cater specifically to debt settlement programs. A comparative analysis of their features, fees, and user feedback can guide companies in making informed choices.

Case Studies: Successful Implementation

Real-life examples showcase how efficient payment processors contribute to the success of debt settlement programs. Positive outcomes for both debtors and creditors highlight the importance of choosing the right payment solution.

Regulatory Compliance

Adhering to financial regulations is crucial in the Indian context. Payment processors play a vital role in ensuring that debt settlement programs comply with the relevant regulations, fostering trust among stakeholders.

User-Friendly Interface

An intuitive interface is essential for users navigating through debt settlement processes(1). A user-friendly design enhances the overall experience, promoting transparency and ease of use.

Customer Support in the Payment Processing Industry

Responsive customer support is a pillar of a reliable payment processing(2) system. The ability to address issues promptly and efficiently contributes to a positive user experience and fosters trust.

Future Trends in Payment Processing for Debt Settlement

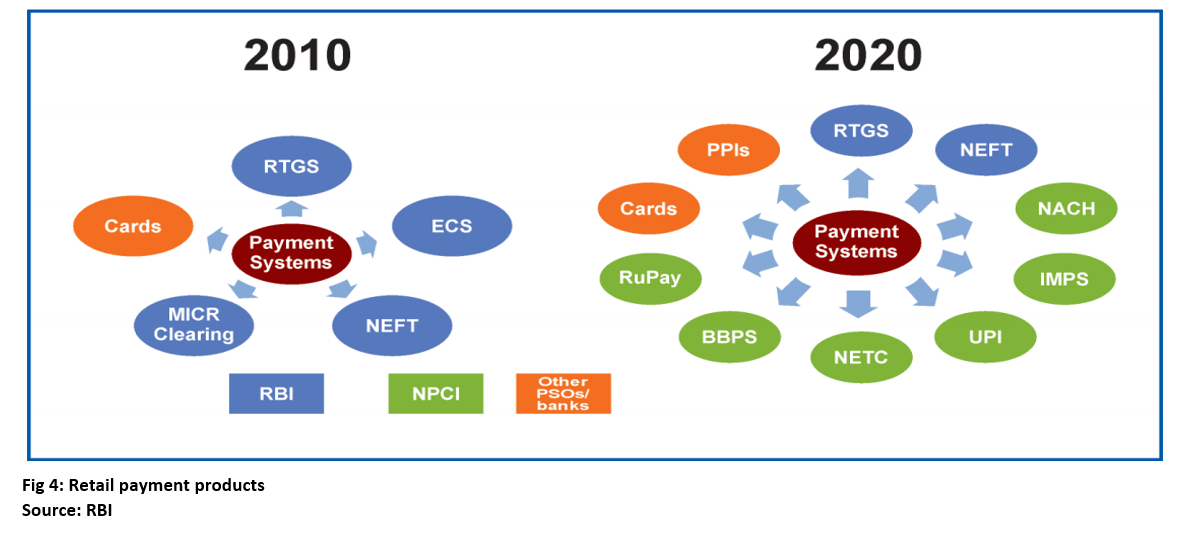

The payment processing landscape (3)is evolving, with advancements in technology and innovation. Anticipating future trends helps debt settlement companies stay ahead and adopt solutions that align with industry developments.

Benefits for Debt Settlement Companies

Investing in an efficient payment processor brings multiple benefits(4) for debt settlement companies. Improved operations, increased client satisfaction, and enhanced trust contribute to the overall success of these programs.

Risks and Precautions

While payment processors offer numerous advantages, it’s essential to be aware of potential risks. Implementing precautionary measures safeguards both companies and clients from unforeseen challenges.

Choosing the Right Payment Processor for Your Program

Selecting the right payment processor(5) requires careful consideration. Factors such as compatibility, security, and long-term viability should guide the decision-making process for debt settlement companies.

Conclusion

In conclusion, the role of a reliable payment processor in the success of debt settlement programs in India cannot be overstated. As the industry continues to grow, companies must invest in solutions that address the unique challenges they face, ensuring a smooth and secure payment process for all stakeholders involved.

FAQs

- Is it necessary for debt settlement companies to use specialized payment processors?

- Yes, specialized processors are tailored to handle the unique demands of debt settlement transactions, ensuring efficiency and security.

- What security measures should a payment processor have for debt settlement programs?

- Robust encryption, secure data storage, and compliance with industry standards are crucial for a payment processor handling debt settlements.

- How can debt settlement companies ensure regulatory compliance in India?

- Regular audits, staying updated on financial regulations, and choosing a payment processor with built-in compliance features are essential steps.

- What role does customer support play in the success of a payment processor for debt settlement?

- Responsive and efficient customer support contributes to a positive user experience, resolving issues promptly and building trust.

- Are there upcoming technologies that could impact payment processing for debt settlement?

- Yes, advancements in technology such as blockchain and AI may influence the future of payment processing for debt settlement programs.