AUTHOR : Sook

DATE : 25/12/2023

Introduction

In the dynamic landscape of financial transactions, delinquent accounts pose a significant challenge. These accounts refer to payments that have not been made on time or have defaulted altogether, impacting businesses and individuals alike. In India, where the market is vibrant yet diverse, the issue of delinquency demands attention and effective solutions.

Challenges Faced in India

India’s payment ecosystem presents its own set of complexities. With various payment methods, cultural differences, and economic disparities, delinquency becomes a concern. Factors such as late payments, defaults, and cash flows contribute to this issue.

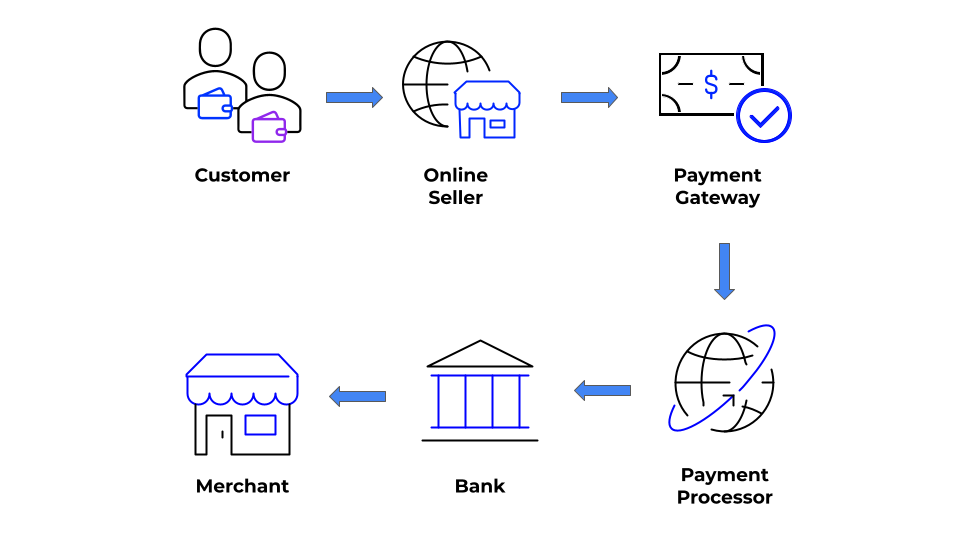

Need for a Reliable Payment Processor

To combat delinquency effectively, businesses require a reliable payment processor. These processors act as intermediaries between entities, secure and timely transactions. Selecting the right processor involves considering factors like transaction speed, security protocols, and compatibility with existing systems.

Exploring Available Payment Processors

In India, several payment processors cater to different business needs. From traditional banks to modern fintech companies, each offers unique services. Understanding their features and how they address delinquent accounts is crucial for businesses seeking effective solutions.

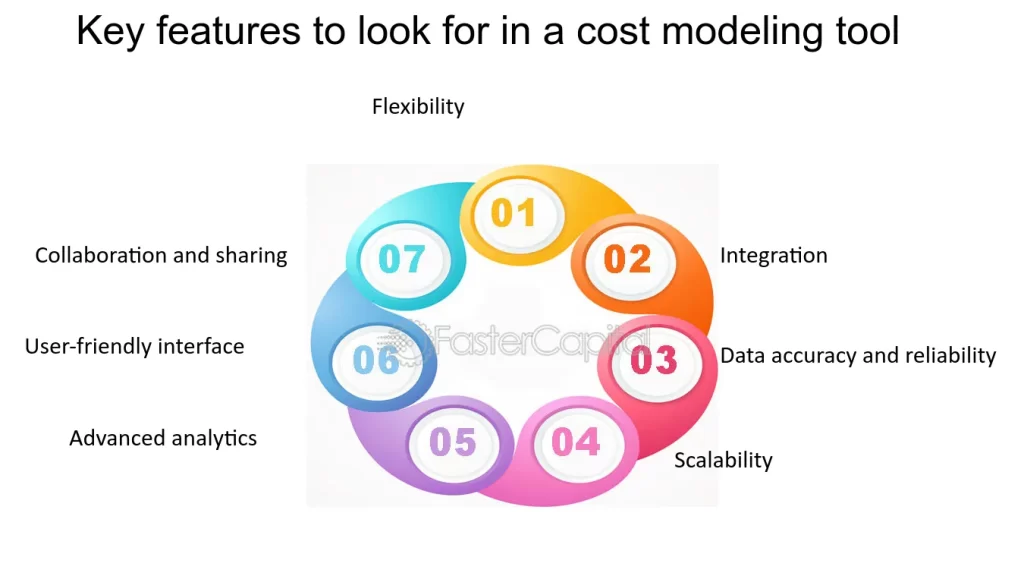

Key Features to Look for

When choosing a payment processor[1] to handle , certain features are indispensable. Security measures like encryption, fraud detection, and compliance with industry standards are paramount. Additionally, scalability, user-friendly interfaces, and seamless integrations are vital.

Benefits of Utilizing a Payment Processor

Case Studies: Successful Implementation

Implementing a robust payment processor yields numerous benefits. Beyond recovering revenue from delinquent accounts, Payment Solutions[2] it enhances customer relations by providing convenient payment options. It streamlines processes, reduces administrative burdens, and boosts overall efficiency.

Real-life examples highlight the success stories of businesses that effectively managed delinquency with the Online payment processing[3]. These case studies illustrate how companies improved their financial health and customer satisfaction by leveraging these solutions.

Tips for Implementation and Integration

Integrating a payment processor Payment Operations[4] seamlessly involves strategic planning and execution. Businesses should follow step-by-step guidelines to ensure a smooth transition. Strategies for optimizing the processor’s functionalities and troubleshooting common issues are imperative.

Future Trends and Innovations

As technology evolves, the future of Delinquent payments[5] processors holds promising advancements. Innovations like AI-driven risk assessments, blockchain-based security, and enhanced payment experiences are expected. These innovations will likely revolutionize delinquency management in India.

Conclusion

Addressing delinquent accounts in India requires a proactive approach, and selecting the right payment processor plays a pivotal role. By understanding the challenges, exploring available options, and leveraging their features, businesses can navigate delinquency effectively, fostering financial stability and growth.

FAQs

- Can payment processors guarantee 100% debt recovery?

- Do payment processors charge a fixed fee or a percentage for their services?

- How long does it take for payment processors to initiate debt recovery?

- Are payment processors equipped to handle legal complications in debt collection?

- Can businesses integrate payment processors with their existing accounting software?