AUTHOR : ZOYA SHAH

DATE : 28-12-2023

Digital downloads[1] have become an integral part of the modern era, offering convenience and instant access to various digital goods. In India, as the digital landscape expands, the need for reliable payment processors for these downloads becomes paramount.

Understanding Digital Downloads

Digital downloads encompass a wide range of products, including e-books, music, software, and more. The ease of accessing these items online has led to a surge in demand, necessitating efficient payment processing solutions[2].

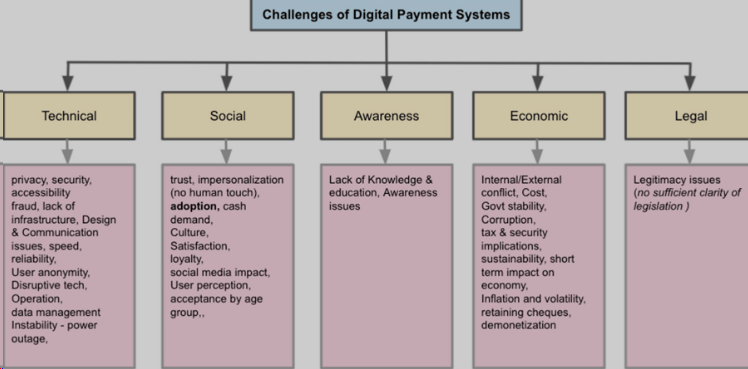

Challenges in Digital Transactions

Despite the increasing popularity of digital transactions, there are challenges unique to the Indian market. Issues such as multiple payment gateways[3], currency conversions, and security concerns need to be addressed for a seamless experience.The rapid digital transformation in India has created a thriving market for digital products, including eBooks, online courses, music, software, and more. For businesses and independent creators selling these products, selecting the right payment processor is critical for ensuring smooth, secure, and efficient transactions. Below is a detailed exploration of payment processors tailored for digital downloads in India.

The Need for Reliable Payment Processors

A reliable payment processor[4] acts as the backbone of successful digital transactions. It ensures smooth payments, builds trust among users, and contributes to the overall success of businesses dealing in digital downloads.

Key Features of Ideal Payment Processors

The ideal payment processor for digital downloads in India should offer secure transactions, user-friendly interfaces, seamless integration capabilities, and support for multiple currencies. These features ensure a positive user experience and streamlined operations.

Popular Payment Processors in India

Several payment processors cater specifically to the Indian market. From well-established ones like Paytm and Razorpay to newer entrants, each offers unique features and benefits for businesses involved in digital downloads.

Comparison of Payment Processor Options

To make an informed choice, it’s crucial to compare different payment processors. While some may offer lower transaction fees, others might provide better integration options. Evaluating these aspects helps in choosing the most suitable option.

Setting Up a Payment Processor

Integrating a payment processor may seem daunting, but a step-by-step guide can simplify the process. From creating an account to linking it with your digital store, this section provides a comprehensive walkthrough.

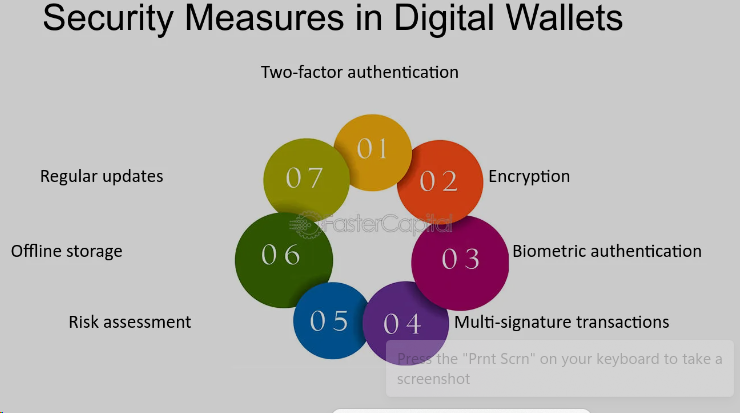

Security Measures for Digital Transactions

Addressing security concerns is paramount in the digital realm. This section delves into the security measures implemented by payment processors to protect user data and ensure safe transactions.

Impact of Payment Processors on Sales

A smooth payment process positively influences the purchasing decision of customers. Exploring how an efficient payment processor can boost sales highlights the importance of investing in the right solution.A payment processor for digital downloads facilitates online transactions specifically for intangible products. Unlike physical goods, these processors must handle instant payment confirmations, automated delivery of digital files, and robust fraud prevention to ensure a seamless user experience.

Legal Compliance in India

Navigating legal requirements is crucial for any business. Understanding the regulatory landscape in India ensures compliance with laws related to digital transactions[5] and payment processing.

User Reviews and Experiences

Real-life experiences provide valuable insights. In this section, we explore user reviews and experiences with different payment processors, offering a practical perspective on their effectiveness.

Future Trends in Digital Payments

As technology evolves, so do payment processing methods. This section discusses upcoming trends, such as cryptocurrency integration and AI-driven transactions, providing a glimpse into the future of digital payments.

Tips for Choosing the Right Processor

Choosing the right payment processor involves considering factors like transaction fees, customer support, and integration capabilities. This section provides tips to guide readers in making an informed decision

Transaction Security

Security is paramount in digital transactions. Razorpay and CCAvenue, among others, employ advanced encryption and security protocols to safeguard user data, fostering trust among customers.

Conclusion

In conclusion, a reliable payment processor is a cornerstone for successful digital transactions in India. By understanding the challenges, exploring options, and prioritizing security, businesses can enhance the overall experience for both sellers and buyers.

FAQs (Frequently Asked Questions)

- Q: Are there specific payment processors designed for small businesses in India?

- A: Yes, there are payment processors tailored for small businesses, offering cost-effective solutions and easy integration.

- Q: How can I ensure the security of digital transactions when using payment processors?

- A: Payment processors implement encryption and security protocols. Additionally, choosing reputable ones with a track record of security is crucial.

- Q: Do I need to consider legal aspects when integrating a payment processor for my digital store?

- A: Absolutely. Adhering to legal requirements ensures your business operates within the framework of Indian regulations.

- Q: Can I use multiple payment processors for my digital downloads store?

- A: While possible, it’s advisable to streamline operations by choosing a single, reliable payment processor.

- Q: What trends can we expect in the future of digital payments in India?

- A: Future trends may include increased use of cryptocurrencies, advanced AI-driven transactions, and enhanced mobile payment solutions.